Post FOMC Market Analysis and Trade Setups

Stock-Markets / Financial Markets 2012 Aug 23, 2012 - 06:25 AM GMTBy: Capital3X

FOMC did exactly what it was supposed to do: DO NOTHING and yet give the feeling that it was going to do the biggest asset purchase in its history. Looking at forex markets, it seemed QE was going to begin this week. But for us traders, we couldnt care less if they did QE or not. We leave those to for skillful pens of financial journalists and the analysts out there who feast on every word that comes from FED mouth. We are far too buzy to analyse the language of FED and if he has used “an” or “a” or “the” (sarcasm implied). It splits me up when I read some of the things on the net about how Bernanke is using words like “appropriate time” and “extended” to imply his hearts deepest desire to print. Well they may have a point but that is not trade-able advice and hence ignore it.

FOMC did exactly what it was supposed to do: DO NOTHING and yet give the feeling that it was going to do the biggest asset purchase in its history. Looking at forex markets, it seemed QE was going to begin this week. But for us traders, we couldnt care less if they did QE or not. We leave those to for skillful pens of financial journalists and the analysts out there who feast on every word that comes from FED mouth. We are far too buzy to analyse the language of FED and if he has used “an” or “a” or “the” (sarcasm implied). It splits me up when I read some of the things on the net about how Bernanke is using words like “appropriate time” and “extended” to imply his hearts deepest desire to print. Well they may have a point but that is not trade-able advice and hence ignore it.

Charts and setups and all analysis from US Treasury markets and forex markets.

The US 10 Year treasury futures made a major up turn post FOMC which was limiting risk upside. Imminent purchase gave a free run to the speculators who grabbed the futures triggering stops above 133. It is now capped at the 20 DMA and then the 25,2 BB mid lines and 50 DMA at 133.87 and 133.9 respectively. As long as capped by the mid lines, the downtrend for 2012 is still alive and kicking.

FOMC bond purchase could focus on the short end of the curve if UST2Y price jump is to be believed. The sheer pace of this move made yen the strongest pair of the day as USDJPY fell from 79.2 to 78.2 in a matter of 15 minutes. All our Yen trades (EURJPY, CADJPY, GBPJPY) hit targets with precision netting over 150 pips. The future is still moving strongly higher making the case for YEN to strengthen further. Lets be clear: If UST2Y decides to put in a move like this, there is jackshit that BoJ or anyone else can do. Yield spreds are supreme drivers of forex markets and therefore for BoJ to effectively manage YEN, they will need to jump in the pit with the FED and do either of two things:

Scenario 1: sell off UST2Y in a bigger quantity than FED is prepared to buy or

Scenario 2: buy Japanese bonds in a quantity larger than FED buyouts.

They have given indicaions that they are prepared to do scenario 2 but Scenario 1 could be the real solution for Yen strength but is bereft with political ramifications.

Peripheral yields continue to move down as prices rise under the expectations that ECB may act on its threat on yield cap via bond purchase. This has led EURUSD on a furious rally from 1.23 to 1.,245 and now 1.255. But BTP has real test coming up at 103.7 which could also correspond with EURUSD barriers test at 1.2620/650 which are the upper bollingers of the 100,2.

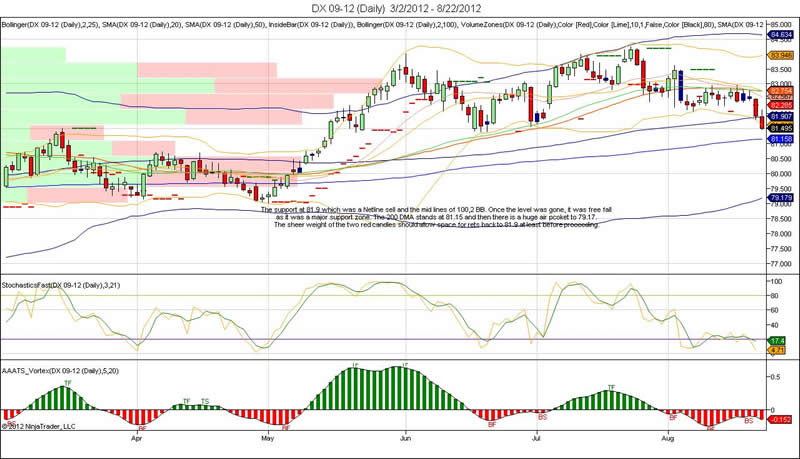

The support at 81.9 which was a Netline sell and the mid lines of 100,2 BB. Once the level was gone, it was free fall as it was a major support zone. The 200 DMA stands at 81.15 and then there is a huge air pcoket to 79.17. The sheer weight of the two red candles should allow space for rets back to 81.9 at least before proceeding.

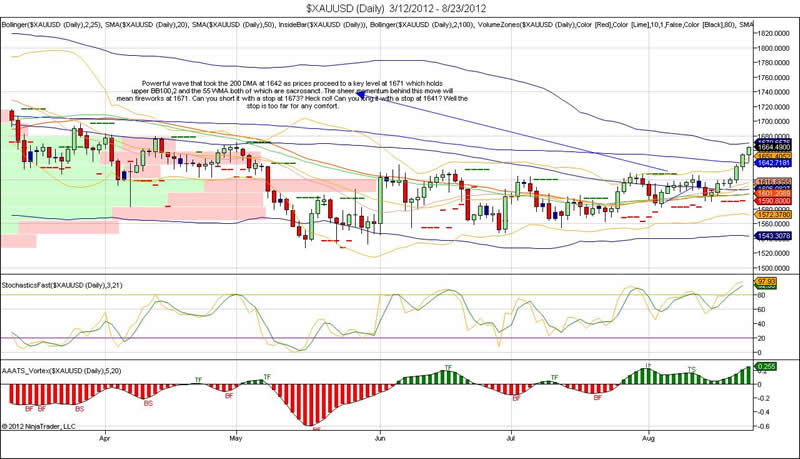

Powerful wave that took the 200 DMA at 1642 as prices proceed to a key level at 1671 which holds

upper BB100,2 and the 55 WMA both of which are sacrosanct. The sheer momentum behind this move will

mean fireworks at 1671. Can you short it with a stop at 1673? Heck no!! Can you long it with a stop at 1641? Well the stop is too far for any comfort. But these are thoughts coming from me who was psychologically damaged after the stop out at 1653. So take it with a pinch of salt.

In all the commotions, one level which was importan for the overall sanctity of the bull market was 82.2 on AUDJPY. It has held till now. A long here with stop at 82 will not be a bad strategy. The daily stochs and vortex are all in good shape. The correction from 83 and the pause at 82.2 gives a lot of health to its bull market.

AUDUSD has honoured its committment to move to its designated place at 1.0650/.069. The pair easily withstood 1.043 pre FOMC. Post FOMC it lit up the skies with a move above 1.05 and closing above 1.05. Clear buy on dip pair with vortex neutral while sotchs reversing at mid point.

ES held 1410 on closing and is looking ready to burst higher. It may held back yesterday as the bond markets were rising on FOMC minutes but today may be a different ball game. The strategy has to be to long abovee 1425 with a stop at 1420 or long at 1387 with a stop at 1381. In between, you find another asset to trade.

If you are not a member with us: There are two levels of membership

- Capital3x membership which comes with all the benefits of Capital3x FX portfolio and premium analysis.

- Capital3x Membership with MNI news bulletsThere is a combined package where you can get both Capital3x and MNI forex real time news bullets. You can explore membership to that via this link:

Kate Capital3x.com Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2012 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.