Credit Crunch Fifth Anniversary

Stock-Markets / Financial Markets 2012 Aug 13, 2012 - 06:57 AM GMTBy: Alasdair_Macleod

We are coming up to the fifth anniversary of the financial crisis, at least for the UK’s banking system, because it was five years ago that anxious depositors were queuing up to withdraw their money from Northern Rock, leading to its inevitable rescue by the tax-payer.

Anniversaries are often a time for reflection. The Northern Rock failure marked the popping of the UK’s residential property bubble. The signs of excessive valuation were all there, particularly speculation in the buy-to-let market, wide-spread public participation in a “sure thing”, and Northern Rock offering loans with a loan-to-value of 120%. The same extremes of sentiment were visible in the US where there was a lending frenzy on the false assumption that a diverse portfolio of mortgages was somehow risk-free.

Bubbles everywhere went pop. It was completely unexpected by academic economists, a point made deliciously by the Queen, who when opening the New Academic Building at the London School of Economics was moved to ask why no one saw the crisis coming. They had no answer. The same academics reassured us the crisis was a just a temporary blip, and normal economic growth would shortly resume. Yet, here we are five years later, still awaiting the recovery while sinking deeper into the mire; and Her Majesty might still be reflecting on this fact.

The problem is one of misdiagnosis, which is why Keynesians have been wrong-footed from the start. They do not seem to realise that their policy of ever-expanding debt has a real-world limit. Having successively expanded it as a solution to previous economic difficulties, the economic establishment has become complacent. It certainly does not want to reconsider cherished neo-classical assumptions. This is why it still believes that “more of the same” is the answer: inject money into the economy and hike government spending. If that fails it is because we are not doing it aggressively enough.

Here we are five years on. There is no meaningful recovery and the crisis has shifted to the Eurozone, and unless that can be resolved it threatens to bring down the entire global banking system.

The Keynesian answer unsurprisingly is to print however much money it takes. After all, the inflation-rate outlook is benign. Interest rates are zero, so governments, with the exception of some in the Eurozone, have a duty to borrow limitless amounts at negligible cost to ensure recovery. The Keynesian analysis is of course fatally flawed. It assumes savings are bad, spending is good and debt does not matter. It ignores the very basis of a sound economy such as that of Germany and endorses the policies common to all failed states.

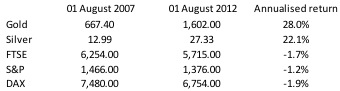

One is left wondering whether the next crisis, the predictable result of the mishandling of the first, will occur by the sixth anniversary. I for one can’t wait for the Queen’s insightful comment about that one. Perhaps her financial advisers, who this time might be on the receiving end, might like to reflect how they have protected the Royal Portfolio from systemic risks so far. The table below will give you some insights into how well different vehicles fared in preserving purchasing power during those last five years with buying gold and silver as the clear winner.

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2012 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.