Keys For the Next Gold Breakout

Commodities / Gold and Silver 2012 Jul 26, 2012 - 11:11 AM GMTBy: Clif_Droke

Gold's historic run-up from $250 to nearly $2,000 an ounce in the last 10 years has underlined the long-term value and intrinsic worth of a key asset. It has also provided a fabulous, once-in-a-lifetime investment opportunity for many individuals, not to mention a long-term momentum trade for both retail and institutional investors.

Gold's historic run-up from $250 to nearly $2,000 an ounce in the last 10 years has underlined the long-term value and intrinsic worth of a key asset. It has also provided a fabulous, once-in-a-lifetime investment opportunity for many individuals, not to mention a long-term momentum trade for both retail and institutional investors.

Gold has also provided investors with an important lesson in the past year: despite its distinctive safe haven value, the metal definitely has a speculative element which is critical to its price appreciation. In this regard at least, gold is no different than other assets. Gold's speculative element was nowhere more evident than in the series of margin requirement hikes last summer, which saw gold fall from an all-time high of just under $2,000 an ounce to a low of around $1,550.

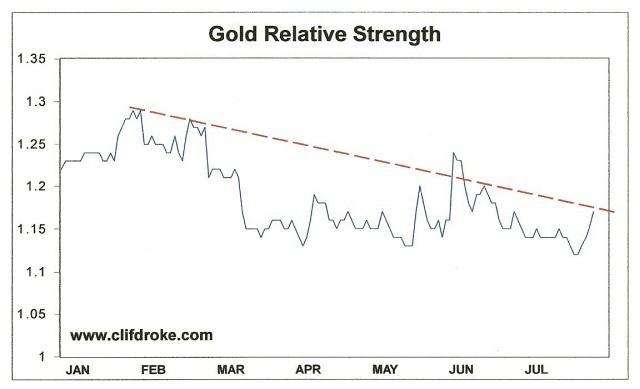

From the bottom of the 2008 credit crisis, gold benefited from a combination of bullish factors. At the bottom of the crisis in late 2008 - and well before the smoke finally cleared from the financial market in March 2009 - gold got the benefit of relative strength versus the equity market. Hedge funds and institutional traders are constantly on the lookout for markets and investment opportunities that are outperforming the general equities market. Compared to the benchmark S&P 500, gold was a shining example of relative strength and it quickly caught the eye of big money traders in the latter part of 2008. Gold was really the ultimate relative strength play in the early stages of the 2009-2011 global recovery.

Aside from relative strength and valuation considerations, gold also benefited from successive quantitative easing initiatives undertaken by the Federal Reserve between 2009 and 2011. The gold market was a huge recipient of "hot money" inflows owing to the excessive liquidity generated by QE1 and QE2, and these programs helped propel gold to all-time highs.

Fast forward to the summer of 2012 and we find gold the opposite of the technical position it was in during the 2009-2011 period. It no longer had the benefit of relative strength and the residual effects of QE2 have long since faded. Worse still (from an intermediate-term perspective), gold doesn't even have the benefit of the leveraged, speculative traders prior to the CME Group's margin hikes last summer. Gold has been forced to undergo a long period of quiet consolidation as the trend trading crowd seeks opportunities in other markets.

What will change this situation and generate the return of the speculative element so critical for gold's success? One of two possibilities can be mentioned for the foreseeable interim outlook. The first possibility is the one being widely discussed by investors today, namely a third quantitative easing program (QE3). This is the least likely of the possibilities as far as fueling a near term gold breakout. A third QE program during an election year would be politically toxic and too controversial to be considered (barring a massive deterioration in the global economy and financial market between now and November). Moreover, Fed Chairman Bernanke isn't likely to prime the liquidity pump anytime soon given the relatively high levels of prices for both equities and consumer prices.

The second possibility for a gold turnaround is the one most likely by year end. A conspicuous increase in gold's relative strength would do much to attract the attention of market-moving hedge funds and institutional investors. This could easily be accomplished even if gold doesn't break out from its consolidation pattern anytime soon. Indeed, gold need only remain within its lateral trading range of the past few months during an equity market decline after the 4-year cycle peak this fall. This is essentially what happened in the latter part of 2008, which was the previous 4-year cycle peak. The fourth quarter of 2008 also provided gold with its opportunity to shine vis-à-vis equities, which could easily be repeated in Q4 2012.

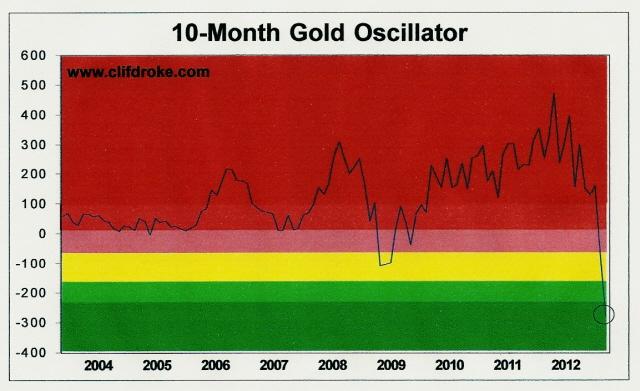

If history repeats, by this fall gold will be poised to benefit from both a relative strength increase as well as an historic long-term "oversold" signal (discussed in previous commentaries, see chart below).

There are several prominent trouble spots in the global economy which could easily metastasize and reach crisis proportions by 2013. I'm referring to the European debt problem, China's economic slowdown, and the coming U.S. tax increases of 2013-2014. Gold will once again resume its traditional safe haven role once the concern over these problems reaches the boiling point and morphs into full-fledged fear.

The two points along the 60-year economic cycle in which gold ownership is most desirable is during the peak phase of the cycle when runaway inflation reaches its apogee, and the trough of the cycle when extreme deflation is at its worse. We are about to arrive at the latter end of the cycle when the deflationary undercurrents which have damaged the economy in recent years will accelerate and become uncontainable. It's in just such a ravaging environment that gold will truly shine.

2014: America's Date With Destiny

Take a journey into the future with me as we discover what the future may unfold in the fateful period leading up to - and following - the 120-year cycle bottom in late 2014.

Picking up where I left off in my previous work, The Stock Market Cycles, I expand on the Kress cycle narrative and explain how the 120-year Mega cycle influences the market, the economy and other aspects of American life and culture. My latest book, 2014: America's Date With Destiny, examines the most vital issues facing America and the global economy in the 2-3 years ahead.

The new book explains that the credit crisis of 2008 was merely the prelude in an intensifying global credit storm. If the basis for my prediction continue true to form - namely the long-term Kress cycles - the worst part of the crisis lies ahead in the years 2013-2014. The book is now available for sale at: http://www.clifdroke.com/books/destiny.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.