America’s Competitive Spirit Driving Global Economic Growth

Economics / US Economy Jul 26, 2012 - 02:37 AM GMTBy: Frank_Holmes

One of the few things that Barack Obama and Mitt Romney can agree on is that our economy is still struggling to regain its strength. Stubborn unemployment and sluggish growth at home combined with a slowing China and a dysfunctional eurozone have cast a dark shadow on America’s eternal optimism. The media favors negative news and the 24/7 cycle of gloom and doubt can be dispiriting.

One of the few things that Barack Obama and Mitt Romney can agree on is that our economy is still struggling to regain its strength. Stubborn unemployment and sluggish growth at home combined with a slowing China and a dysfunctional eurozone have cast a dark shadow on America’s eternal optimism. The media favors negative news and the 24/7 cycle of gloom and doubt can be dispiriting.

We are always looking for the economic points of light around the globe and strive to provide a counterpoint to the pervasive pessimism. As Warren Buffett once said, “It’s never paid to bet against America. We come through things, but it’s not always a smooth ride.

I moved from Toronto to San Antonio more than twenty years ago. A Canadian pursuing the American Dream. I bought a business that became U.S. Global Investors. I believed back then, as I still do today, that there is nowhere else in the world where opportunity abounds and initiative is rewarded as it is in the U.S.A. “Despite all its setbacks, the U.S. remains at the center of world competiveness because of its unique economic power, the dynamism of its enterprises and its capacity for innovation,” according to IMD, a well-regarded Swiss business school.

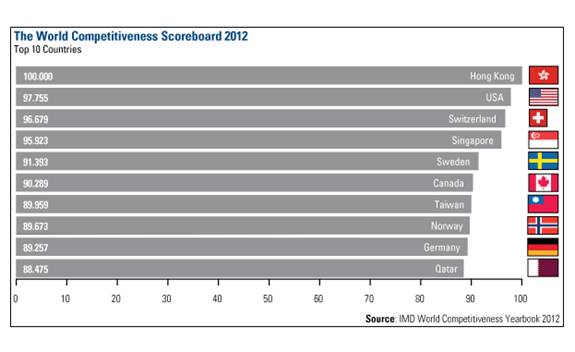

IMD recently released the findings of its annual World Competitiveness Yearbook (WCY). Its rankings survey more than 4,200 international executives and measure how well countries manage their economic and human resources to increase prosperity. The top three most competitive of the 59 ranked economies in 2012 are Hong Kong, the U.S. and Switzerland.

Barron’s editorial page editor Thomas G. Donlan wrote, “It’s worth contemplating the advantages that a group of international business executives and analysts still can find in the U.S. economy. At the top is access to financing, following a strong research-and-development culture, an effective legal environment, dynamism of the economy, a skilled workforce, and reliable infrastructure. At the bottom, they find the U.S. lacks competency of government and a competitive tax regime.”

During tough times, Americans must be vigilant in safeguarding our competitive edge by continuing to be a compassionate and generous nation while resisting the siren calls of socialism. A system that strangles private property rights and sponsors excessive bureaucracy, regulation and taxation cannot deliver on a promise of prosperity to its people. We must not lose our collective faith in capitalism because it has proven to be the only social system that rewards individual ability, initiative and achievement.

What Henry Ford said a century ago holds true today, “What's right about America is that although we have a mess of problems, we have great capacity—intellect and resources—to do something about them.”

The Economist’s cover story last week heralded America’s economy the “Comeback kid.” “Led by its inventive private sector, the economy is remaking itself. Old weaknesses are being remedied and new strengths discovered, with an agility that has much to teach stagnant Europe and dirigiste Asia,” according to the story.

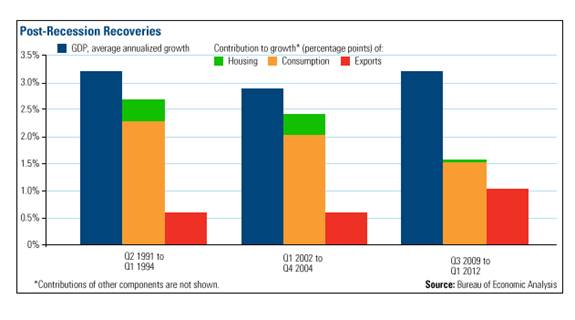

The story notes that while America’s overall growth is unimpressive, some components show signs of boom. We have shifted from a consumption-driven economy to a more outward-facing one. In the post-recession economy exports contributed 43 percent of growth, one of the strongest showings in any recent economic recovery. While sales to traditional markets in the OECD have risen just 20 percent since the end of 2007, they are up 51 percent to Latin America and 53 percent to China.

According to The Economist, emerging markets have also reinvigorated America’s role as a big commodity producer. Grain exports are soaring, agricultural land values are rising, and higher oil prices have triggered new output. American innovation in discovering new techniques to release oil and gas from shale has paid massive dividends to the energy sector and created thousands of new jobs in the industry. I wrote about this employment boom recently in Frank Talk and we see this explosion of growth first-hand just south of San Antonio with the development of the Eagle Ford Shale.

Cheap, plentiful natural gas benefits industries as diverse as glass, fertilizers, plastic and steelmakers. Last year for the first time in decades, America became a net exporter of refined products. And our nation’s gap between oil consumption and domestic production is shrinking.

A way to take advantage of a potential upturn in commodities is by choosing dividend-paying global resources equities. In the S&P 500 Index, nearly all of the materials and utilities stocks and more than half of energy companies pay a dividend that is higher than the 10-year Treasury. Materials and utilities companies yield an average of 2.3 percent and 4.1 percent, respectively, while energy stocks pay an average yield of 2.2 percent. We like the combination of income with growth and it is an important factor in our stock selection process for the Global Resources Fund, as well as our other equity funds.

We believe there are many great American companies to invest in. We like those that are growing their top line revenues and paying robust dividends. Currently 47 percent of the S&P 500 stocks pay a dividend yielding more than a 10-year Treasury, demonstrating the resiliency and strength of American enterprises.

Professor Stephane Garelli, director of IMD’s World Competitiveness Center, said, “U.S. competiveness has a deep impact on the rest of the world because it is uniquely interacting with every economy, advanced or emerging. No other nation can exercise such a strong ‘pull effect’ on the word. In the end, if the U.S. competes, the world succeeds!”

It is the nature of humans to compete. The Summer Olympics commencing this week in London will bring together more than 10,500 athletes from 204 countries to compete for the gold. I look forward to watching this showcase of the human spirit and the drive to succeed.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.