Unconventional Oil is NOT a Game Changer

Commodities / Crude Oil Jul 04, 2012 - 04:50 AM GMTBy: Raul_I_Meijer

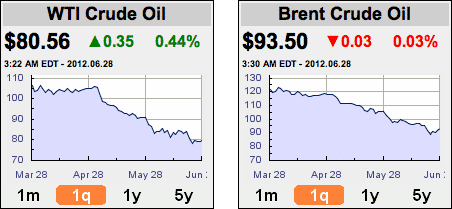

Oil prices have been falling.

Oil prices have been falling.

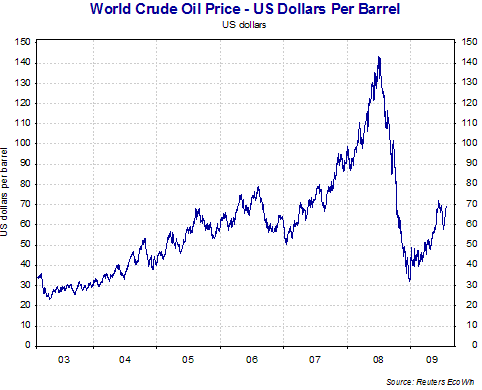

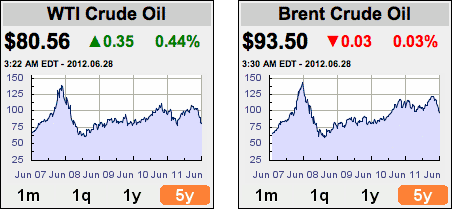

This is no surprise to us here at The Automatic Earth, as our position is that the 2008 price peak will stand for a very long time, and that the rise from the 2009 low has been a counter-trend rally. Prices of many assets have been moving with the ebb and flow of confidence, and therefore of liquidity, in this era of extreme financialization, and commodities are no exception.

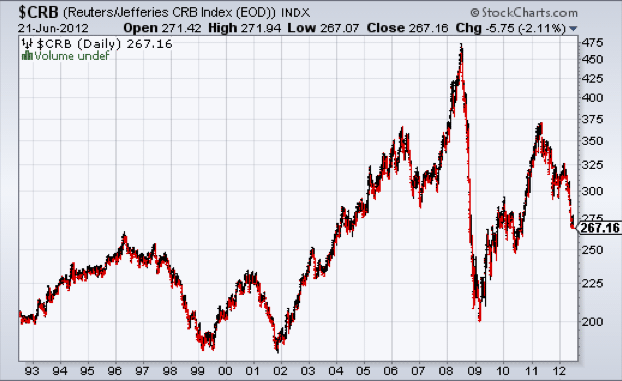

As we have pointed out many times, prices do not reflect the fundamentals of supply and demand in any particular industry. If they did so, equities and different commodities would not move in relative sychrony, yet they have often done so.

Instead, prices reflect a combination of general confidence (or lack thereof) and the perception of future scarcity or glut, whether or not that perception is, in fact, accurate. Commodities top on fear of shortages. When there is a perception of scarcity, speculators bid up the price in advance of what the fundamentals would justify at that time, as they did in the run up to the 2008 price peak.

When the speculative bubble bursts, the sector is dumped and the price collapses as speculation goes into reverse. In 2008, commodities in general fell 58%, and oil prices plunged 78% in five months as the financial crisis sucked liquidity out of the system and the perception of imminent scarcity disappeared.

With the temporary resurgence of confidence from the 2009 bottom, liquidity returned, and, increasingly, so did the perception of scarcity for commodities in general and for oil specifically. Prices were bid up again, although not to the previous high, even though analysts extrapolating the trend forward were calling for a much larger commodity price spike than 2008.

Commodity prices in general peaked in May 2011 and continue their retreat.

Confidence is ebbing as the scope of the financial crisis centred in Europe becomes increasingly evident, and vulnerabilities in other regions and sectors of the economy emerge. Even the Chinese juggernaut (the primary driver of commodity demand) is visibly faltering.

Retreating liquidity and persistent economic weakness act to undermine comodity prices further. This process is far closer to its beginning than its end. As the global credit bubble of the last thirty years implodes, we will be heading right in to the teeth of liquidity crunch, economic seizure and another deflationary Great Depression. Under such circumstances, we can expect demand to be weak for many years, and with falling demand will come falling price support.

At the same time, in the case of oil, we are seeing a sharp reversal of perception - from one of scarcity to one of glut - as pundits discuss how technological innovations, including horizontal drilling and hydraulic fracturing, will increase global supply dramatically. De-conventionalization of oil supply is touted as the solution to peak oil for the foreseeable future.

Euphoria particularly surrounds the projections for US production, with talk of the country becoming both energy independent and an exporting powerhouse - a New Middle East.

Leonardo Maugeri:

Thanks to the technological revolution brought about by the combined use of horizontal drilling and hydraulic fracturing, the U.S. is now exploiting its huge and virtually untouched shale and tight oil fields, whose production although still in its infancy is already skyrocketing in North Dakota and Texas.

The U.S. shale/tight oil could be a paradigm-shifter for the oil world, because it could alter its features by allowing not only for the development of the worlds still virgin shale/tight oil formations, but also for recovering more oil from conventional, established oilfields whose average recovery rate is currently no higher than 35 percent.

The natural endowment of the initial American shale play, Bakken/Three Forks (a tight oil formation) in North Dakota and Montana, could become a big Persian Gulf producing country within the United States. But the country has more than twenty big shale oil formations, especially the Eagle Ford Shale, where the recent boom is revealing a hydrocarbon endowment comparable to that of the Bakken Shale. Most of U.S. shale and tight oil are profitable at a price of oil (WTI) ranging from $50 to $65 per barrel, thus making them sufficiently resilient to a significant downturn of oil prices.

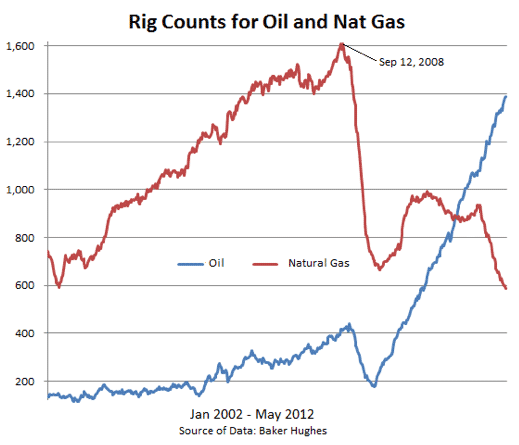

The difficulty is that an analogous scenario has unfolded before, in the natural gas industry. Out of sync with other commodities, the boom and bust in natural gas is giving us a glimpse of the future for unconventional oil. The extraction techniques are the same ones that have generated tremendous hype, while simultaneously setting up a ponzi scheme in flipping land leases, creating the perception of supply glut, crashing the price of natural gas in North America to far below break-even, amplifying financial risk for increasingly indebted producers, and threatening to put those same producers out of business.

This is the dynamic that is set to lead North America into a natural gas supply crunch over the next few years, as we discussed recently in Shale Gas Reality Begins to Dawn.Those involved in unconventional oil would do well to take note.

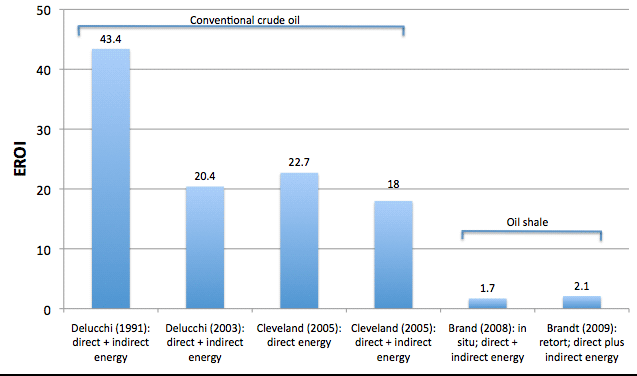

The drilling costs are high, as are the decline rates ("While some have been able to yield as much as 1,000 barrels a day, the rate then falls off to 65 percent the first year, 35 percent the second, and 15 percent the third"), and the EROEI is very low in comparison with conventional oil. As with unconventional gas, which suffers from the same obstacles, the industry is set on an accelerating drilling treadmill in an attempt to grow equity by expanding the reserve base with the cash flow generated.

Continued expansion is necessary to maintain the perception of company value. In other words, the industry is based on ponzi dynamics. So long as prices hold up, we can expect it to continue, but if we look at the broader economic context in conjunction with the lessons derived from unconventional gas, there is every reason to expect that the production boom is temporary, precisely because these circumstances will generate a price collapse.

Estimates of the price required for the new supplies to be economic vary. The consensus appears to be that there is a sufficient price cushion to withstand a fall, but producers are not anticipating a major one. Unfortunately for them, we can expect the perception of glut, combined with deepening economic depression, to force prices down to the cost of the lowest price producer, and quite possibly lower, at least temporarily. Companies on the unforgiving drilling treadmill will be facing increasing financial risk, and over the next few years, as over-extended and over-indebted companies go out of business, we can expect a supply crunch to develop.

The timescale is difficult to predict, as there are many factors with different timeframes to consider. Large scale deleveraging, which is set to unfold over the next few years, will have a tremendous impact on project capital availability, on demand, and on the affordability of operating and maintaining existing infrastructure. It will also be very difficult to build out new oil transport infrastructure to cope with changing energy supply patterns. The infrastructure mismatch will put continued downward price pressure on North American oil in comparison with international supplies, reducing the fungibility of oil.

Marin Katusa:

Oil Price Differentials: Caught Between Sands And Pipelines

North America has a long history of oil production and processing. Decades of producing oil and consuming lots of petroleum products have left the continent with a pretty good system of pipelines and refineries but pipelines are annoyingly stagnant things that tend to stay where you build them. And it turns out that the pipelines of yesterday are in the wrong places to serve the oil fields and refineries of today.

America's oil infrastructure was built around two inputs some domestic production and large volumes of imports. You see, while the Middle East may be the biggest producer of crude oil in the world, most of the refining occurs in the United States, Europe, and Asia. There are two reasons for this. The first is that it's easier to ship massive volumes of one product (crude oil) than smaller volumes of multiple products (gasoline, diesel, jet fuel, and so on). The second reason is that refineries are generally built within the regions they serve, so that each facility can be tailored to produce the right kinds and amounts of petroleum products for its customers...

...Remember how the US's oil pipelines were designed primarily to move refined products from the Gulf region and the coastal refineries to inland customers? Well, those pipelines of yesterday now run the wrong way.

The production boom in shale oil has momentum, and that is likely to carry on for some time, even in the face of sharply falling prices, as has been the case for natural gas. The rig count in shale oil production is skyrocketing, even as the rig count for natural gas falls, and production lags rig count.

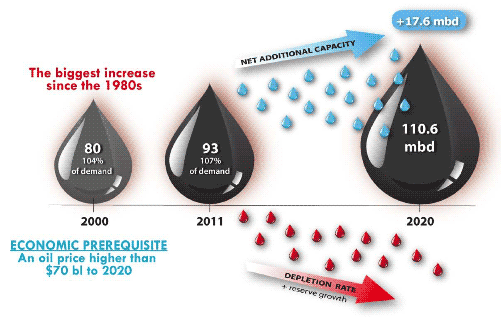

The quantity of recoverable oil has been considerably hyped, and this resource is not going to represent a game-changer. In fact it would not even if we were not facing economic circumstances set to crash production.

Robert Rapier:

Does the U.S. Really Have More Oil than Saudi Arabia?

The estimated amount of oil in place (the resource) varies widely, with some suggesting that there could be 400 billion barrels of oil in the Bakken. Because of advances in fracking technology, some of the resource has now been classified as reserves (the amount that can be technically and economically produced). However, the reserve is a very low fraction of the resource at 2 to 4 billion barrels (although some industry estimates put the recoverable amount as high as 20 billion barrels or so). For reference, the U.S. consumes a billion barrels of oil in about 52 days, and the world consumes a billion barrels in about 11 days.

In addition, the enormous number of expensive wells required would takes decades to drill with the rigs available, even if considerable efforts were made to increase their number, meaning that the oil that is there would be produced very slowly.

Beyond the shale oil of the Bakken in North Dakota or the Eagle Ford in Texas, there are other forms of unconventional oil that form part of the North American production boom hype.

Robert Rapier again:

When some people speak of hundreds of billions or trillions of barrels of U.S. oil, they are most likely talking about the oil shale in the Green River Formation in Colorado, Utah, and Wyoming. Since the shale in North Dakota and Texas is producing oil, some have assumed that the Green River Formation and its roughly 2 trillion barrels of oil resources will be developed next because they think it is a similar type of resource. But it is not.

The prospects for some of these are significantly worse than for shale oil, especially where the EROEI is even lower. Colorados oil shale in particular is unlikely ever to amount to much. While shale oil is a liquid hydrocarbon trapped in low permeability source rock, which can be liberated through fracking, oil shale is not a liquid at all, but solid kerogen that requires tremendous energy inputs to be separated from the source rock. Those required energy inputs mean a rock-bottom EROEI. Costs in monetary terms are sky-high as well.

Elliott Gue:

The Difference Between Oil Shale and Shale Oil

To generate liquid oil synthetically from oil shale, the kerogen-rich rock is heated to as high as 950 degrees Fahrenheit (500 degrees Celsius) in the absence of oxygen, a process known as retorting.

There are several competing technologies for producing oil shale. Exxon Mobil has developed a process for creating underground fractures in oil shale, filling these cracks with a material that conducts electricity, and then passing currents through the shale to gradually convert the kerogen into producible oil. Royal Dutch Shell Plc buries electric heaters underground to heat the oil shale.

Although estimates of the cost to produce oil shale vary widely, the process is more expensive and energy-intensive than extracting crude from Canada's oil sands. Producers would require oil prices of roughly $100 a barrel before this capital-intensive process would be feasible on a commercial scale.

Shale oil may have an EROEI of approximately 4, while tar sands would come in at 3 and oil shale would be 2 or less.

Humans are prone to grasp at straws and believe in fantasies rather than face unpleasant realities. Believing that unconventional fossil fuels can maintain business as usual is a fantasy. We cannot run our current complex society on low EROEI energy sources.

We are still facing peak oil, and, on the downslope of Hubberts Curve, we will be running faster and faster on our accelerating treadmill just to slow the decline in supply. Unconventional supplies with lower and lower EROEI are not going to change that picture, and the crash of prices that will happen thanks to economic depression will aggravate the situation considerably in the short term. We can expect prices to fall faster than the cost of production, and many corporate casualties to emerge as boom turns to bust, as it always does.

The next few years will be remembered for financial crisis, where it will be money in short supply rather than energy. As economic contraction proceeds, and purchasing power falls substantially due to the collapse of the money supply, demand for energy will - temporarily - fall a long way. Beyond that, as the deleverging comes to an end and the economy begins to stabilize somewhat (probably between five and ten years down the line), we are likely to see a supply crunch develop.

With that we are likely to see a major price spike, and the potential for resource wars will grow dramatically. Oil is liquid hegemonic power, and conflict can be expected to develop when it is perceived to be scarce. Thats not where we find ourselves today, but it is where the future is taking us.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.