Samaris Of Sypris Winning The World’s Dumbest Politician Contest

Politics / Eurozone Debt Crisis Jun 08, 2012 - 03:56 AM GMTBy: HRA_Advisory

A country that represents less than 2% of the Euro block and a tiny fraction of the world economy continues to be the tail that wags the dog. We'll all have to wait until June 17th to see whether Greeks vote with their emotions or with their heads. Currently it looks like it could be the former, which would not bode well for markets.

A country that represents less than 2% of the Euro block and a tiny fraction of the world economy continues to be the tail that wags the dog. We'll all have to wait until June 17th to see whether Greeks vote with their emotions or with their heads. Currently it looks like it could be the former, which would not bode well for markets.

The US and Germany have both released decent economic readings but that won't be enough to overcome fears of yet another debt meltdown unless the Greek vote goes the right way. Negative news out of Europe pummels the Euro and the correlation between the value of the Euro and commodities is currently very high. Metals prices aren't going anywhere until the issue is resolved.

If it is resolved favourably there should be a fairly strong rally in precious metals prices. This would translate into gains for juniors though the current level of fear in the market would take time to dissipate. If things go well small producers, advanced developers and the occasional strong drill play would get some traction. Many others will need to rebuild their markets and balance sheets which wouldn't start until autumn in many cases.

If it is resolved favourably there should be a fairly strong rally in precious metals prices. This would translate into gains for juniors though the current level of fear in the market would take time to dissipate. If things go well small producers, advanced developers and the occasional strong drill play would get some traction. Many others will need to rebuild their markets and balance sheets which wouldn't start until autumn in many cases.

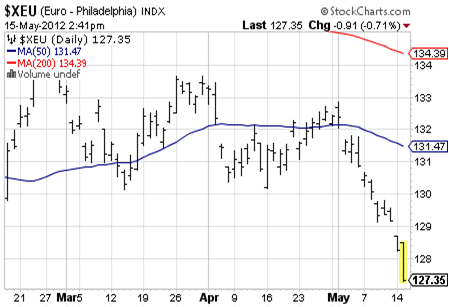

Keep an eye on the Euro chart and the polls out of Athens. It will be a volatile and none too predictable market until the polls close (again).

Everyone has a favorite in this race. The World's Dumbest Politician contest never has a lack of entrants and some days it's tough to choose between all the contenders. No longer, however. The events in Greece have lifted one contestant so far above the rest that we simply have to declare him the winner.

You may think this is a reference to Alexis Tsipras, the leader of the left wing Syriza party. We'll get to him later. No, without a doubt the mantle of Dumbest of the Dumb Politicos has to go to Antonis Samaris, the leader of the "winning" New Democracy party in Greece.

You may recall that New Democracy was the party in power in Athens before Pasok which was just voted out. New Democracy was mainly responsible for cooking the books and hiding deficits (with the help of Goldman Sachs) so that Greece could gain entry into the Eurozone.

Having been caught out and tossed from office Samaris later agreed to vote with Pasok on the latest bailout agreement. The condition of his agreement was to force an election on the Greek populace rather than have the government of technocrats under the Pasok banner keep running things.

Even though largely responsible for worsening the mess in Greece, New Democracy apparently thought they would get voted back into office with a higher seat count. Can you say "in denial"?

To give Samaris some credit, he at least has enough sense to understand the repercussions of reneging on the bailout agreement, which is more than can be said for all of the other party leaders other than Pasok.

Post-election there are now seven parties in parliament and five of them are "anti-bailout" or "anti-austerity" as they would prefer to be called.

The leader of this pack is Tsipras, former communist and student activist who is now the man with the momentum in Greek politics. This party came in second place on May 6th but more recent polls indicate he'll be number one in the next election that should take place in mid-June.

In a second vote, Tsipras could leach votes from both minor parties that have little chance of being in government as well as from the two "major" old line parties. Small party leaders eyeing spots in a new coalition after a second vote don't want to be seen as disagreeing with the probable coalition leader.

Where to from here? A second election campaign will be dominated by a leader who insists the EU is bluffing when it says Greece could be ejected from the Euro.

In fact, all anti-austerity parties insist Greece will be keeping the Euro, come what may. This makes one wonder just how reality challenged these politicians might be. They seem either incapable of grasping that Euro membership has conditions or are so cynical they are ignoring it.

Canadian readers of a certain age will be familiar with the phrase "sovereignty-association". This was the twofaced slogan of the Parti Quebecois during the late 1970's and early 1980's.

The PQ insisted that Quebec would be able to vote for sovereignty and then negotiate an agreement that would give them everything they wanted from Canada. The wish list included keeping current borders and access to whatever federal programs were advantageous and, of course, continued transfer payments from Ottawa.

Even those who remember the economic mismanagement of Pierre Trudeau's administrations appreciate how much of an impact he had on the Quebec sovereignty debate. As a respected Francophone Quebecer who also happened to be Prime Minister of Canada he was one of the few with the credibility to face down the separatists. He was able to convince enough Quebecers that the deal PQ followers were dreaming of was just that--a dream.

It's unknown if there is someone with similar credibility in Greece, though there seem no obvious candidates. The Greek electoral system will not allow enough time for someone new to take over either old line party before the next vote.

Polls indicate that 70% of Greeks want the last bailout package to be renegotiated. Ironically, that is exactly the same percentage of respondents that want Athens to do whatever it takes to stay in the Euro. Clearly, a lot of Greeks hope both of these diametrically opposed agendas can be run in tandem. Is this possible?

An Greek anti-austerity politicians are betting that the last debt workout actually strengthens their hand. That agreement effectively transferred the bulk of Greek sovereign debt from banks to EU institutions.

Tispras has alluded to this ownership change but is seriously misreading the situation. The EU is far more worried about financial system and bond market contagion than it is about taking a write-off itself. The EU is a large economy. Writing off $3-400 billion will not be the end of the world as long as the situation is containable. There is more willingness to force Greece out of the EU and take the loss on its debt now than at any time since the crisis erupted.

While the Greeks may still want a free lunch most remember just how much lower the standard of living was before the country joined the Euro block. Those with even longer memories understand that a return to the Drachma will mean a huge loss of purchasing power and probable bankruptcy for anyone unlucky to have large foreign currency debts.

All that said, the austerity measures taken by Greece, Spain, Portugal and Ireland are pretty extreme. It's easy to watch this unfold from the other side of the Atlantic (or Berlin for that matter) and say "they need to do more". To put the situation in perspective, the annual cuts that Athens has pushed through in each of the last two years as a percentage of GDP is five times the level of budget cuts that politicians in Washington could not agree to last August. It's true governments in the debtor nations have to do more but you can't say they aren't trying.

Ultimately debtor countries DO need to do more, but cutbacks have reached levels that are extinguishing hope in these countries. There is real danger a negative growth spiral, which Greece is already in, will make it impossible to balance budgets.

You can't fix debt with more debt but it may be time for the creditor countries in Europe to come up with some extra cash for infrastructures programs or something else that generates a bit of hiring. Money should be focused on the countries that are making structural changes--like Ireland and Spain--in the hopes this lightens the mood some. Getting the debt levels down is obviously critical but making structural changes that make debtor economies more flexible is the only thing that will have a lasting impact.

In the broader Euro Zone, statistics just released indicate that the region scraped by in Q1 with zero growth, avoiding a recession but only just. That is wholly due to a much stronger performance by Germany which posted 0.5% growth as opposed to the 0.1% consensus estimate. These figures will sharpen the debate between Germany and France. Newly elected President Francoise Hollande is demanding a "growth pact" that provide some new spending funded by EU institutions.

Germans will view today's figures as a vindication of their fiscal conservatism. There is some truth to that but it's also arguable that Germany's success shows the value of an open trading block. Germany is an export powerhouse and the cheap Euro has been a boon to it. Just as the peripheral countries would see their currencies plunge if they went back to pre-Euro days Germany would see its scrip balloon in value.

This doesn't belittle Germany's great strengths when it comes to quality, innovation and its relentless drive for higher productivity. Those are the long term reasons for its success and qualities other Euro countries need to emulate. Nonetheless, being in the Euro zone has been very good to Germany and other nation states know this. Germans have good self-interested reasons to be accommodating, at least to a point.

Gold, the Euro and Resource Stock Despair

A gold chart would be redundant since the Euro chart on the right says it all. The next month will be dominated by an unnecessary election in a minor country that represents 2% of the EU economy.

The Euro has been crashing and will swing wildly with every Greek opinion poll until the next election. Yields are rising in Spain and Italy and this trend will continue as long as bond traders expect Greece to be ejected.

Although some European economies are victims of real estate bubbles, many of the region's troubles are self-inflicted. The EU has been dithering about how to handle the crises for three years and providing nothing but half measures and stopgap "solutions". This has to end or things will continue to get worse before they get better.

As soon as the campaign in Greece restarts the rest of the continent has to make it clear and be unequivocal that the vote is about being inside or outside the Euro zone and nothing else. Even if there is room to give Greece some breathing space on austerity measures it must be made clear that loosening of conditions will only apply if there is a pro-bailout government. Even then, Greece may breach some debt covenants before it has time to complete a new vote, assuming that vote results in some sort of coalition.

Many of the debtor nations have been and are making large strides in dealing with their debt overhangs. The market won't care about this if bond traders get to play "who's next?" if there is a Greek exit. Greece should have been ejected from the EU three years ago. That didn't happen so northern Europeans and particularly Germans will have to be prepared to do what it takes to hold the zone together or face the consequences.

Most Greek debt is no longer held by banks. There would be fallout in the swap markets but if the February deal is anything to go by it will be smaller than many fear. The important thing is to ensure the bond markets for other peripheral countries are protected. The ECB should be prepared to extend unlimited (and we mean unlimited) buying power in defense of Europe's bond markets. It's far more important t ensure Spanish, Italian and French bonds don't crash than it is to save Greece. Tough sledding, but that's just how things are.

Until there is some visibility in Europe gold and other commodities will track the Euro and resource stocks will continue to see fear and liquidity generating selling. It's depressing to see and avoidable problem blow up yet again. Time really has run out for Greece and for Europe. Let's hope cooler heads prevail--very soon.

By Eric Coffin

http://www.hraadvisory.com

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com

©2012 Stockwork Consulting Ltd. All Rights Reserved.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.