Central Banks Still Significant Buyers On Gold Price Dip

Commodities / Gold and Silver 2012 May 24, 2012 - 07:16 AM GMTBy: GoldCore

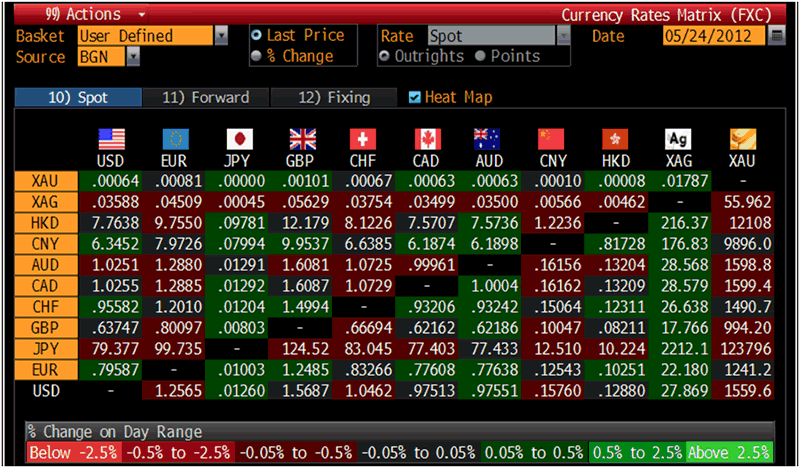

Gold’s London AM fix this morning was USD 1,558.50, EUR 1,239.27, and GBP 993.62 per ounce. Yesterday's AM fix this morning was USD 1,555.00, EUR 1,229.44, and GBP 989.56 per ounce.

Gold’s London AM fix this morning was USD 1,558.50, EUR 1,239.27, and GBP 993.62 per ounce. Yesterday's AM fix this morning was USD 1,555.00, EUR 1,229.44, and GBP 989.56 per ounce.

Silver is trading at $28.12/oz, €22.46/oz and £18.01/oz. Platinum is trading at $1,430.25/oz, palladium at $591.80/oz and rhodium at $1,275/oz.

Gold fell $5.60 or 0.36% in New York yesterday and closed at $1,561.20/oz. Gold has been trading sideways in Asia and was slightly lower in Europe prior to buying which saw gold rise to about the close in New York yesterday.

Fears about Greece and the EU after the EU summit came up short on delivering a grand solution to solve the debt crisis are supporting gold at these levels and leading to some safe haven buying.

EU leaders once again failed to agree to plans with regards to the increasing possibility that Greece exits the euro. Instead, Greece was again urged to continue to meet targets and continue the austerity to complete the ‘bailout’ schedule.

Meanwhile, the crisis is being compounded by the increasing insolvency of Spanish banks and indeed Spain itself.

Spain announced a 9 billion euro ($11 billion) bailout of Bankia on Wednesday, and endeavoured to find new ways to meet its demanding financing needs which may pull the country deeper into the eurozone crisis. The Irish NAMA style solution of creative accounting and kicking the can down the road is being looked at rather than the more prudent, but short term painful, winding down of all the ‘bad’ insolvent Spanish banks.

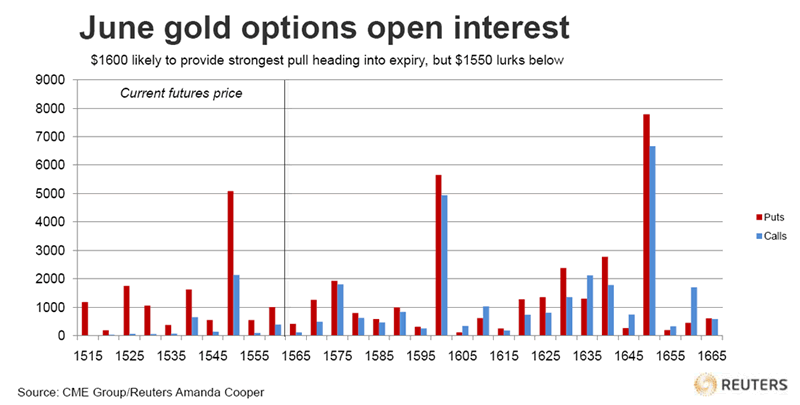

Gold may struggle to make gains over the coming trading session ahead of the expiry of monthly US options. However, sharp gains could be seen after option expiration – as has often been the case in recent years.

Reuters report that traders said that because the underlying June futures price was trading roughly between $1,550 and $1,600, where most at-the-money open interest was clustered, it was not clear which would exert a greater “gravitational pull” on the gold price.

Most open interest, which reflects investor positioning, is located at $1,550 and $1,600, with a firm bias towards the $1,550 level where gold may be guided towards.

Puts, options that give the holder the right, but not the obligation to sell a predetermined amount of an asset at a set price by a certain date, outnumber calls, or buy options, by nearly 2:1.

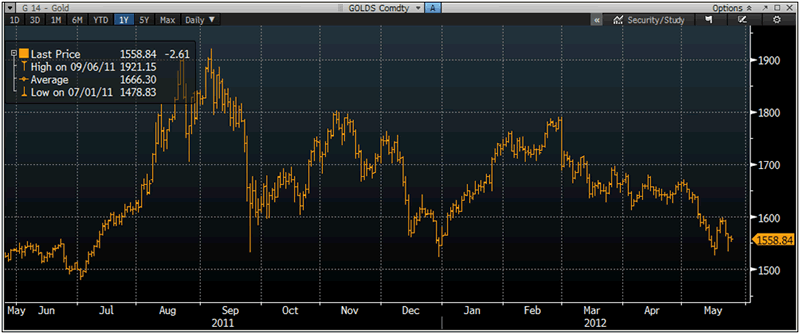

Gold 1 Year – (Bloomberg)

The massive reversal higher in the gold mining shares yesterday which saw an outside day reversal to the upside and over 4% gains in the XAU and HUI is another sign that we may be close to a bottom.

Central Banks Still Significant Buyers On Gold Dip

Central banks internationally continue to diversify their foreign exchange reserves into gold bullion due to concerns about fiat currencies – including the dollar and especially the euro.

IMF data shows that central banks were again net buyers in April with Turkey and Philippines being the largest buyers of gold.

The Philippines increased their gold holdings significantly by 32.13 tonnes to 194.241 tonnes in March – a 17% increase in their gold reserves in the month.

It was the single largest addition Philippines has made since September 2008. They have been pretty consistent buyers of gold over the last few years, but the 17% increase in April was another big rise.

Turkey expanded its gold reserves by 29.7 metric tons in April. Turkey’s bullion reserves climbed to 239.3 tons last month meaning that Turkey increased their gold reserves by 14% in April.

The central bank on March 27 doubled the share of lira reserves banks can hold in gold to 20%, saying it would provide 6.1 billion liras ($3.3 billion) of extra liquidity.

Mexico increased gold holdings by 2.92 tonnes to 125.5 tonnes in April.

Kazakhstan raised gold holdings by 2.02 tonnes to 98.19 tonnes in April.

Ukraine upped gold reserves by 1.4 tonnes to 30.607 tonnes in April.

Sri Lanka raised gold reserves by 2.177 tonnes to 7.807 tonnes in January. There is a delay in Sri Lanakan gold reserve reporting to the IMF.

Central banks added 456.4 tons last year, the most in almost five decades, and will buy as much as 400 tons this year, the London-based World Gold Council estimates.

Cross Currency Table – (Bloomberg)

While the gold tonnage demand from central banks in recent months has been significant, gold remains a tiny fraction of most central banks, especially emerging market creditor nations such as China, foreign exchange reserves and therefore the trend is sustainable and indeed may accelerate.

Central bank reserve diversification into gold may increase given the Eurozone debt crisis and the risk of debt crisis spreading to Japan, the UK and the U.S.

Indeed, there is the increasing possibility that some G8 debtor nations, such as the UK and Japan, may decide to once again add to their gold reserves in order to protect their currencies and guard against the risk of devaluations of the euro, dollar, yen, pound and a wider international monetary crisis.

Price is not a determining factor in central bank buying rather they are more likely being guided to secure an allocation of a percentage of their overall foreign exchange reserves into gold bullion.

Sovereign government buying of gold is likely to support gold at these levels and indeed could be the driver to higher prices in the coming weeks and months.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.