Is the World Ready for Gold Turkey?

Commodities / Gold and Silver 2012 May 23, 2012 - 10:13 AM GMTBy: Jan_Skoyles

Since the beginning of the year we have seen increasing levels of interest in Turkey’s gold market. Earlier on in the year rumours abounded of Turkey swapping gold for oil with Iran, whilst this month the World Gold Council’s most recent report placed a particular focus on Turkey’s gold demand.

Since the beginning of the year we have seen increasing levels of interest in Turkey’s gold market. Earlier on in the year rumours abounded of Turkey swapping gold for oil with Iran, whilst this month the World Gold Council’s most recent report placed a particular focus on Turkey’s gold demand.

Below we take a brief look at Turkey’s relationship with gold, and ask why does it now seem to be a focus of the international community’s concerns?

Disobeying the UN

In January it was reported that Turkey were preparing to bypass UN sanctions by trading with Iran for oil in exchange for gold.

This was confirmed when, in early May, the Turkish Statistical Institute reported that gold sales to Iran, from Turkey, soared over 30 times in March. Data shows gold exports between the two countries increased by nine metric tonnes; a significant amount considering the previous year this amount sat at just 286kg.

The Turkish government has assured the US that they will reduce oil imports from the Islamic Republic this year, however total trade increased by 47% in the first quarter of 2012 between the two countries. It is not surprising Iran has become one of Turkey’s biggest trading partners; the country benefited heavily from the Iran-Iraq war in 1980-1988, becoming a trading partner to both parties.

It is this recent surge in trade with Iran which analysts believe accounts for the tripling in demand by Iran for Turkey’s precious metals, mainly gold. The longer the Islamic Republic remains isolated, the greater the trade in Turkish gold, and the longer high prices in the local market are maintained. Reuters report that the fall in the rial’s value against the dollar has caused an increase gold investment for savings purposes.

Gold demand starts at home

However, the gold market is not just an export-opportunity for Turkey. The World Gold Council reports a change in the demand pattern within the country.

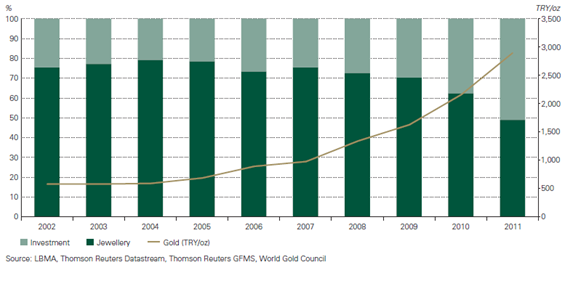

The graph below shows the gradual switch between demand for gold jewellery and gold for investment purposes (coins and bars).

Between 2010 and 2011, an 80% increase (year-on-year) was seen in retail investment demand for gold coins and bars. The WGC expects this rise to continue ‘despite recent gold price performance’; the gold price increased by 216% when priced in Turkish Lira between May 2007 and April 2012. It is interesting to note that as the gold price has increased, the demand for jewellery has decreased, yet gold investment demand has grown. The WGC report; ‘In 2011, for the first time, gold investment accounted for the lion’s share of the country’s total consumer demand.’

Gold is Turkey’s safe-haven

We suspect this increasing demand will continue to exhibit itself thanks to growing concerns in regard to the international economic arena, but also Turkish citizens’ concern for their own economic situation.

Gold is the traditional form of saving in a country whose current account deficit is slowly getting out of control. The WGC estimates there to be approximately 5,000 tonnes of accumulated gold in homes across the country. This is greater than Germany’s Bundesbank which (reportedly) has only 3,400 tonnes. Compared to Turkey’s own central bank, the Turkish citizens have over 3,800 tonnes more.

According to the recent WGC report, Turkey has the 8th largest retail demand for investment gold. This year they have invested in 72.9 tonnes of gold bullion. Per capita, the country has 21.9g of gold consumption intensity.

Prior to 1993, the Turkish gold market was not fully liberalised. However since then the World Gold Council report to have seen ‘rapid growth of the sector’. It seems that the Turkish government are actively persuading individuals to invest in gold, but this may have an ulterior motive.

Turkish economic history

For a country whose average inflation rate between 1965 and 2010 was 39.78% and experienced triple digit inflation in May 1980, it is not surprising that individuals have chosen to buy gold bullion, the most secure store of value.

The modern economic history of Turkey does not make comfortable reading. Since 1950, the country has experienced at least one economic crisis per decade.

In a similar series of events to that seen recently in Britain, between the 1970s and 1990s the country saw a series of rapid expansion plans, military operations and significant balance of payments deficits. Turkey ran serious current account deficits, usually financed by foreign loans. Their external debt rose to more than a quarter of GDP, a significantly lower number than that shouldered by both the US and UK at present.

We want your gold

Recently the Turkish government have gained some attention thanks to their plans to draw ‘under the pillow’ savings into the economy.

This has raised warnings of the danger of keeping your gold in the banking system. As Zero Hedge wrote back in March, in light of the Wall Street Journal report, ‘How will Turkey spin gold confiscation in the politest of ways?’ In reference to Executive Order 6102, whereby President Roosevelt signed an order which forbid the hoarding of gold within the United States.

The Turkish government now allow gold, in any form, be it coins, bars or bangles, to be used as collateral. Meanwhile the central bank has increased the allowance of gold that could qualify as reserves by commercial banks to 20%. This is purportedly in order to improve the liquidity of the Turkish banking system.

It is estimated that Turkish banks are holding $2.8bn worth of gold-related deposit accounts and $1bn worth of gold-related investment funds. The heavy promotion of gold-linked savings accounts by the Turkish government has now seen gold become the top investment option, after real estate and property, for private investment.

The current-account deficit, which we alluded to earlier, is the assumed reason for the Turkish government’s offerings of incentives in order to encourage the deposits of privately held gold into the banking system.

Future of gold for Turkey

It is reported that there are approximately 23 million ounces of gold still to be mined in Turkey. This more than allows for future increases in private gold investment and any further gold payments to other countries such as Russia, India, China and Iran who have all showed their willingness to partake in the gold-for-goods trade.

The Turkish citizens continue to find their currency devalued against other currencies, such as the US dollar; in 2011 it lost 23% of its value against the US currency. It has been devalued against gold by an even greater number.

It is interesting to see yet another country, which does not seem to be dominating the headlines as much as its Western counterparts, in regard to the financial crisis, to be hoarding gold in response to the slow but continued unfolding of the financial crisis.

The new initiatives by both the government, central bank and commercial banks all indicate that the appreciation for gold as an insurance policy remains strong. The issue is whether or not the Western world has registered that a country, which has been through similar crises to that which they are going through at present, has shown that after several IMF loans and conditional international support the only thing anyone can trust is gold.

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.