Full-Fledged European Bank Run Underway; Monetarist Fools are Everywhere; Believe in Gold

Politics / Credit Crisis 2012 May 21, 2012 - 11:11 AM GMTBy: Mike_Shedlock

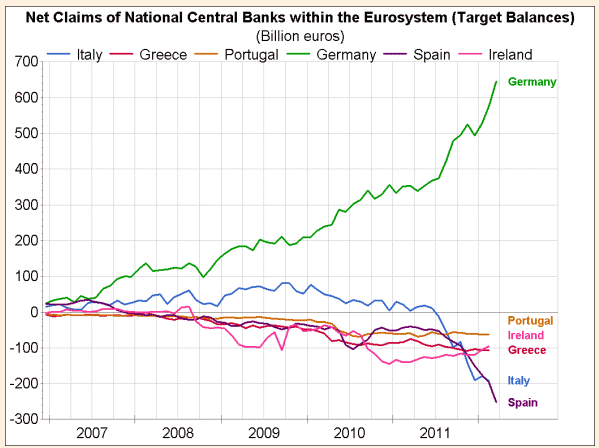

One chart is all it takes to prove a full-fledged European bank run on the banks is well underway in the Club-Med countries and Ireland.

One chart is all it takes to prove a full-fledged European bank run on the banks is well underway in the Club-Med countries and Ireland.

The above chart is from the Financial Times article The anatomy of the eurozone bank run by Gavyn Davies.

A bank run is now happening within the eurozone. So far it has been relatively slow and prolonged, but it is a run nonetheless. And last week, it showed signs of accelerating sharply, in a way which demands an urgent response from policy-makers.

The fear of bank runs is deeply ingrained in all economists who know anything about the genesis of the Great Depression in the United States in the early 1930s. Then, the failure of the Bank of United States in December 1930 led to multiple bank runs across the country. Bank failures in the following two years wiped out personal savings and greatly exacerbated the collapse of demand in the economy.

The classic account of the crisis, by Milton Friedman and Anna Schwartz, concluded that the collapse was largely the fault of the Federal Reserve, which failed to provide enough liquidity to keep the banks functioning and thus end the panic.

Classical Nonsense

We need to stop right there for a bit because the "classic account" Davies believes in is complete nonsense. The crisis then and now is a crisis of solvency.

The culprit is fractional reserve lending coupled with fraudulent lending practices that allow banks to secure deposits for 2 years or less but lend money out for 30 years.

The way to stop runs on the bank is easy enough: stop fractional reserve lending and other fraudulent lending practices.

Davies continues with still more nonsense.

After the crash, the establishment of the Federal Deposit Insurance Corporation was intended to ensure that deposit holders never again had to live in fear that their savings would be in jeopardy. What are the lessons for the eurozone?

How FDIC Played a Part in the US Real Estate Bust

Clearly there was fear depositors would lose money and the run on Lehman and Bear Stearns is proof enough.

The irony is there was no fear for the longest time because of FDIC when fear should be a rational worry. That lack of fear led to depositors chasing the highest yields simply because they were government guaranteed.

For example, Corus bank (among numerous others) offered attractive rates and invested deposits in condo construction schemes in Florida, California, and Las Vegas. Were it not for FDIC, no one in their right mind would have put deposits at Corus and other such banks that went bust in the real estate crash.

The fools who did place deposits at such banks seeking higher yields deserved to lose those deposits.

End Fractional Reserve Lending

Under a full-reserve 100% gold-backed banking system, inflation would be nonexistent and bank failures would be few and scattered. Instead, we have seen boom-bust cycles of increasing magnitude with faith placed on FDIC, and that faith contributed to the magnitude of the bust and an enormous failure of hundreds of banks in a short period of time.

In short FDIC should be phased out along with the end of fractional reserve lending.

The rest of Davies' article is a hodge-podge of still more fallacies concluding with ...

Mario Monti apparently took a plan to the G8 summit to offer jointly-funded guarantees on bank deposits to apply across the entire eurozone. This would certainly help, but whether it would be sufficient to eliminate fears of exchange rate losses if the euro were to disintegrate is another matter. To fix that problem, belief in the integrity of the euro as a single currency needs to be restored. The bank run could bring matters to a head.

Belief in the Euro? Why?

Pray tell why should there be a belief in the Euro, especially when the "solution" proposed by Keynsian and Monetarist clowns is simply to print more money to cover fraudulent lending practices by banks, every time banks get into trouble?

Belief in Gold

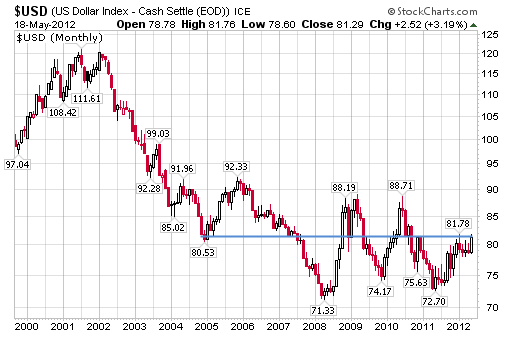

Note that the US dollar index is right where it was over seven years ago.

The US$ index is at a spot first touched in late 2004. Gold was well under $500 an ounce at that time, so please do not tell me gold is a function of the US dollar.

One of the reasons gold is at $1600 with the US dollar index above 81 is precisely because central banks in general (notably the Fed, the ECB, the Bank of England, and China) have printed nonstop and the Fed and the ECB have initiated all sorts of liquidity and QE measures. In addition, the ECB's balance sheet is more bloated than the balance sheet of the Fed thanks to the LTRO program.

Integrity of Gold

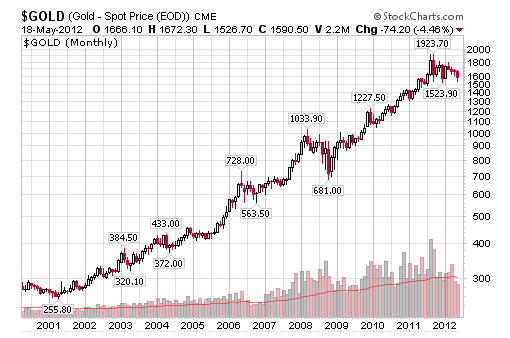

The proper conclusion is that gold is a function of mistrust in fiat currencies in general, not just the US dollar. However, nothing moves in a straight line including faith (or lack thereof) in central banks' ability to handle this crisis.

By now it should be perfectly obvious the LTRO is a complete failure. Banks in Spain took the money and bought more of their own bonds and are now underwater on them.

Only monetarist fools want the ECB to do more of the same. Sadly, monetarist fools are nearly everywhere, and the chart of the price of gold says just that.

In conclusion, if the ECB was to take the action suggested by Davies (and they might), it certainly will do nothing for the "integrity of the euro", but it is highly likely to further the integrity of gold.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.