Fear stalks the Financial Markets

Stock-Markets / Financial Markets 2012 May 18, 2012 - 02:51 AM GMTBy: Brian_Bloom

Fear is stalking the darkening streets of the investment world. Will the EU fall apart? If so, how will this impact on the rest of the world? Will governments resort to printing money in order to inflate their debts into oblivion or will austerity prevail; leading to a collapse in the world’s financial markets?

Fear is stalking the darkening streets of the investment world. Will the EU fall apart? If so, how will this impact on the rest of the world? Will governments resort to printing money in order to inflate their debts into oblivion or will austerity prevail; leading to a collapse in the world’s financial markets?

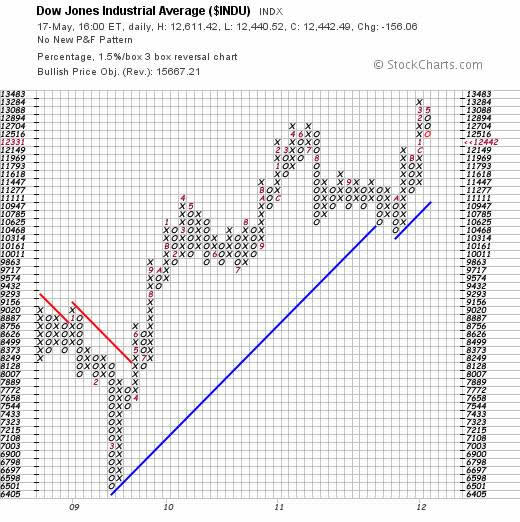

In terms of chart #1 below (courtesy stockcharts.com) the level of 12,331 – if it is reached – represents a high pole reversal warning level. If it is reached, this will imply that the Dow might retrace its previous up move all the way back to 11,447. Nevertheless, readers should note that the chart would still be above its rising blue trend line.

Chart #1

Chart #2 is a weekly bar chart of the Dow. Of significance, it shows the intersection of all three of the 40 week MA, the first Fibonacci retracement support (blue semi circle) and the rising green support trend line at around 12,334

Clearly, a break below that number – should it happen – will be highly significant.

Chart #2

The angle of decline of the three parallel, blue, descending trend lines indicates that a “final” resolution of the Primary Direction of the market will manifest within about 4 to 5 months. That is the point (September/October) at which third descending trend line intersects the third (and final) Fibonacci retraction – which happens to be in the region of 12,000, or the support level of 11,969 on Chart #1 above.

The following are selected quotes from an article that appeared in the media this morning:

http://news.yahoo.com/spain-slides-back-recession-first-quarter-073134907.html

- “The IMF, which along with the EU is all that stand between Greece and a disorderly default and eurozone exit, have warned that no new funds will be released from the latest 240-billion euro ($305-billion) bailout if progress on pledged reforms and tough austerity measures falters.”

- “The ECB said Wednesday that it was no longer dealing with some Greek banks via the conventional credit window, Dow Jones Newswires reported, and has restricted the banks to "emergency lending assistance" from Greece's central bank that must be approved from month to month. "Add this to the long list of other eurozone problems and investors are finding it very difficult to justify taking on the additional risk associated with the eurozone," Erlam said.”

- "There was a high degree of agreement that fiscal consolidation and growth are not mutually exclusive but that both are needed," a spokesman for German Chancellor Angela Merkel said in an email.

The first two quotes clearly have deflationary implications, whilst the third quote sounds like political gobbledegook to this commentator.

When we look at the inflation oriented argument that the central banks are just going to inflate the global public debt away, there is a subtlety which the inflationist camp’s argument seems to be missing:

Accounting in the modern world is based on the concept of double sided entries. For every debit there must be a corresponding credit. This insistence by the inflationists that the authorities will just create money out of thin air flies in the face of the double sided entry concept. Historically – since the establishment of the US Federal Reserve Board – fiat “money” was never created out of thin air – as the Fed’s Balance Sheet demonstrates. But let’s not get ahead of ourselves. Let’s think it through.

The double sided entry associated with money creation might require one of the two following entries:

- If the Federal Government wanted to spend more money than it has available to it, the entry in the Fed’s books would be:

- Debit the asset of US Government Treasury Bonds (which would either be held on the Fed’s Balance Sheet or on-sold into the market)

- Credit the liability/ies of “federal reserve notes” or “deposits” (depending on how the money was sourced to lend to the US Government).

- If the Federal Government were to take over the printing of “cash” – and eliminate the Fed from the equation, then the entry would be:

- Debit the asset of cash at bank

- Credit profit (liability of money owing to citizens) arising from creation of cash out of thin air

But, given that it is physically impossible to create profit out of thin air, there would be a corresponding loss to citizens somewhere else. That loss would be represented by a fall in the “price” of the US Dollar against other currencies that were not being printed by their governments. And the books of the owners of the country (citizens) would balance.

Now let’s look at Option #1 in a bit more detail:

If you go to the Fed’s website and you look at its Balance Sheet as at Wednesday, May 16th, 2012, you will see the following ( in millions of dollars) http://www.federalreserve.gov/releases/h41/current/h41.htm

- Assets (Item 8): $2,853,300

- Liabilities: $2,798,651

- Capital plus surplus: $54, 649

Given that $2,798,651 + $54,649 = $2,853,300, the Balance Sheet of the US Federal Reserve balances and the maximum accumulated “profits” that would have accrued to the Fed since its creation in 1913 – from creating money out of thin air – would have been somewhat less than $27 billion.

It follows that the Fed has not created money out of thin air. The creation of money has been facilitated by Government borrowing. For every dollar “liability” created by the Fed when it prints money (a dollar bill is a certificate of liability of the Fed), there has been a corresponding “asset” created in the form of a debtor – the person/organisation to whom the Fed lends the cash.

Does the money supply rise? Of course it does. But so does the government’s debt. Therefore, under option #1 above, to argue that the Federal Government can just “inflate the debt away” is pure garbage. Yes, the worth of the Treasury Bond to the holder will be reduced as the value of the dollar falls, but the amount of absolute debt (amount of Treasury Bonds) will rise. In simplistic terms: How will it be possible to “inflate the debt away” by printing dollars, if halving the value of the dollar has a consequence of doubling the amount of public debt? The argument is mindlessly nonsensical.

Let’s look at some actual statistics:

In the ten years from January 1st 2002, to December 30th 2011, the US Public Debt rose from $5.94 trillion to $15.2 trillion, or by 156% (source: http://www.treasurydirect.gov/NP/NPGateway )

In the same period, seasonally adjusted M1 rose from $1.19 trillion to $2.17 trillion, or by 82%. (Source: http://www.federalreserve.gov/releases/h6/current/ )

Why did debt rise by more than money supply – in both dollars and percentages? Because the US government’s borrowings are not funded exclusively with new dollars; some treasury bonds are bought by US citizens/institutions using existing US savings and some are bought by foreigners using their savings.

So, with the above in mind, how does it arise that an entire sub-culture of the finance industry – populated by economists, investment advisers, bankers, financial “experts” and enthusiastic amateurs – can genuinely believe that the public debt can be inflated away? Is this merely akin to religious dogma or is there some substance to the argument?

Well, assuming that they have not taken leave of their collective senses and they are not displaying signs of “irrational discouragement” then they must be making some assumption regarding Option #2 above. They must be assuming that, like the Weimar Republic and like Zimbabwe, central governments will merely take over the function of money printing, thereby eliminating the central banks and thereby eliminating the need to “borrow” the money.

Okay, so let’s run with that assumption. How will that newly created money find its way into circulation? Well, there are three ways:

- The government can “gift” it to its citizens who will, presumable, spend it on consumables or assets like food, furniture, electronics etc.

- The government can spend the money itself – thereby increasing the proportion of GDP that it contributes relative to private enterprise

- The government can “lend” the money to commercial banks who, in turn, will lend it (or a multiple thereof) to consumers and/or commercial/industrial borrowers.

Let’s look at these three in some more detail:

- If citizens take the gifts and spend these gifts on consumer goods, there will be a temporary “sugar hit” to the economy, followed by a fall in the currency relative to other currencies, and consumers will land up bearing the pain of the free gift down the track. i.e. There is no such thing as a free lunch.

- If the government increases its proportional contribution of GDP then it will – by definition – reduce the proportional contribution of private enterprise. Of course, if the money is “invested” on a temporary basis in a way that will kick-start the “wealth creation” motor, then private enterprise can take over later as the economic momentum grows. But we are living in a world of oversupply – from widgets to engineering, from cars to condoms. So the investment needs to be in areas where there is an under supply. The most visible areas of under supply are:

- Energy: Because Energy Return on Energy Invested has been decreasing over the decades, the NET energy available (after applying energy to mine deteriorating energy content coal or pump increasingly difficult to access oil and gas) has been decreasing on a per capita basis across the planet since the late 1970s. That, ultimately, has been the cause of the Global Financial Crisis – because governments sought to plug the wealth creation gap by making money more freely available.

- Potable water: Because of a combination of population growth and associated environmental pollution, there is a growing need to supplement natural supplies of potable water with artificially created supplies like desalinated sea water.

- Arable land: Clearly, because the amount of land is finite, what has to change is that the yields per hectare of land need to be structurally improved. But flogging farmland to yield temporary increases gives rise to deteriorating ability of the land to continue to provide the improved yield. Therefore, we also need to develop ways of prolonging the viability of agricultural land.

- If banks on-lend the money to already indebted consumers, who then consume what they have bought, the consumers will land up with increased debt which they cannot repay. So, a point will be reached when banks will be reluctant to lend to consumers. On the other hand, if banks lend to commerce/industry then commerce/industry will “invest” the money in anticipated high yield ventures – where the profits are expected to be sufficiently large to repay the debt and make a return. Unfortunately, in a world that is characterised by oversupply (and excessive accumulated debt which has accompanied an increasingly moribund world economy) those opportunities are also limited. Further, it is unlikely the relatively high unit costs associated with 2 a, b and c above will give rise to adequate short term profits and, therefore, what society actually needs will not be supplied by private enterprise. Therefore, banks will become increasingly reluctant to lend to private enterprise and the price of money – interest rates – will rise.

Interim Conclusion #1

If Governments assume responsibility for generating an increased proportion of GDP (and thereby place downward pressure on private enterprise’s ability to drive the economy) printing money will destroy all citizen’s wealth – rich and poor alike. The poor will become fixated on how to make ends meet, and logic dictates that there will be a spike in crime. The rich will become fixated – not on wealth creating activity, but on wealth preservation activity such as buying assets that will be a store of value.

This, ultimately, is the logic that underpins the inflationist argument. This, ultimately, is why the inflationists believe that the gold price will rise to the sky.

The source of concern in this analyst’s mind – regarding the above argument – is that the inflationists appear not to have thought the argument through properly.

Assume that (say) Germany, was to agree to the ECB inflating the number of Euros in circulation. Germany has in fact decided to close down all its nuclear power plants. Where will Germany get its energy from? Well, part of its future energy requirements will presumably be supplied by France’s nuclear plants and part will be supplied by Greece’s solar generators. That energy can be paid for in Euros. But what about Germany’s rising need for coal, oil and natural gas? If Germany is to pay in euros, and the ECB prints Euros, then the price of the Euro will fall relative to (say) the Russian Rouble.

Chart #3 is a chart of the Euro relative to the Russian Rouble (source: http://www.x-convert.com/chart/EUR-RUB?period=10y )

Chart #3

The Euro:Rouble has clearly broken below a rising trend-line that has been in place since October 2008.

Will Russia be prepared to accept Euros in payment for its oil and gas? Probably not. The “stock” reaction of the inflationists is that, therefore, items that retain their value – such as gold – will become the media of exchange.

Unfortunately, there will be other consequences too. Inside Germany, inflation will raise its head and the pressures on German commerce and industry will cause business volumes to contract as volume demanded falls – dictated by incomes that will be unable to keep pace with inflation. So the “velocity of money” inside Germany will fall even as the volume of money increases. Net, net, the German economy will go backwards.

Now, instead of looking at this from the perspective of the 99% who live inside Germany and who will be fixated on making ends meet, let’s look at it from the perspective of the 1% inside Germany who will be fixated on protecting what they have. Clearly, hard currency capital will either be taken out of circulation as it is spent on wealth preserving assets abroad, or it will be taken out of circulation as it shifts to offshore investments. Bottom line: “hard currency” availability will contract savagely.

Interim Conclusion #2

If the European governments resort to printing money, the net effect will be to both place a downward pressure on wealth creating activity inside Europe and sabotage the capital markets inside Europe. This will make it doubly hard for anyone in private enterprise to create wealth. Supply will contract along with demand.

Interim Conclusion #3

The printing of money by governments cannot inflate the debt to nothing. What will happen is that in the short term prices will spike but, in the longer term, economic activity will implode.

If there is inadequate wealth creation activity then a point will be reached where the printing of money will lead to a destruction of the economy; and repayment of outstanding debt will become the subject of purely academic discussion. Will the ownership of gold at that point be seen as sensible? That is also a subject for academic discussion. Who cares? If the economy implodes, what will the owners of that gold exchange their gold for?

If the above Interim Conclusion #3 is “reasonable” then it follows that others will also come to this conclusion. In particular, those who are wealthy and who will be fixated on preserving their wealth will come to this conclusion quicker than most. They – those who are the movers and shakers behind governments – will conclude that it is not in their interests to allow rampant printing of fiat money.

So, where this argument is ultimately leading to is that it is in everyone’s long term interests (including the politicians) to allow the forces of deflation to prevail; and the only question is: “At what rate will the forces of deflation overpower the forces of inflation?”

If it happens slowly, then the world economy can muddle through for 15 to 20 years – essentially going nowhere as old debts are repaid, dinosaur legacy industries die off, new industries are nurtured, and the economy can finally gain traction. If it happens slowly, the financial markets will churn sideways for years to come. Some companies will fold, others will grow and the indices will, on average, move sideways within a trading range.

On the other hand, if it happens quickly, then the world economy will contract sharply, the debt will be written off, and a Depression will likely emerge.

Therefore, if we are going to take “strategic” investment decisions, we should look at the monthly charts and at the desensitised Point & Figure charts.

Here is the monthly chart of the Dow – courtesy of DecisionPoint.Com

Chart #4

10,000 to 11,000 seems to offer “reasonable” technical support which, if broken, will lead to a swift deterioration to or below 7,000. The probability of the Dow rising to new heights does not seem high

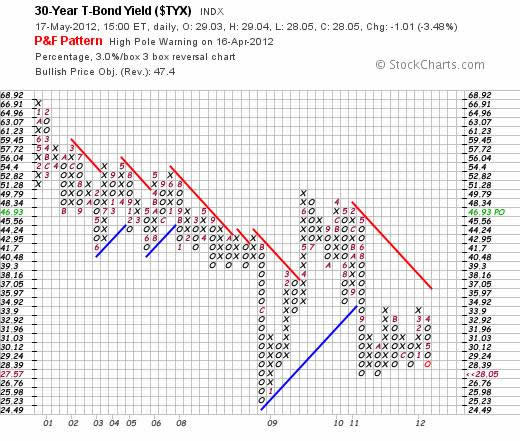

Here is a desensitised chart of the long dated Treasury Bond yield:

Chart #5

This chart looks like it has bottomed but there is no visible reason why the 30 year yield should rise strongly.

The P&F Chart below shows the possibility of a rise to 4.693% - which would still be within the bounds of the falling channel and, if the upper trend line is penetrated on the upside, there is significant technical resistance to further rises above that level.

Chart #6

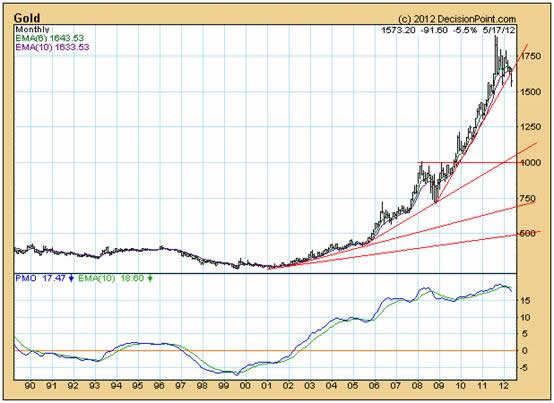

The following chart #7 is the monthly chart of gold.

Chart #7

The steeply rising trend line has clearly been penetrated on the downside. It seems highly unlikely that gold will rise to a new high in the foreseeable future.

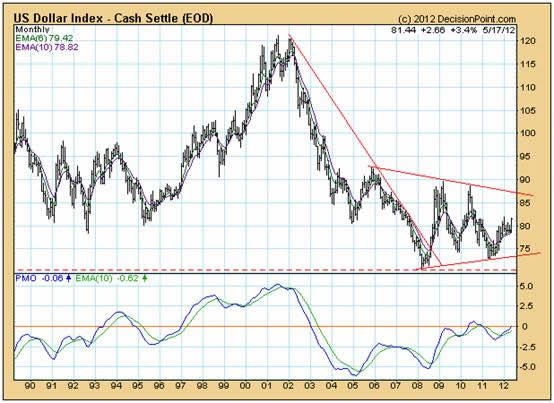

Finally, Chart #8 is a monthly chart of the dollar index.

Chart #8

Whilst this chart is not looking “bullish” it has clearly stopped falling. The index is showing rising bottoms and the MACD seems about to rise above the zero line for first time in nine years. This is not a sign that the market is anticipating rampant printing of US Dollars and a destruction of the value of the dollar.

Overall Conclusion

Whilst there is “fear” creeping into the financial markets there is no sign (yet) of “panic”. What seems most likely – flowing from the above analysis – is that the European crisis will somehow be addressed with a bias towards austerity, money will flow into the US (keeping the dollar relatively strong), gold will remain in a bull trend – albeit a more shallowly rising bull trend that will stop short of rising to new heights (it might even fall to $1100 and still be in a bull trend), US treasury yields will rise slowly – indicating that banks will become more cautious in their lending, and the equity markets – at least in the USA – will churn sideways for the foreseeable future. It seems reasonable to conclude that there will be gradually decreasing volatility as the opportunistic traders, who will find it increasingly difficult to make a buck through arbitrage, begin to exit the markets. At the end of the day, “wealth creation” is a function of adding value. Investment horizons should move from weeks to years as “traders” crawl back into their shells, and sensible investments will be in companies that hold the promise of adding value by addressing real needs – ranging from low carbon emission energy, to health, to agriculture and water, to entertainment, to new and more efficient modes of transport.

Brian Bloom

Author, Beyond Neanderthal and The Last Finesse

In the global corridors of power, a group of faceless men is positioning to usurp control of one of the world’s primary energy resources. Climate change looms large. Can the world be finessed into embracing nuclear energy? Set in the beautiful but politically corrupt country of Myanmar, The Last Finesse, through its entertaining and easy-to-read storyline, examines the issues of climate change, nuclear energy, the rickety world economy and the general absence of ethical behaviour in today’s world. The Last Finesse is a “prequel” to Beyond Neanderthal, which takes a right-brain, visionary look at possible ways of addressing the same challenges. The Last Finesse takes a more “left brain” approach. It is being published in all e-book formats.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.