Stock Value and Dividends at Wall Cycle Lows

Stock-Markets / Stock Markets 2012 May 13, 2012 - 11:23 AM GMT In light of the top of the multi-decade bull market and the recurring bear market massacres since the top, investors are increasingly jaded and skeptical. Stocks need to deliver an acceptable dividend stream to satisfy the growing investor preference for income. Investors want value for their money and that means sustainable dividend income at the right price. Combining the principles of value investing with market cycle tracking allows investors to identify value and the most opportune times to buy it.

In light of the top of the multi-decade bull market and the recurring bear market massacres since the top, investors are increasingly jaded and skeptical. Stocks need to deliver an acceptable dividend stream to satisfy the growing investor preference for income. Investors want value for their money and that means sustainable dividend income at the right price. Combining the principles of value investing with market cycle tracking allows investors to identify value and the most opportune times to buy it.

It helps to remember that the only real reason for an investor to buy a stock is to capture future cash flows in the form of dividends, or the share price appreciation that sustainable cash flows deliver over time. Growing cash flows and income delivered to shareholders confirms that a company is worth owning. Dividends put a floor under price. The purpose in tracking market cycles is to identify the best time to purchase great stocks that offer discounted value and income for improved risk adjusted returns.

Value investor legend Benjamin Graham made the case for large cap value, since large caps have an established record of accomplishment in business and a history of paying dividends. Managers of small cap and mid cap stocks are often still in the mode of selling dreams to investors. Investors get burned if the dreams do not pan out. Large caps on the other hand have already been through the phase of selling dreams and have matured. In most cases with large capitalization companies, professional managers have bought into the dream. They are managing the dream day in and day out to deliver a steady growing stream of cash flows.

There is often value in small and mid-cap companies, but it is more difficult to identify than in large caps. Once you determine the type of value you are looking for in stocks, you then must identify the best time to buy that value. Dividends went out of fashion for years, while investors focused on growth and earnings power. Since the top of the bull market, as investors have been educated on the pain of a bear markets, they are now saying, "Show me the money". They are searching for dividends and guaranteed income.

Chasing dividend dreams can also be a dangerous investing occupation. Patience is a virtue in value and dividend investing. When the market is in a Wall cycle correction phase it allows patient value based dividend investors to pick through the wreckage to find great value and yields. When the market is undergoing a Wall cycle correction, inevitably, the baby is thrown out with the bath water. Large cap companies that pay dividends are put on sale at Wall cycle lows at prices that represent value.

After decades of market cycle research, it is increasingly clear that the 20-week cycle (aka the Wall cycle) is the most important cycle driving the market for both investors and traders. Most market analysts recognize the Wall cycle, but it was market analyst legend PQ Wall that recognized that the Wall cycles ebbs and flows as a miniature long wave cycle.

Since the bottom of the global business cycle in 2009, the expected nine Wall cycles that make up every business cycle have been unfolding. Central bank intervention makes tracking cycles more complicated, but tracking the cycles is still a worthwhile endeavor for investors looking to pick up value and dividends at Wall cycle lows. The Wall cycle was threatening to roll over hard in late 2011, when the central banks came to the rescue by pumping hundreds of billions into the global financial system to insure liquidity. The U.S. Fed's twist and dollar swaps, combined with the ECB's LTRO that traded good debt for bad debt expanded the cycle.

Global financial markets represent a complex system. Interference in the system can expand the cycles, but it cannot prevent cycles from ultimately completing their ebb and flow. A great many of the risks faced by the global economy and financial markets have been shifted into the future, but the risks are still there and expanding. In terms of the current Wall cycle, which was rolling over in late last year and given new life, it has now clearly turned down globally.

Wall cycle lows open a narrow window several times a year where investors can buy discounted value and pick up additional yield. Although our interest is primarily large cap value, since it provides a margin of safety, Wall cycle lows provide an opportunity for improved execution of many investing and trading strategies. The last Wall cycle low and opportunity to buy deeply discounted value and dividends came last fall.

Global markets are presently in another Wall cycle decline. A number of markets are in the final stages of decline and are ahead of U.S. markets. Many large cap stocks are now approaching or reaching oversold levels in Europe. A global Wall cycle low in the next few weeks is expected. Tracking the cycles in the indexes and the individual stocks using price, time and sentiment provides target dates for cycle turns. The indexes often turn on Fibonacci price grid targets. Stochastics identify when the cycle is making a bottom.

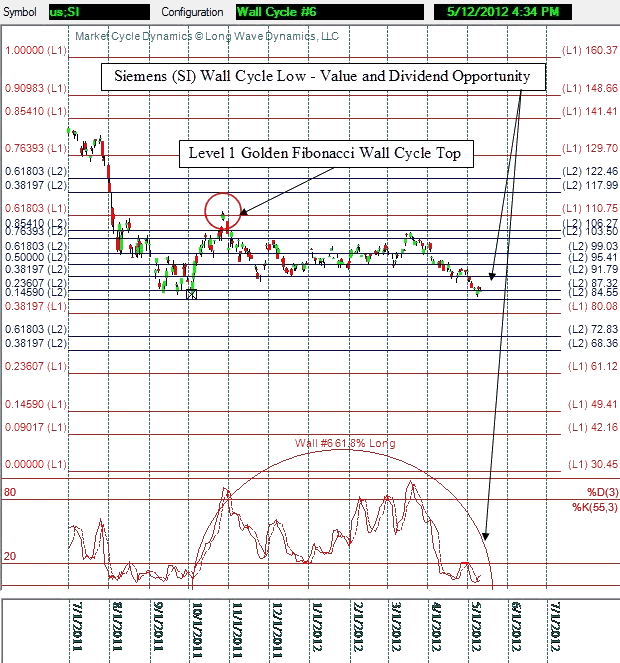

Many large cap companies with high yields are closing in on Wall cycle lows, but there is likely more to go on the downside. The German large cap Siemens (SI) appears to be forming a Wall cycle low, with close to a 4.5% yield. Notice the high of the Wall cycle close to the Level 1 golden ratio using an important high and low.

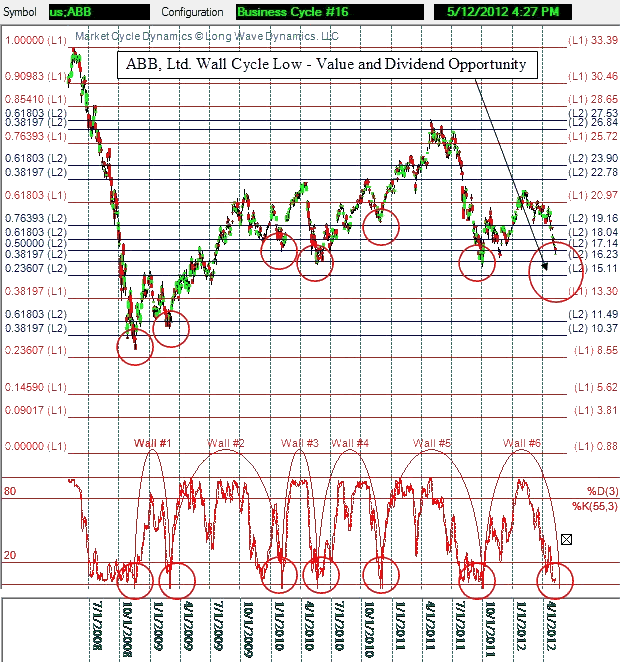

The Swiss machinery company ABB, Ltd. (ABB) is forming a cycle low and offering an attractive dividend of over 4%. The ECB's LTRO program liquified global markets and many investors fled the banking system for large cap value that pays dividends. Swiss stocks benefited a great deal. Those stocks are now correcting from the LTRO liquidity injection that triggered bifurcation in the Wall cycle.

Some of the large cap telecom stocks such as Telefonica (TEF), with a 15% yield, and Deutsche Telekom (DTEGY), with an 8.5% yield and are making or approaching Wall cycle lows. The Dutch company Royal KPN (KKPNY) was paying an 18% dividend last week and then rallied 20% in price when Carlos Slim offered to buy a large stake.

Most U.S. large caps are approaching oversold Wall cycle conditions, but more downside is expected. The Wall cycle method generates specific target dates for Wall cycle lows, using prior cycle lows. The current cycle is running long. An upcoming target date in May is interesting because it is both a golden ratio extension of the Wall cycle from last fall, and the Kitchin cycle (aka Business cycle) third from the July 1, 2010 lows. The market cycles often turn around their Fibonacci target date extensions. A final leg down in the Wall cycle is likely globally.

The rally of the next Wall cycle will drive dividend-paying large cap stocks much higher in price. Investors will have to determine if they hold onto their large caps and receive dividends or take profits. There are three more Wall cycles in the current business cycle. The rally of next Wall cycle may be significant if the central banks come to the rescue again. This Wall cycle is beginning to produce panic as it searches for a bottom globally and the calls for additional rounds of QE grow louder.

The expected decline of the current business cycle into 2013 is going to force investors to make some tough decisions. The next few Wall cycle rallies may offer opportunity to take some profits as the business cycle turns lower into next year.

The bottom of the upcoming business cycle is anticipated to offer some of the greatest value and dividend buying opportunities in a generation or two. Investors should keep some powder dry for the business cycle low. It will prove to be a great time to buy value and dividends at a Wall cycle and business cycle low. Since this is the final business cycle of the long wave winter season, the discounted value and dividend yields that will be available globally will be far better than most are expecting.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2012 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.