Open Market Manipulation of the Gold and Silver Futures Market By Banks and Producers

Commodities / Market Manipulation May 02, 2012 - 11:04 AM GMTBy: Marshall_Swing

The precious metals marketplace and even main street media is all abuzz about the 7,500 contract trade, in gold, on Monday, April 30th. Gold fell $15 in the space of a minute as many news outlets reported. Speculative traders think the trade could have been a fat finger. COMEX floor traders say otherwise and think the trade was deliberate just like any other trade because no one makes a trade of that size without specific instructions.

The precious metals marketplace and even main street media is all abuzz about the 7,500 contract trade, in gold, on Monday, April 30th. Gold fell $15 in the space of a minute as many news outlets reported. Speculative traders think the trade could have been a fat finger. COMEX floor traders say otherwise and think the trade was deliberate just like any other trade because no one makes a trade of that size without specific instructions.

What is particularly of note is that silver fell dramatically during this exact same time period with trades of similar magnitude relative to the two metals price and volume statistics and ratios. Silver fared markedly less well as price did not return to the same level as did gold so quickly albeit with some time lapse as we will discuss.

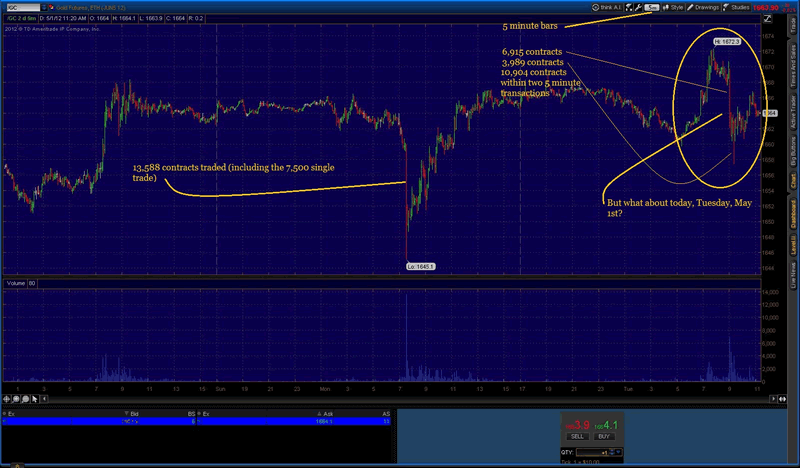

Here is the gold chart from yesterday:

We traders in the industry see this type of manipulative price action all the time in the precious metals future's markets. It is a common weekly, if not almost daily occurrence.

We see that 13,588 contracts traded on one 5 minute bar which included the 7,500 contract trade. Then we see a series of what I call steps in which over the price of gold goes directly back to the price level that the entire sequence started at right up to the 5:00PM COMEX close, and prior to trading opening in Asia.

On the 5 minute trade bar on the chart above, the gold high was $1659.90 and the low was $1645.10. The overall effect was $1651.80.

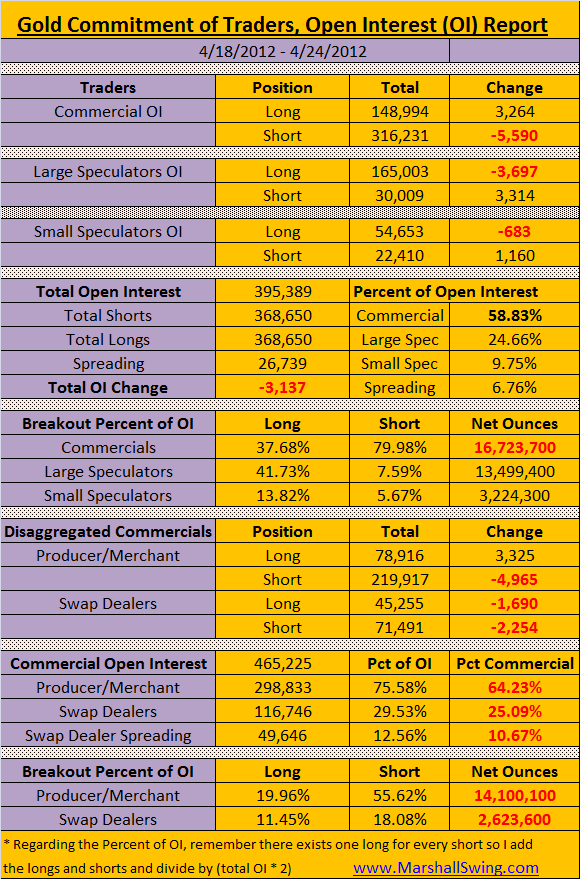

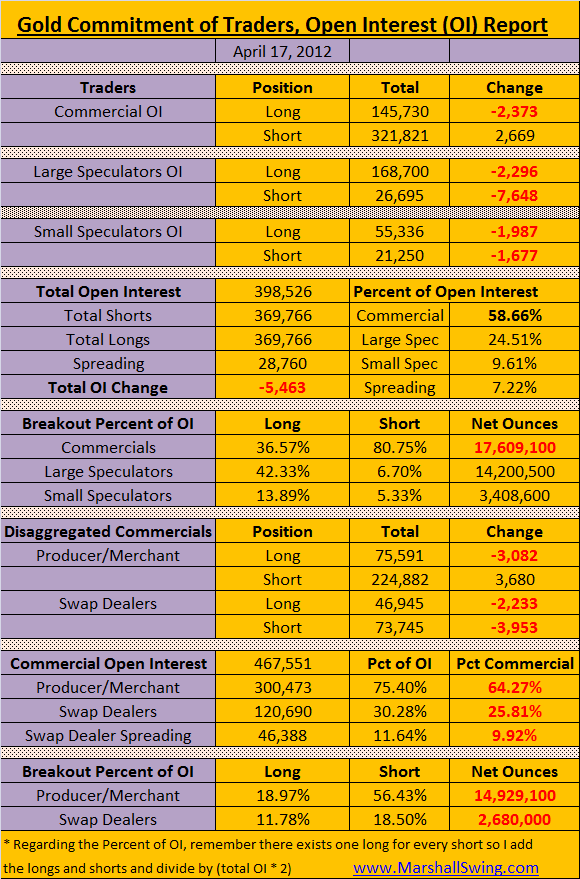

The steps buying action I referred to above is a regular occurrence in we in the precious metals industry see all the time. The Chicago Mercantile Exchange publishes Commitment of Traders report every Friday in the early afternoon. I document those reports in tables and publish them weekly. Here are the prior two reports for gold:

In the April 17th table, and in this article I documented specifically how the commercial traders, who are 17,609,100 ounces short, manipulate the price of gold to fleece the speculative longs out of their money. They do this for two reasons. 1. to profit and 2 to pick up those speculative long positions to match their huge short positions. In all futures markets there has to exist one long for every one short, and unlike equities markets this matching is the entire futures market and not a small subset as in stock short positions.

Therefore, the stop trade limits of the speculative longs are triggered whenever there is a large single or multiple very fast dumping of positions by the commercials (in particular the disaggregated producer/merchant positions which you see in the tables above). Another aspect of these trades is the use of initial high frequency trading (HFT) used in order to trip the speculative longs stops, the the producer/merchants add to this sequence their own open interest positions so the fully affect the price drop. Then they turn around and but those longs at far cheaper prices, which you see clearly in the chart from yesterday. Only the producer/merchants know exactly where and when the bottom will be so they can purchase those longs quickly. The new longs are purchased for the manipulation of the spot price and options months later on in the week or months ahead. The producer/merchants have algorithmic computers software that handles these transactions at the behest of the senior trader of the producer/merchants.

Who are these producer/merchants? We know for a fact who one of them is and that is the bank of JP Morgan Chase who picked up these outrageously huge short positions from bear Stearns in the demise and bankruptcy of Bear Stearns in March of 2008. There are many. many people in the precious metals industry that JP Morgan was instrumental in the demise of Bear Stearns and have documented as such.

Currently, the Commodities Futures Trading Commission (CFTC) has on its desk the review of gold and silver metals manipulation and have had that review for 4 years now. Their deplorable failure to act in a reasonable time frame is corruption at the very highest levels of the market's leadership and oversight responsibilities. The Dodd/Frank bill passed by Congress and signed into law by the President which required positions limits in futures markets no later than January 1st, 2011 has been subverted by both the CFTC, the producer/merchant banks and no doubt the Securities and Exchange Commission of the United States Government.

I do not make these charges lightly. They are extremely well documented by numerous analysts who are far better equipped than myself to expose this massive fraud on the speculative long position holders. It is a crime of the highest order of magnitude that position limits were not established on January 1st, 2011. It is blatant fraud on the Congress of the United States and the American people, most of whom own gold and silver majoritively in the form of gold and silver jewelery and also on millions of Americans who own gold and silver coins and bullion purchased from the US Mint and dealers, and coin shops across America and all other countries in the world.

For readers who not aware, the COMEX futures market is the sole market used to determine the spot price for all traders in the world. Yes, all precious metals traders have to comply with the spot price of a heavily manipulated market, by law.

The primary reason the Dodd/Frank bill was passed was to corral the price of oil in 2008 which saw price at $150 a barrel.

As we all know now, the price of oil quickly reversed itself and dropped to the mid $30 a barrel in a few months.

That is the power of a free market. That is the power of the American Constitution that is supposed to guarantee a free marketplace for a free world.

Without a doubt, the producer/merchant banks have subverted the free market of the world and use it for their own profit and price suppression so their short positions are not out of the money. They have to manipulate the price or else they would cease to exist if they have to deliver physical metal upon speculative traders standing for delivery in the COMEX market.

They will do anything they have to to prevent having to deliver including commit crimes of the highest magnitude.

Is it any wonder that they own and contribute such huge sums of money to the political campaigns of the senior Congressmen and Senators in the United States Government?

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.