Gold Miners, Buying Gold at Discount

Commodities / Gold and Silver 2012 Apr 20, 2012 - 12:33 AM GMTBy: William_Bancroft

China has been trying to diversify her foreign exchange reserves for some time. We are all familiar with the figures released by the likes of the World Gold Council about Chinese gold investment demand, as well as statistics showing official gold imports through Hong Kong into the Chinese mainland. Chinese reserves contain only 2% gold, compared to nearly 10% for India and Russia, and figures in the 70th percentile for developed nations such as the USA and Germany.

China has been trying to diversify her foreign exchange reserves for some time. We are all familiar with the figures released by the likes of the World Gold Council about Chinese gold investment demand, as well as statistics showing official gold imports through Hong Kong into the Chinese mainland. Chinese reserves contain only 2% gold, compared to nearly 10% for India and Russia, and figures in the 70th percentile for developed nations such as the USA and Germany.

China is getting out of paper and into gold as fast as she can, because she simply doesn’t have enough of old yella’. Any effort to internationalise the RMB will not work until it is a trusted enough currency. One of the key ways to achieve trust is larger gold reserves.

It is not just the PBOC that is on the gold rush, since opening up the domestic gold market individuals are also allowed to invest in gold. The Chinese still have a limited range of savings and investment options open to them (one of the reasons why so much money flowed into their property bubble), and gold continues to shine when other investment options (especially the Chinese stock market) are being questioned.

Gold above ground

However the physical gold market is not a deep and liquid market like the US treasury market. Therefore China is not able to rebalance her portfolio out of sovereign debt quickly without causing the gold price to ‘gap up’ whilst sending ripples through the gold market.

The Chinese authorities have even urged caution about taking up the IMF’s remaining gold. In early 2010 a senior official from the China Gold Association was quoted by Reuters: “It is not feasible for China to buy the IMF bullion, as any purchase or even intent to do so would trigger market speculation and volatility.”

China knows that she must tread carefully in the physical gold market, for fear of her bidding power sending the price upwards before she has been able to accumulate enough gold in the PBOC’s coffers. China does not want to be chasing the gold price.

For this reason she is very happy to watch current weakness whilst apparently keeping bids in the market at the $1,500, $1,550, and $1,600 level.

Nonetheless China is accumulating physical gold, often via her Sovereign Wealth Funds, and other proxies, so that her bids are not open for all to see. Large above ground inventories of physical bullion are difficult to find outside of central bank vaults (even when they do keep it inside their own borders), or even at a smaller scale the ETFs, and COMEX inventories.

Gold in the ground

Where can China turn to firstly get her hands on more gold, but secondly without sending the gold price soaring?

The answer is increasingly being found in gold mining.

By buying gold mines, and thus accumulating the produced gold before it hits the international market, China is able to purchase gold below the spot gold price. China is just taking on the mining risk to do so.

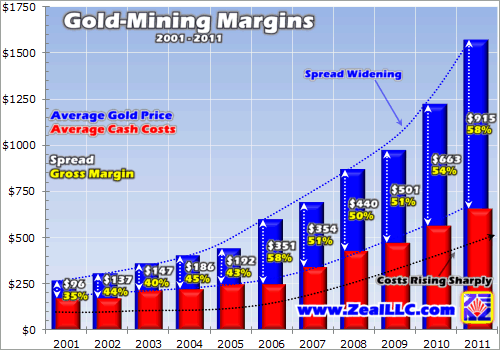

Average extraction costs to mine gold have been rising, but not as fast as the gold price, making owning gold miners an increasingly efficient way to stock up your central bank’s vaults. If Chinese controlled gold mines were producing at an average cost of $657 in 2011 alone her gold accumulated via this strategy for that year was sourced at a discount of $915/ounce, or 58%.

China is accumulating gold at a discount through her gold mines.

China herself is the world’s largest producer of gold, but none leaves the country. Chinese gold mining might be on a huge scale, but it cannot provide sufficient bullion for domestic demand. “The shortage in supply has been deepening very fast; from 48 tonnes in 2007 to 400 tonnes in 2011,” said Song Xin, chief executive of China Gold International, the listing unit of China National Gold, one of the country’s biggest gold producers.

Foreign conquest for gold

If China intends to acquire more gold via this mining strategy she is thus forced to reach beyond her borders and buy foreign gold mines.

Dr. Alex Cowie, writing for Money Morning Australia, sees Chinese purchases of foreign gold mines as a trend that is here to stay, and likely to grow. Whilst another recent article, in the Australian, finds that Chinese acquisitions of gold miners are just the tip of this iceberg. Dr Cowie also believes this is a good thing for gold investors, citing the long life of these mines as likely to mean that China is taking a long term view when it comes to gold. The Chinese are renowned for being long term thinkers, and there is no reason why her gold strategy should not be long term too.

A mini-chronology of recent Chinese pursuits of foreign miners goes some way to substantiating this trend:

- August 2011: Hong Kong based parent of Stone Resources Australia engages in a struggle with Focus Minerals for control of Crescent Gold, an Australian gold miner.

- November 2011: Baiyin Nonferrous Group moves to complete takeover of South African miner, Gold One International.

- December 2011: China Gold International Resources Corporation buys a gold mine in Central Asia, and is reported to be looking at Canada and Mongolia for its next target.

- December 2011: Shanghai based investors acquire a majority interest in Zara Mining, an Eritrean gold project.

- December 2011: Chinese interests take control of A1 Minerals, now renamed Stone Resources Australia.

- April 2012: Zijin Mining Group bid for Australian gold miner, Norton Goldfields.

- April 2012: Sovereign Gold partners with Jiangsu Geology & Engineering who will pay $4m for 30% of two gold tenements in Australia.

Beyond the above, Yunnan Tin also owns 12.3% of YTC Resources, which is developing the Hera goldmine in Australia. Australia is in the geo-political spotlight and a favoured option for China, but with US marines now stationed in Darwin in the Northern Terrorities this geo-political struggle will be fascinating to behold.

Gold investors should watch China’s continuing reach for foreign gold mining assets with great interest. If her currency and gold plans are really long term, this trend would appear one only set to strengthen. Whilst China is still buying such mines, her presence in the gold market should continue to stay strong. The fact is that to effectively rebalance her reserves China needs to buy thousands of tonnes of gold. Given a small physical gold market that will have to be carefully navigated, and that not much more than 4,000 tonnes of gold are mined each year, a limited quantity of quality global mining assets will likely have to be pursued by Beijing.

China’s currency predicament may be even more acute than those of Brazil, India and Russia, but it will be fascinating to see if these other BRIC nations join China’s pursuit of global gold mining assets.

Worried about debt mountains, money printing and crashes? Invest in gold, and act as your own central bank…

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2012 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.