Gold Bull Market Not Over, Depressed Stocks Primed to Take off

Commodities / Gold and Silver 2012 Apr 02, 2012 - 02:32 AM GMTBy: Clive_Maund

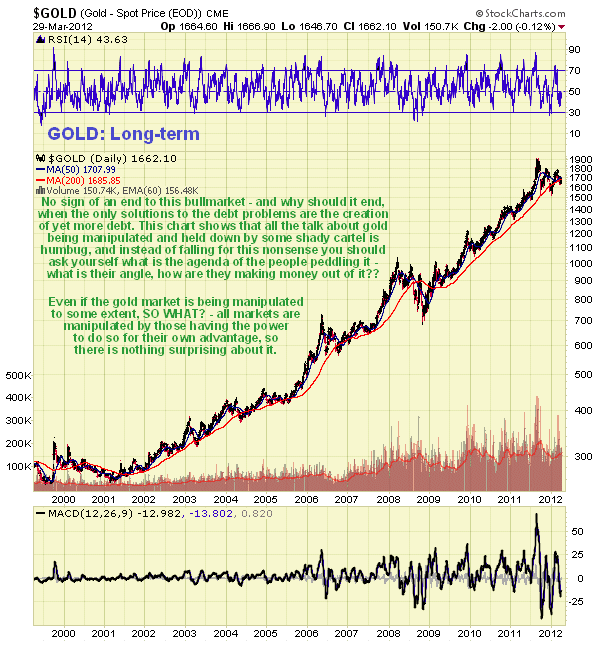

There is no indication on gold's long-term chart that its bullmarket is over, it appears to be simply pausing to consolidate after its sharp rise last year. Why should its bullmarket be over when the only solution to the global debt problem is to buy time by creating more debt which makes the problems even worse? It's true that "they" might throw in the occasional deflation scare as an arm twisting measure to justify bailouts and more QE etc, but other than that the course is set firmly in the direction of fiat worthlessness.

There is no indication on gold's long-term chart that its bullmarket is over, it appears to be simply pausing to consolidate after its sharp rise last year. Why should its bullmarket be over when the only solution to the global debt problem is to buy time by creating more debt which makes the problems even worse? It's true that "they" might throw in the occasional deflation scare as an arm twisting measure to justify bailouts and more QE etc, but other than that the course is set firmly in the direction of fiat worthlessness.

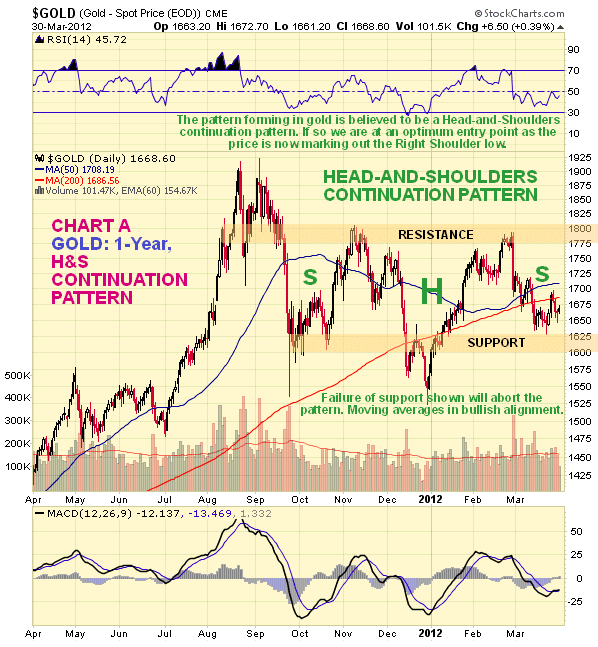

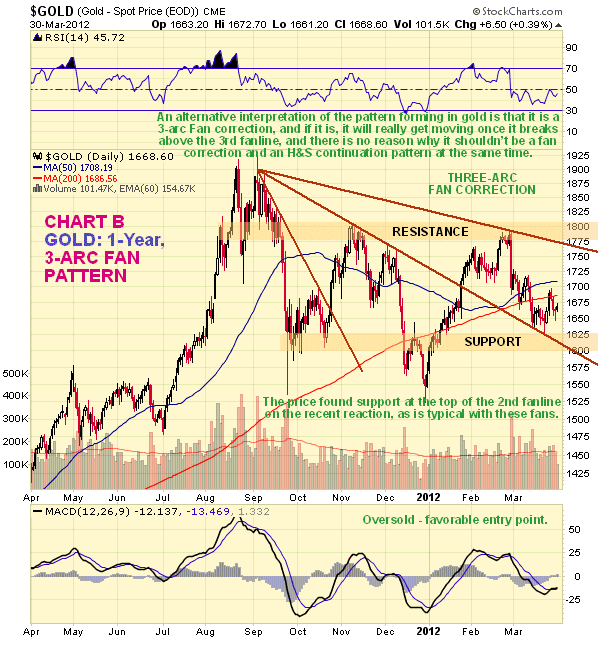

Gold has been flim-flamming around in a trading range for so long now - over 6-months from the September panic low - that we ought to be able to discern what kind of pattern is evolving. Well, we can, and there are 2 alternative explanations, both of which are bullish, and neither of which contradicts the other because they are complementary - because they are both valid interpretations of what is going on. They are shown on the two 1-year charts for gold shown below. They are not shown on the same chart as it would get too crowded and confusing.

Gold's significant rally in January and February was a positive development that snapped it out of its downtrend and in so doing changed the trend to neutral. This rally terminated in the zone of resistance in the vicinity of the November highs, making this zone of resistance the top boundary or "neckline" of a potential Head-and-Shoulders continuation pattern shown on the 1-year chart Chart A below, and if that is what it is then gold has just dropped down to form the Right Shoulder low of this pattern, and in so doing has thrown up an optimal buying opportunity from a price/time perspective. Gold "likes" these Head-and-Shoulders continuation patterns and you may recall that a huge one formed after its 2008 peak, with the low of the Head of that pattern being the late 2008 financial crisis panic lows. Gold will need to stay above the support approaching its September - October lows for this interpretation to remain valid, and it looks like it should.

The other interpretation, which is coexistent with the Head-and-Shoulders continuation pattern interpretation is that gold is marking out a 3-arc Fan Correction, as shown on the 1-year chart Chart B below. This interpretation is given added credence by the high volume that accompanied the breakout above the 2nd fanline in January and by the way the price found support at this fanline when it reacted back in March. The rule is that once the price breaks above the 3rd fanline of the 3-arc Fan Correction, it is free to take off higher, but if we have figured out the game plan in advance we don't have to miss out on a juicy $100 advance to that point while we wait for such confirmation. Instead, buying now and jamming in a stop below the support shown makes a lot more sense from a risk/reward perspective.

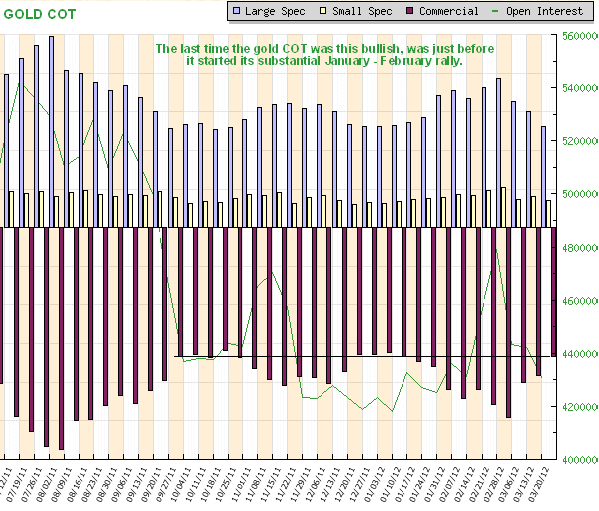

The latest COTs for gold look positive - Commercial short and Large Spec long positions are at a relatively low level again - similar to the levels prevailing before the sizeable rally in gold and silver that occurred in January and February, as can be seen on the COT chart below. This is another factor pointing to an imminent rally.

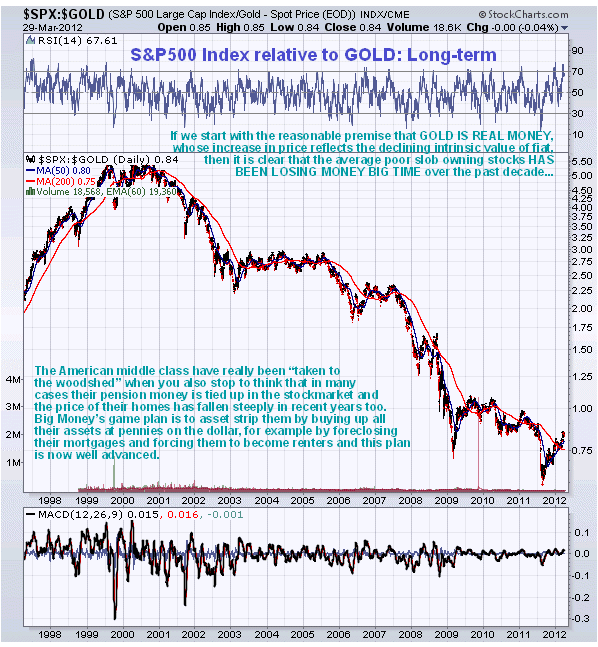

The shocking malaise of fiat is disguised by the fact that many investors and even professionals make the mistake of only comparing fiat currencies with each other. The right thing to do is to compare each currency with real money - gold - when you do that the gravity of the situation becomes clear. Gold is simply a barometer of the intrinsic value of fiat, so when gold is rising a lot against most currencies it simply means that fiat is going down the drain. When you comprehend this it is a sobering experience to look at a chart for the US stockmarket for the past decade relative to gold which we do now below.

Many investors like to kid themselves that the stockmarket is "resilient" and "holding up well", but our stockmarket versus gold chart shows that the real value of holdings in the stockmarket is "going down the gurgler". This is bad news indeed for the many Americans whose pension money is holed up in the stockmarket and is reflected in the fact that the fiddled CPI index shows a low rate of inflation, but many Americans are caught in a financial vice as the price of their principal asset, their home, has fallen in price, while the price of the basic necessities of life, such as food and gas, has soared and looks set to continue to soar.

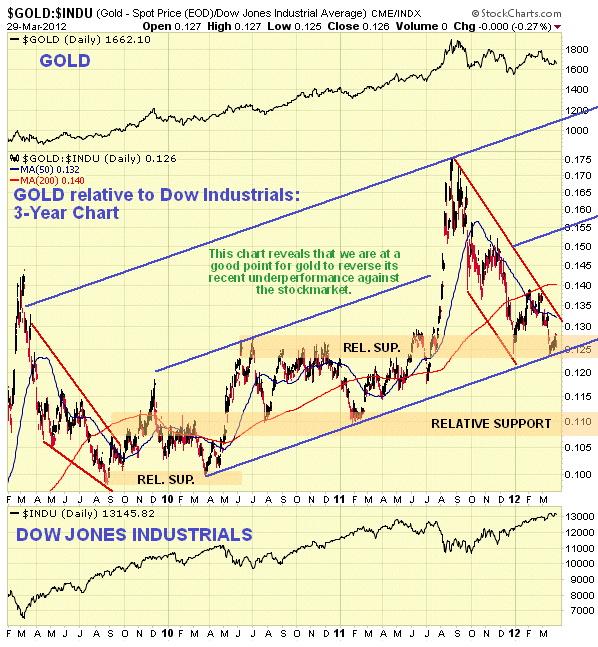

While gold and the PM sector have been getting a bad press in recent weeks as gloom and depression have become widespread amongst PM sector investors, which is understandable given the way many stock prices have been trashed, our charts show that we are probably at the point of a marked turn for the better. The 3-year chart for gold compared to the Dow Jones Industrials shown below reveals that after a steep relative decline, gold has arrived at strong relative support where it is likely to turn up soon, although a determined advance may be preceded by a period of stabilisation.

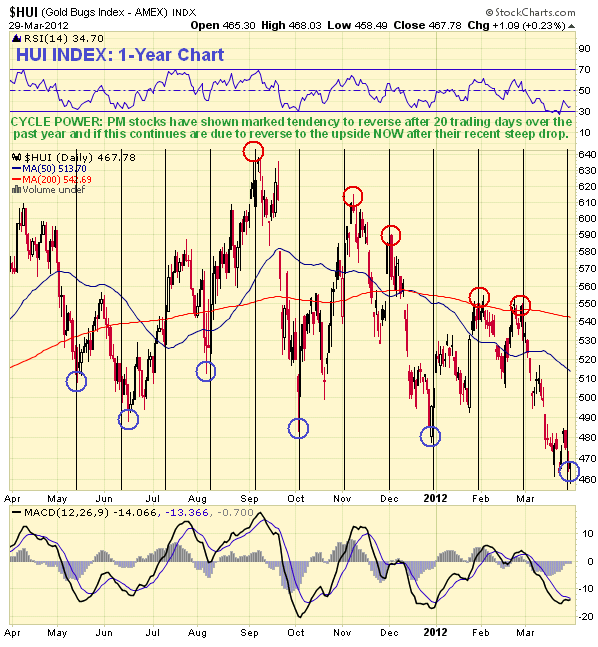

Since PM stocks can be expected to anticipate an improvement in the fortunes of bullion, they are at a good point to turn higher right now. The annotated 1-year chart for the HUI index below shows that they have been in the habit of reversing direction in a significant manner every 20 trading days for the past year, and clearly if this cycle continues the sector should take off higher shortly from its current depressed levels.

Gold and silver's recent reaction has brought a lot of conspiracy theorists out of the woodwork again as usual, harping on about "The Cartel" and their cruel and wicked plan to suppress the gold price, and deprive PM sector investors and speculators of the rich rewards they have been looking forward to for so long, all because a rise in the price of gold and silver will declare to the world the bankruptcy of their fiat monetary system. Well, if that their aim, our first chart at the top of the page shows that they have not had much success with their evil plan, as gold has risen from a low at about $250 to a recent high above $1900 in just 11 years - so much for the success of The Cartel. Carping on about some shady bunch of manipulators suppressing the gold price makes about as much sense as moaning to a gas station attendant about the price of gas - stop wasting time and pay up and get on with your life. So what if the gold and silver price are being manipulated to some extent? - most markets are - those in power will always manipulate things to their advantage, that's basic human nature. If you must ask questions then the point to start is to enquire about why these people are promulgating these conspiracy theories in the first place - are they just cranks or are they making money out of it some way - what's their angle?

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.