Plunge In U.S. Savings Rate Highlights Economic Risk

Economics / US Economy Apr 01, 2012 - 03:29 AM GMTBy: Tony_Pallotta

I can't resist mentioning the irony of talking about personal income "growth" on April Fool's Day. You can't make this stuff up. The headlines read "US consumer Spending Rose 0.8% In February, Best Gain In 7 Months; Income Lagged"

I can't resist mentioning the irony of talking about personal income "growth" on April Fool's Day. You can't make this stuff up. The headlines read "US consumer Spending Rose 0.8% In February, Best Gain In 7 Months; Income Lagged"

Talk about misleading and uninformative. That headline is no different than Thursday's "Weekly Jobless Claims Fall To Lowest Levels Since April 2008." The truth of the matter is personal income grew on a nominal basis but real or inflation adjusted was flat at best. The result is the savings rate plunged to multi-year lows.

This raises serious concerns about the health of the US economy as the consumer is eventually going to be forced to scale back spending. It also highlights how vulnerable the economy is to a "shock at the pump."

Income Growth

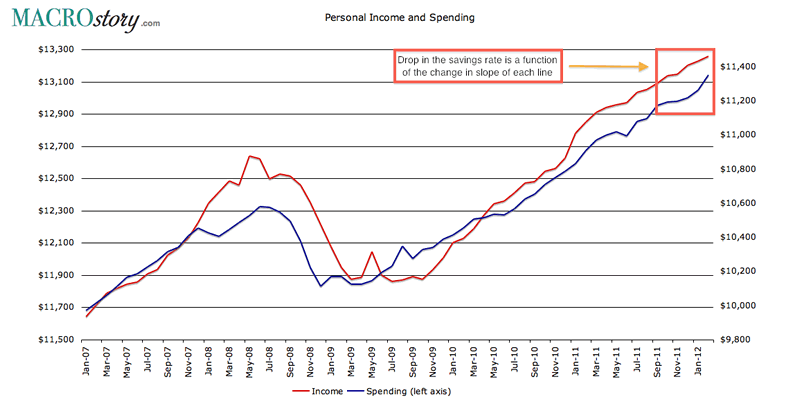

Personal income rose 0.2% in February following 0.2% growth in January. On a 12 month rolling basis personal income is growing roughly 2.4% while over the same period unadjusted CPI has grown 2.9%. A simple "back of the envelope" analysis would say real income growth contracted (0.5)% or at best was flat.

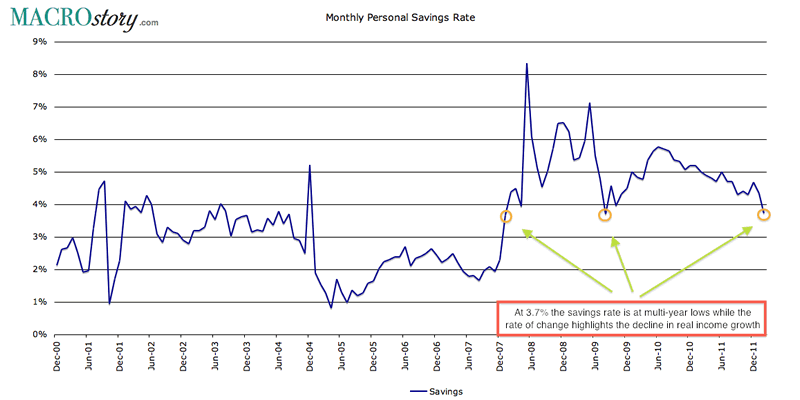

Since consumer spending habits do not change immediately this lack of income growth has resulted in the savings rate plunging to 3.7% from 4.3% in January, a multi-year low. This then begs the question in the absence of real wage growth how much longer can consumers "finance this spending."

Savings Rate And Economic Growth

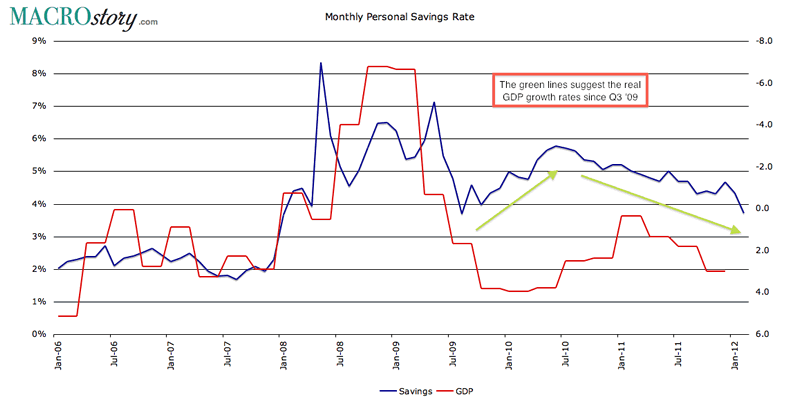

A rather intuitive chart that when the savings rate declines GDP expands. More spending means more growth right? So one can argue as this chart would support that the plunge in the savings rate is good news for future economic growth.

But I raise two concerns. First and foremost this chart looks like so many equity charts. Notice the divergence since Q3 2009. As I have discussed previously (Is The Price Index Inflating Real GDP) this chart would support the theory that GDP has been overstated since that time.

Second and most important how much lower can the savings rate go and for how long. Add in any "shock at the pump" and this economy will tip into recession in a heartbeat.

Bottom Line

Bernanke and the Fed will "threaten" the use of QE3 but between the recent data and the concern raised in the March Chicago PMI "oil tipping point fast approaching" they are powerless.

The Fed cannot nor will they do a preemptive launch of QE3 with oil prices elevated and the economy in such a fragile state. Should the economy deteriorate and the deflationary trend reemerge specifically in the commodity sector then QE3 is possible. For now it is simply a hollow threat.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.