ETF's The Pesky Details of Prospectus Disclosure

Companies / Exchange Traded Funds Mar 27, 2012 - 10:47 AM GMTBy: Casey_Research

Vedran Vuk, Casey Research : In the infamous case of the Goldman Sachs Abacus 2007 AC-1 fund, it doesn't take a whole lot to figure out the wrongdoing. Paulson & Co., a multibillion-dollar hedge fund, helped select the mortgage-backed securities held by Abacus while at the same time, Paulson was planning on shorting it. This was all unbeknownst to Abacus buyers, since Goldman Sachs conveniently left out the details of Abacus' creators and their bet against the fund in the investment marketing materials. Ultimately, the case was settled for $550 million.

Vedran Vuk, Casey Research : In the infamous case of the Goldman Sachs Abacus 2007 AC-1 fund, it doesn't take a whole lot to figure out the wrongdoing. Paulson & Co., a multibillion-dollar hedge fund, helped select the mortgage-backed securities held by Abacus while at the same time, Paulson was planning on shorting it. This was all unbeknownst to Abacus buyers, since Goldman Sachs conveniently left out the details of Abacus' creators and their bet against the fund in the investment marketing materials. Ultimately, the case was settled for $550 million.

Goldman Sachs made a huge mistake here. By not telling its clients about the conflict of interest, the whole thing seemed like the coverup of a malicious act in order to defraud investors. What it really should have done is put the fund's flaws in difficult-to-understand language on page 82 of the hundred-page prospectus. After all, that's what everyone else in the industry does, and they're certainly not settling for half a billion dollars with anyone.

The exchange-traded fund (ETF) industry has made millions – if not billions – of dollars on products sold with a similar approach. If the problems are laid out somewhere, it's not the ETF company's fault when the fund fails. Better yet for them, ETFs never promise results… they are marketed only as an investment tool. In the majority of cases, this works just fine. It's wonderful that investors can purchase a whole index such as the S&P 500 with a single ETF.

Unfortunately, these incentives can create a serious problem in the ETF industry, as popularity drives much of its profits, rather than results. When commodities became all the rage in the past decade, retail investors flooded billions into futures commodity ETFs promising to provide an easy way to invest in the asset class. It didn't matter that the underlying investments were doomed for failure. The funds lay out the risks in the prospectus and then wash their hands clean should the ETF head for the worst. Sometimes the failure of those funds is hardly an accident or the result of bad luck.

In regard to ETFs, Wall Street needs to answer the following question: Is there a moral difference between constructing a package of worthless securities while hiding the creation process, and packaging the same sort of garbage while informing the investors about the problems on page 82 of a hundred-page prospectus? In both cases, you're aggressively marketing a product which is known to be harmful, if not disastrous, to the investor.

Sure, one can pretend to not know what's in the product. After all, ETFs aren't promising returns… they are just an investment tool. It's always "buyer beware," but if the tool is broken, someone should be held responsible for the damage. In the securities industry, ETF companies are encouraged to play stupid. If one pretends not to know about the likely performance of the fund, then everything is fine, as long as the fund's faults are somewhere in the prospectus. But if one packages a garbage fund and doesn't write down the details, then one's likely to face a billion-dollar lawsuit.

In reality, the two are close to the same thing. Of course, one man's garbage could be another man's treasure, but there are cases where one could objectively call the product pure trash. When a company shorts a product it created or an ETF fails to follow its intended index, then these are truly garbage investment products. It's hard to say that anyone would want to invest in such financial instruments, if one properly understands them.

An ETF that resembles this description is the United States Oil Fund (USO). Let's take a look at the summary on the front page of USO's website:

The United States Oil Fund, LP ("USO") is a domestic exchange traded security designed to track the movements of light, sweet crude oil ("West Texas Intermediate"). USO issues units that may be purchased and sold on the NYSE Arca.

The investment objective of USO is for the changes in percentage terms of its units' net asset value ("NAV") to reflect the changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the changes in the price of the futures contract for light, sweet crude oil traded on the New York Mercantile Exchange (the "NYMEX"), less USO's expenses.

If I were a retail investor sans the education of a master's in finance, I would immediately think that this sounds like a great way to invest in oil prices. Unfortunately, the devil is in the details. Essentially, because it's impossible to hold so much oil, ETFs must purchase oil futures contracts. And by investing in the futures market, the fund must worry about contango. When a futures contract comes close to maturity, the fund must sell the contract and buy one further out in the future, since the company can't take delivery of the oil.

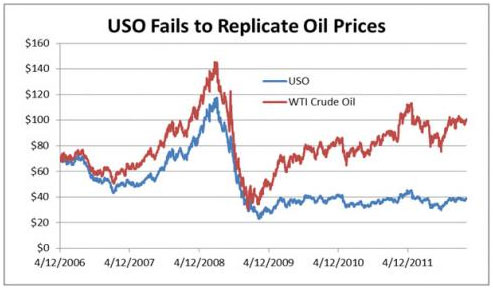

If the futures curve is in contango, that means future oil prices are more expensive than the current maturing contract. So, when the fund sells the maturing contract, it must buy a more expensive future contract. The fund breaks the cardinal rule of investing – it buys high and then sells low! Over time, the fund continues to lose money until its path fails to follow WTI crude oil prices:

In 2009, as oil prices began their drive from around the $30 range to over $100 today, USO stayed flat. Since mid-January 2009, oil prices have increased a stunning 142% while USO only rose by 33%. A lot of prescient investors who saw the rise coming made practically nothing with their prediction, thanks to this ETF.

This isn't an accident. Any financial professional with some basic knowledge of contango could have seen this coming. The fund simply doesn't track spot oil prices. USO is only useful in a situation of backwardation; it's the opposite of contango, where further-away maturities are cheaper than the nearest maturing contract.

All of these problems are spelled out by the company on its website – though the details are deep in the prospectus. One can't say that the fund is intentionally hiding anything. However, does the fund's existence depend on investors failing to read the prospectus or to comprehend the futures market? Those who understand the fund stay away from it.

With $1.51 billion under management, USO still finds plenty of unsuspecting buyers who think it's a good way to invest in oil. With all of this said, is the fund doing anything illegal? Absolutely not. Is the fund acting in an unethical manner, much like the Abacus scandal? I'll let the reader decide.

[The United States Oil Fund is just one of ten popular ETS which are anything but what their names suggest.. Learn who the other nine are – and why you need to be careful with them.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.