Is Apple Stock the short of a lifetime or the new widow maker?

Companies / Tech Stocks Mar 27, 2012 - 07:00 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes:

I have a confession to make.

Keith Fitz-Gerald writes:

I have a confession to make.

I believe Apple stock (Nasdaq: AAPL) is going to be world's first trillion-dollar company yet I want to short the snot out of it.

Am I being compulsive?...impulsive?....or foolish?

Perhaps it is all three considering that Apple has risen more than 3,000% in the last ten years, turning almost any attempt to go against the grain into a "widow maker" trade.

I say almost because I am one of the lucky ones.

A few weeks ago I recommended my Strike Force subscribers purchase put options on Apple, effectively shorting the stock. That resulted in a 47% profit in less than 24 hours for anyone who followed along, excluding fees and commissions.

I'm not alone in my thinking.

Uber investor Doug Kass, general partner of Seabreeze Partners Long/Short LP and Seabreeze Partners Long/Short Offshore LP, tweeted recently that he had covered "half his short" on Apple following the announcement of their dividend and buyback plan.

Given that the stock had run up to nearly $608 a share before the announcement, presumably Kass had banked some gains, too.

7 Reasons to Short Apple Stock

(Nasdaq: AAPL)

I haven't spoken with Mr. Kass so I can't comment on his current thinking nor the specifics of his trade, but here are mine:

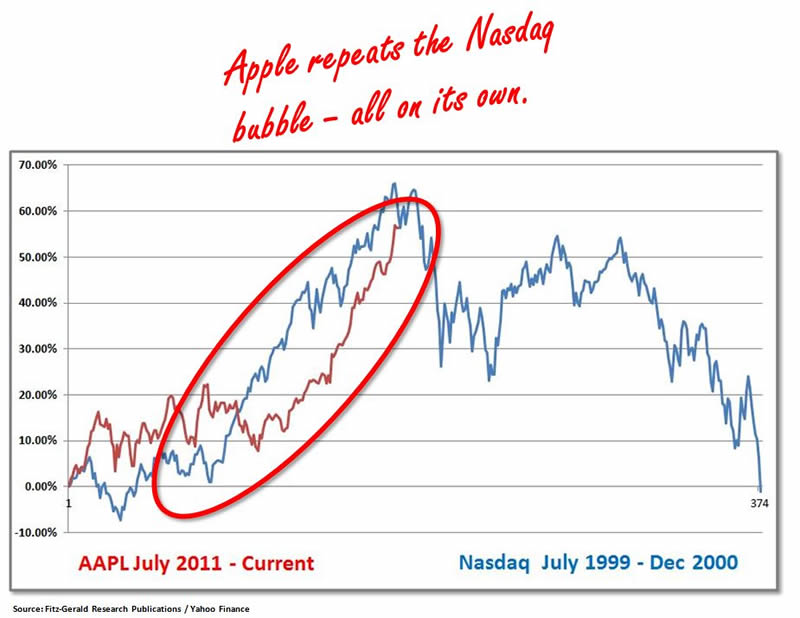

1.The company has single-handedly repeated the bubble curve of the Nasdaq run up. That leaves a lot of empty space to the downside.

2.Apple is a "fad" or a "hit" company, meaning that its price seems to correlate to new product launches rather than the sustainable development of key product lines. Companies that do that tend to fall back from orbit at some point - especially in the tech world. Palm and Research in Motion (Nasdaq: RIMM) are two that come to mind.

3.When great leaders are gone, their legacies can struggle. While Apple has stood up so far following Steve Jobs' unfortunate death, I can only wonder, as many in the tech community are wondering, how deep and how far out his thinking will live on. Is it one product cycle, two cycles? Nobody knows. But we do know that Microsoft (Nasdaq: MSFT) became a very different company after Bill Gates stepped aside. Intel (Nasdaq: INTC) also flatlined three or four cycles after Andy Grove's departure from day-to-day operations.

4.Apple's short interest of only 9.8 million shares is very low considering the company's three-month average daily trading volume is 18.2 million shares and the company's float is 931.8 million shares.

5.The analyst community is almost completely positive. That's usually a sign of two things: a) that they're soft peddling opposing trades from other parts of the "shops" they work for or b) that they want a run up to maximize profits from positions they already hold. Either way, many have been tremendously wrong in their sales projections in recent quarters, understating anticipated results by as much as 30%-40% - a factor also noted by Kass in his trade set up analysis. Therefore, I am skeptical that they are raising numbers again.

6.Apple's profit margins are unbelievably high at a time when the rest of the economy lurches along. While that's not a bad thing in isolation, I have a hard time believing that Apple can remain so far out of line if for no other reason that what goes up must come down eventually. And, since the road higher is far more unlikely for the rest of the markets, it is logical that Apple likely heads lower in the short term.

7.Apple's fundamentals may soften. There are lots of reasons to love Apple but there are just as many reasons things may not be what they seem. If the economy worsens just how many people are going to buy "gee-whiz" technology beyond the hard core Apple-heads? Is there an Apple-killer in somebody's garage right now? Anti-trust investigations and supply problems are also big what ifs at the moment. Even a carrier failure could rock Apple because it may be their subsidies that keep Apple's costs down and profits high.

Add it all up and there is enough to make you go hmmm...

Of course, there is no doubt I will incur the wrath of Apple fans everywhere and arm chair traders from here to Tibet.

Get over it guys; please refrain from the snarky e-mails telling me I'm an idiot or out of touch or worse - I believe in Apple. I really do.

What I am suggesting is simply the logic behind Apple as a trading opportunity for nimble, aggressive and like minded market mavens.

Besides, if I am correct and Apple does trade lower in the weeks ahead, I'm going to be picking up shares as an investment.

I hope you will be buying too.

Source :http://moneymorning.com/2012/03/27/is-apple-stock-nasdaq-aapl-the-short-of-a-lifetime-or-the-new-widow-maker/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.