Becoming the Bank

Politics / Credit Crisis 2012 Mar 25, 2012 - 04:47 AM GMTBoth the mainstream and alternative media spend a good amount of time reporting on the excesses of Wall Street, which range from extremely disproportionate levels of compensation to blatantly criminal practices. Whether we are talking about Goldman Sachs defrauding and front-running clients or former New Jersey governor and MF Global CEO Jon Corzine illegally transferring client funds to JP Morgan, there is a certain air of "so whatness" to the entire discussion. How extensive are these occurrences and why should we care?

There is no doubt that these are serious issues/crimes, but, at the end of the day, there is also a limit to how much one can care about extremely rich people stealing money from and screwing over moderately rich people in the markets. Sometimes, there is almost a distracting quality to these discussions, and it helps maintain the tarnished-yet-still-respectable reputation of the major banks. We begin to forget about the systemically cruel ways in which the global banking system affects the lives of billions of innocent people every day.

When high-level drug traffickers have been removed from all contact with operations on the street, including the handling of drugs or any associated violence, they are said to have "become the bank". They simply use their money to finance drug packages while reinvesting profits into real property and legitimate businesses. Once the traffickers reach this point, there is almost no possible way they can catch a charge and be convicted of any serious crime. The legal distance between them and the street-level dealing and violence has grown much too large, even though none of it would be possible without their money.

In that sense, the phrase “become the bank” is a very apt one. This post is not even meant to draw an analogy between high-level narco-traffickers and the TBTF banks, but rather to sketch a portrait of the literal connection that exists. The large banks are the untouchable source of funds behind almost every illegal (yet highly profitable) industry throughout the world, as well as activities that are technically legal, but still very destructive to society. They are sometimes even aided by Western governments and their intelligence apparatuses, which find valuable policy objectives in doing so.

These institutions help traffick billions worth of drugs and illegal weapons across international borders every year. Just last year, it was revealed that Wachovia (now a part of Wells Fargo) had laundered at least tens of billions of dollars for Mexican drug cartels since the escalation of drug-related violence at the US-Mexico border in 2004. This laundered money has gone towards the purchase of everything from the drugs themselves to the planes used the transport them and the weapons used to kill police and civilians alike. Ed Vulliamy produced an in-depth report on this last year for the Guardian.

How a big US bank laundered billions from Mexico's murderous drug gangs

During a 22-month investigation by agents from the US Drug Enforcement Administration, the Internal Revenue Service and others, it emerged that the cocaine smugglers had bought the plane with money they had laundered through one of the biggest banks in the United States: Wachovia, now part of the giant Wells Fargo.

The authorities uncovered billions of dollars in wire transfers, traveller's cheques and cash shipments through Mexican exchanges into Wachovia accounts. Wachovia was put under immediate investigation for failing to maintain an effective anti-money laundering programme. Of special significance was that the period concerned began in 2004, which coincided with the first escalation of violence along the US-Mexico border that ignited the current drugs war.

Criminal proceedings were brought against Wachovia, though not against any individual, but the case never came to court. In March 2010, Wachovia settled the biggest action brought under the US bank secrecy act, through the US district court in Miami. Now that the year's "deferred prosecution" has expired, the bank is in effect in the clear. It paid federal authorities $110m in forfeiture, for allowing transactions later proved to be connected to drug smuggling, and incurred a $50m fine for failing to monitor cash used to ship 22 tons of cocaine.

More shocking, and more important, the bank was sanctioned for failing to apply the proper anti-laundering strictures to the transfer of $378.4bn – a sum equivalent to one-third of Mexico's gross national product – into dollar accounts from so-called casas de cambio (CDCs) in Mexico, currency exchange houses with which the bank did business.

"Wachovia's blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations," said Jeffrey Sloman, the federal prosecutor. Yet the total fine was less than 2% of the bank's $12.3bn profit for 2009. On 24 March 2010, Wells Fargo stock traded at $30.86 – up 1% on the week of the court settlement.

The conclusion to the case was only the tip of an iceberg, demonstrating the role of the "legal" banking sector in swilling hundreds of billions of dollars – the blood money from the murderous drug trade in Mexico and other places in the world – around their global operations, now bailed out by the taxpayer.

Common sense tells us that the first time a bank gets caught in the middle of such a blatantly obvious practice is not its first time around the block. Indeed, the evidence clearly shows that Wachovia executives were previously made aware of the illegal money laundered through their institutions by several different sources and, instead of acting to remedy the situation, sought to bury the whistleblowers six feet under a pile of disinformation and bureaucracy.

That is simply what they do, and they never catch a criminal charge, or anything beyond a symbolic slap on the wrist, for any of it – they are beyond reproach. A couple hundred million dollars in fines to their companies is a cruel joke on the millions of lives that have been destroyed by the drug trade. More importantly, it does nothing to stop these practices from occurring and destroy millions of additional lives in the future.

When it comes to profiting from murderous and destructive activities, though, nothing ranks higher for the banks than the global arms trade. This type of financing can be carried out in the open for the most part, since governments around the world sanction and engage in the export and procurement of weapons manufactured by the leading companies. Of course, everyone knows that these “legal” arms deals are also fueling the rampant armed conflict in poorer parts of the world. A good portion of the “foreign aid” given to developing nations is recycled right back into the coffers of the large weapons manufacturers and their banks.

"Every gun that is made, every warship launched,every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone. It is spending the sweat of its laborers, the genius of its scientists, the hopes of its children." -Dwight D. Eisenhower

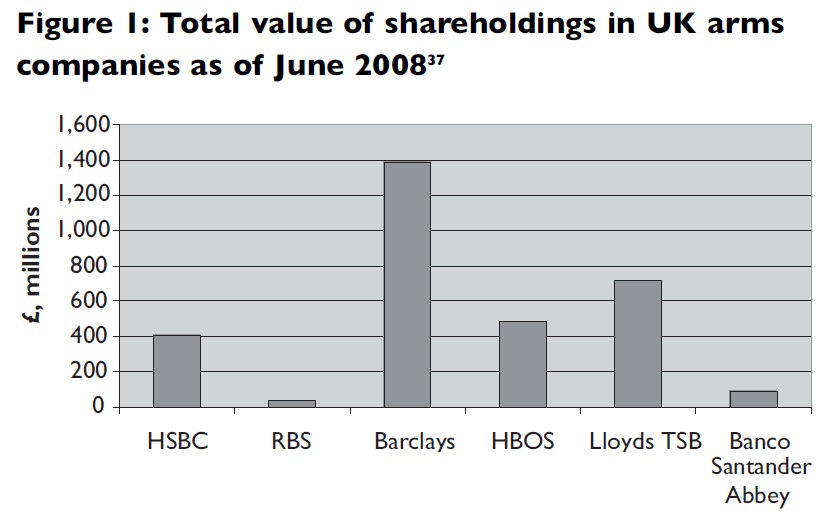

The London-based charitable organization “War on Want” produced a report a few years back highlighting the ways in which major U.K. banks have financed the arms trade through the provision of banking services for the weapons industry, direct investments in arms companies and the provision of credit to these companies through loan syndicates. These include investments in cluster bombs and depleted uranium projectiles, which are universally recognized as inflicting an unacceptably high injury/death toll on civilian populations during and after war.

A section of the map showing the locations of unexploded munitions around Basra in southeast Iraq

Banking on BloodshedIn 2006 the UK government approved sales by UK arms companies to 19 of the 20 countries identified by the Foreign and Commonwealth Office as ‘countries of concern’ for human rights abuses. These countries included Saudi Arabia, Israel, Colombia, China and Russia.21 Colombia, Russia and Israel are also countries in conflict. Deals have been approved in other conflict countries including Algeria, Turkey, Pakistan, Afghanistan, Indonesia and Georgia. In 2007 the UK government, in defiance of an arms embargo, allowed UK companies to sell Zimbabwe £1 million in cryptography equipment and software.Israel is a regular customer of the UK arms industry, despite its flagrant violations of international law, including the military occupation of the Occupied Palestinian Territories. In 2006 the government approved for sale to Israel a laundry list of military hardware: helicopters, military aircraft cockpit displays, unmanned vehicles, anti-armour missiles and other electronic warfare equipment. BAE Systems makes subsystems, or components, for the F-16 fighter jet, of which Israel has 236. F-16s have been deployed by Israel against civilian populations in both Lebanon and Gaza.

The Iraq and Afghanistan conflicts have been a boon to arms companies in the US and the UK. One UK company that has benefited particularly from the surge in demand from the Iraq war has been Chemring, which manufactures niche products such as missile countermeasures and flares. Profits have risen each year since the start of the occupation in 2003. In 2006 returns were almost 500% higher than in 2002, and share prices have followed.

BAE supplies many weapons to the US and UK that have been used in the Iraq and Afghanistan conflicts, including V-22 guns and armoured fighting vehicles. BAE also recently won a contract from the UK Ministry of Defence to service its Tornado jets in Iraq for £10 million apiece.29 Lockheed Martin also supplies extensively to the US and UK governments to fulfil demand from the ongoing conflicts in Iraq and Afghanistan. These supplies include military ground vehicles and sniper targeting pods for fighter aircraft, amongst other products.

There are some weapons that have come under particular criticism for their toll on civilian life even long after a war has ended. Cluster munitions are one such weapon. They are designed to scatter dozens to hundreds of smaller bomblets over a large area and can cause high levels of civilian casualties both during attacks because of their indiscriminate, wide-area effects, and long afterwards, since unexploded ordnance turns fields, roads and even schools into minefields. One in four cluster munitions victims are children.

The arms trade provides the destructive hardware used in conflicts across the world. This report has exposed, for the first time, the extent to which the five main British high street banks are funding this violent trade. High street banks are using our money to fund companies that sell arms used against civilians in wars across the world, including conflicts in Iraq and Afghanistan. They are financing an industry that sells arms to countries committing human rights abuses such as Israel, Colombia and Saudi Arabia. Money from our savings and current accounts is being used to fund companies that produce pernicious weapons like depleted uranium and cluster bombs.

Faith in the banking sector is already at an all-time low. The revelation that high street banks are investing in weaponry will add to this public mistrust. Barclays, Halifax Bank of Scotland, HSBC, Lloyds TSB and Royal Bank of Scotland are all complicit. Barclays stands out for the sheer scale of its investments. Royal Bank of Scotland is the most active in lending to the arms sector. HSBC shows its glaring hypocrisy by having claimed to divest from the arms trade while actually continuing its holdings.

Whilst the complicity of high street banks is the focus of this report, War on Want believes that the arms trade should ultimately be abolished. However, with governments such as the US and UK determined to pursue military adventures around the world, the arms trade remains big business. War on Want believes that now is the time to act to put an end to high street banks’ support for arms companies.

While Congressional panels hold symbolic hearings about which banks sold what toxic investment to which defrauded clients, or who knew what about which funds were transferred to what location, the systemic financing of death and destruction around the world continues on unimpeded. These activities are not only outside the scope of any serious investigation, they are officially sanctioned and effectively immune from regulation or prosecution.

These are the same institutions which have been granted virtually unlimited backstops by American and European taxpayers, in one form or another. More to the point, they are the institutions which many of us use to store our money, take out loans, invest in markets or make purchases. As long as we continue to do so, we are telling them that we are OK with how they conduct themselves around the world; that we are willing to accept their status as the untouchable elite.

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.