South African Gold Production Dives To 90 Year Lows

Commodities / Gold and Silver 2012 Mar 15, 2012 - 07:45 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,646.75, EUR 1,262.26, and GBP 1,052.57 per ounce.

Gold’s London AM fix this morning was USD 1,646.75, EUR 1,262.26, and GBP 1,052.57 per ounce.

Yesterday's AM fix was USD 1,662.00, EUR 1,271.61 and GBP 1,057.93 per ounce.

Gold fell more than 2% in New York yesterday and closed at $1,643.80/oz. Gold fell in Asia and its low hit $1,635.66/oz and high of $1,649.9/oz, and is now trading sideways in Europe at $1,647.05/oz.

Gold recovered some strength on Thursday after a drop in the prior session attracted bargain hunters, however a strong dollar and diminished expectations of more QE in the US made the yellow metal vulnerable to more selling.

Gold has dropped around 8% since late February as institutional funds appeared to have closed out of their bullish gold bets on worries the Fed will not embark on another round of QE to keep interest rates and borrowing costs low. The dollar hit an 11 month high against the yen and a 1 month peak against the euro on Thursday on growing hopes of a US economic recovery and continuing rises in U.S. bond yields.

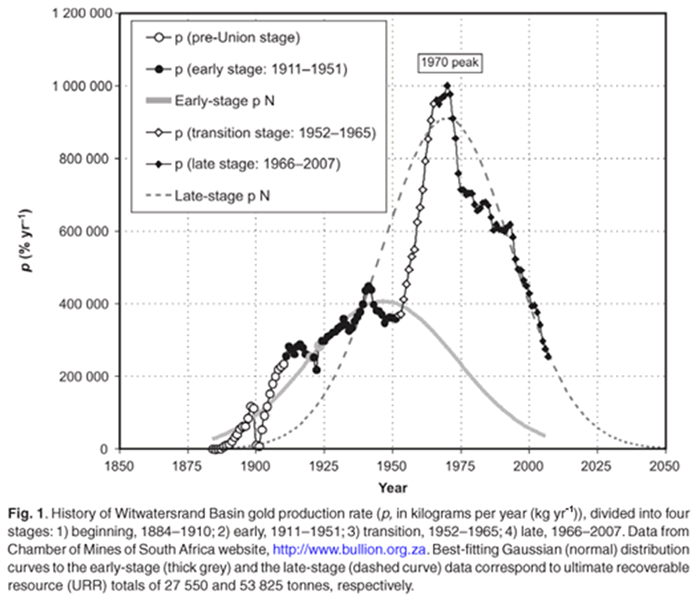

South Africa's gold output fell again in January and was down a very large 11.3% in volume terms in January. Annual gold production is set to be close to 220 tonnes which is a level of gold production not seen since 1922 (see chart below).

The falls were seen only in the gold market with production of other minerals holding up with total mineral production down only 2.5% compared with the same month last year.

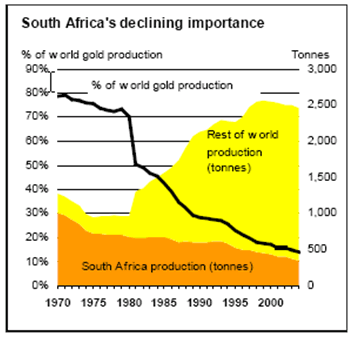

South Africa as recently as two decades ago was the world's largest producer of gold by a huge margin. Only 40 years ago South Africa produced more than 1,000 tonnes of gold per annum but will only produce some 220 tonnes in 2012. Production peaked in 1970 and has been falling steadily and sharply since.

The nearly 80% fall in South African gold production has led to it being recently overtaken by China, Australia and the U.S. It is now even at risk of being overtaken by Russia.

The scale of the collapse is such that it is worth considering the possibility that the Apartheid regime may have exaggerated the size of South African gold production. Indeed, similar questions could be asked of the massive increase in China's gold production in recent years and whether Chinese gold production tonnage figures are exaggerated.

The massive 11.3% decline in South Africa was more than even that seen in December when gold output fell by 8.2%.

The continuing output decline is due to many of the country's biggest gold mining operations having reached the ends of their lives and having closed down.

Old mines that are still operating are mostly getting deeper and deeper with safety concerns a limiting factor, while new operations coming on stream tend to be either small by comparison, low grade, or both.

South Africa's continuing gold production decline is not cyclical and is permanent and is another bullish factor for the gold market in the long term.

Geological constraints mean that there is little prospect of any serious reversal in the trend. Geological and the lack of any major gold finds anywhere in the world in the last 20 years also suggest that the supply side of the gold equation remains bullish.

The decline in South African production has been a major contributor to at best flat global gold production over the past few years.

Indeed, some data suggests that global gold production may have peaked in the early 2000s.

In the light of the continuing strong fundamentals, this is another healthy correction in the gold market as investment demand is set to remain strong for the foreseeable future while supply remains tight.

Also, central banks are increasingly reluctant to sell their gold reserves and indeed some increasingly wealthy and powerful central banks are adding to their reserves or attempting to gain control of the reserves of smaller debtor nations

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.