Did U.S. Q4 GDP Data Pull In Future Economic Growth

Economics / US Economy Mar 04, 2012 - 02:17 AM GMTBy: Tony_Pallotta

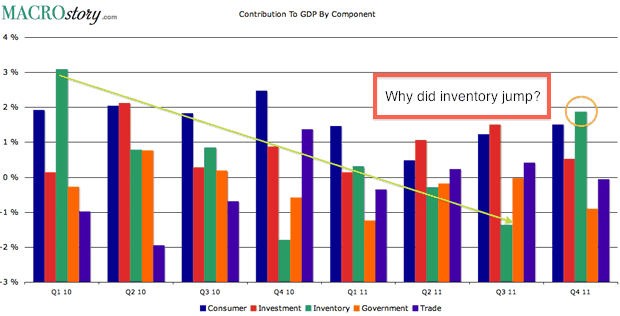

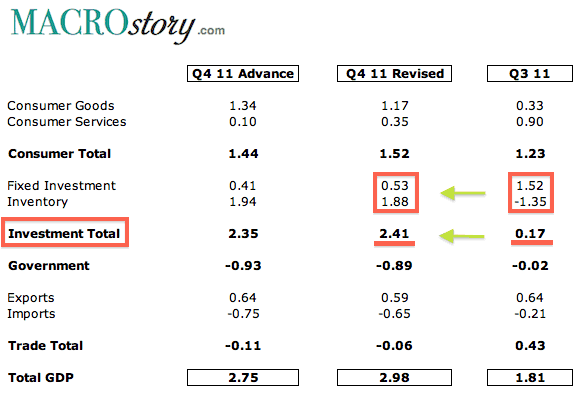

No economics degree is required nor any complex analysis to understand how vulnerable the US economy is right now. In Q4 the economy expanded by 3% fueled by a 1.9% increase in inventory. By comparison Q3 inventory contracted (1.4%). In other words if the two year inventory trajectory did not suddenly reverse Q4 GDP quite possibly would have been flat to negative.

No economics degree is required nor any complex analysis to understand how vulnerable the US economy is right now. In Q4 the economy expanded by 3% fueled by a 1.9% increase in inventory. By comparison Q3 inventory contracted (1.4%). In other words if the two year inventory trajectory did not suddenly reverse Q4 GDP quite possibly would have been flat to negative.

As a former retailer I will tell you that inventory levels are only increased when you expect higher sales. If those sales do not materialize you will sharply cut back all future buys and simply deplete what is on your shelves.

Based on this increased inventory build it would appear something inspired the wholesale and retail channels to invest in future demand. But if you look at both components of total investment you find a mixed message.

Q4 fixed investment fell off sharply from 1.5% to 0.5% whereas inventory went from (1.4%) contraction to 1.9% expansion sharply reversing a two year trend.

Regardless of why inventory increased one simple question can now be asked. Can the consumer afford to buy it? If they cannot it is very likely Q4 GDP simply pulled in future economic growth setting up possible economic contraction in the first half of 2012. So let's see how well positioned the consumer is to meet this expected rise in demand.

Income and Spending

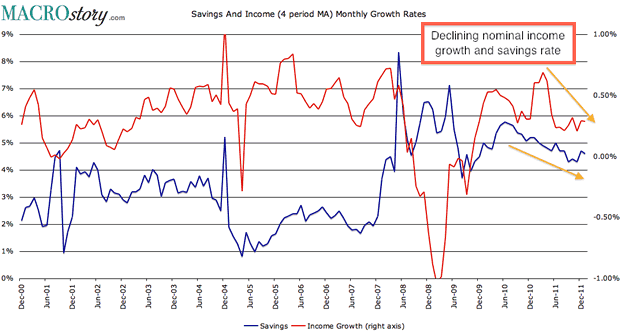

Perhaps retailers were encouraged by the increased sales in Q3 2011. Problem is while retail sales were growing two things were happening. Nominal income growth and the savings rate were both declining. In other words the consumer did not have the income needed to "finance" their spending levels.

A reduction in both the savings rate and nominal income growth is not a sign of a consumer able to increase spending.

Non-Discretionary Spending

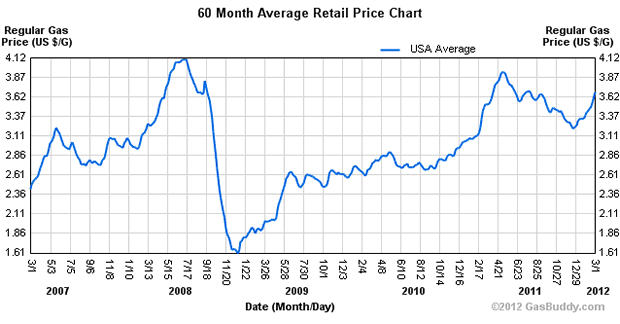

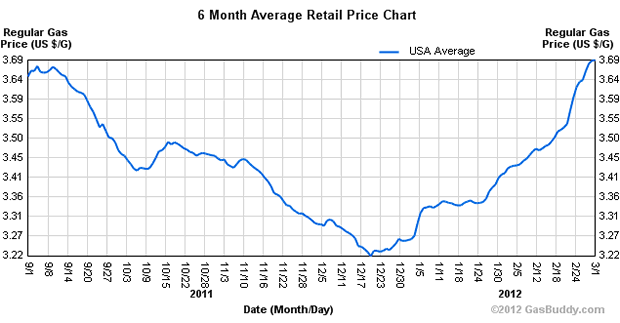

Rising gas prices have been talked to death as an economic killer or tax hike on the consumer. Those assessments are valid though and represent the biggest threat to the US economy in 2012. A consumer that is already spending beyond what their declining income growth can finance cannot afford to spend even more at the pump.

The following two charts show just how significant this rise in gas prices has been from both a multi-year standpoint and since the start of 2012. In fact when retail sales were rising in Q3 2011 notice how gas prices were falling.

Bottom Line

To understand the trajectory of the US economy all one must watch are "prices at the pump" which is directly related to crude prices. If the consumer is unable to purchase all that inventory just built the US economy is in trouble regardless of what the Fed and BEA would want you to believe.

"If you build it he will come" - Field Of Dreams

Let's hope this economic dream of rising demand doesn't in fact turn into a nightmare.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.