Groundhog Day Meets the Markets

Stock-Markets / Financial Markets 2012 Mar 03, 2012 - 02:45 PM GMT Another day, another week passed and it feels like we are all living a dream and playing the role Bill Murray did in the movie Groundhog Day. Virtually the past week felt like February 2nd.

Another day, another week passed and it feels like we are all living a dream and playing the role Bill Murray did in the movie Groundhog Day. Virtually the past week felt like February 2nd.

Still there were some trades around for those traders that were keeping in touch with the markets. The obvious ones were gold and silver.

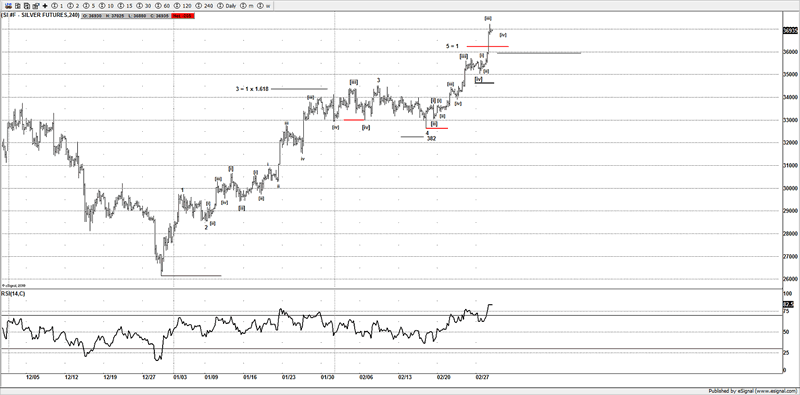

Silver

Having been aggressively bullish from the Dec 2011 lows, coming into these highs this past week, I made in known to members and even the readers of the free trial newsletter that they needed to be cautious as we approach targets as seeing 5 wave advances in both metals from those Dec 2011 lows, had us start to scale out of long side trades, the moves had become very mature, aggressive traders could have looked to sell the metals, but the emphasis was about getting out on long trades and locking in the $.

Great timing, Elliott Wave Analysis nailed it again, it's not always as clean as the metals were showing, but when it's as clean as that, you simply have to take note of it.

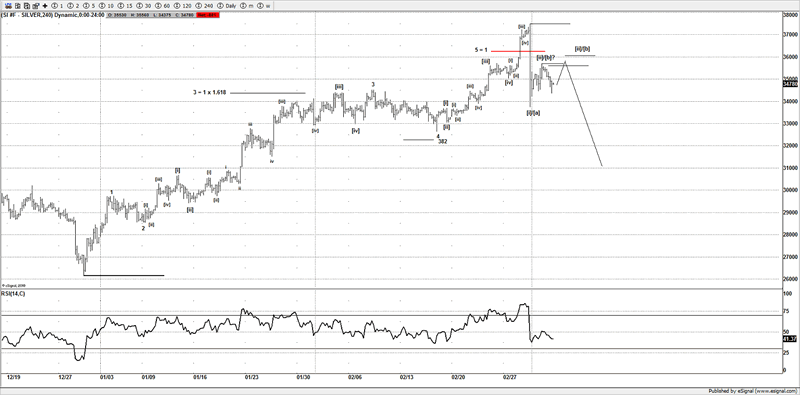

Were you taken off guard with the dump?

We were very prepared to lock in the gains and walk away happy that we missed getting hit. Even readers of the trial service could of taken advantage of locking in the $$, and from the email response just after the metals dumped it seems many were grateful for the warnings.

What was the excuse used for the dump in the precious metals? personally I don't care, I saw 5 waves to the upside and we needed to be careful and take the $$ of the table and move up stops to lock the rest in.

Before

After

Whilst equity traders have been bored to death with the lack of movement, the metals have provided some great gains over the past few weeks, and I don't think it's over by a long shot.

Give me a market that moves.

If I can count it, we can find a setup to trade it.

When you are staring at a screen for the past 2 weeks that seldom is offering a setup in either direction, imo traders really need to move to markets that are offering the set ups.

Going forward there is some big picture ideas I am working, and from some levels lower will confirm or negate if the bears finally have a hold on the precious metals.

Do you want ideas where the precious metals could be going over the coming weeks/months?

If you have not done so take a peek at the Elliott Wave Market Newsletter, I go into great detail on the precious metals, while it's still on a trial basis you simply have nothing to lose, it's free until the trial is terminated. http://www.wavepatterntraders.com/forum/203-elliott-wave-market-newsletter/

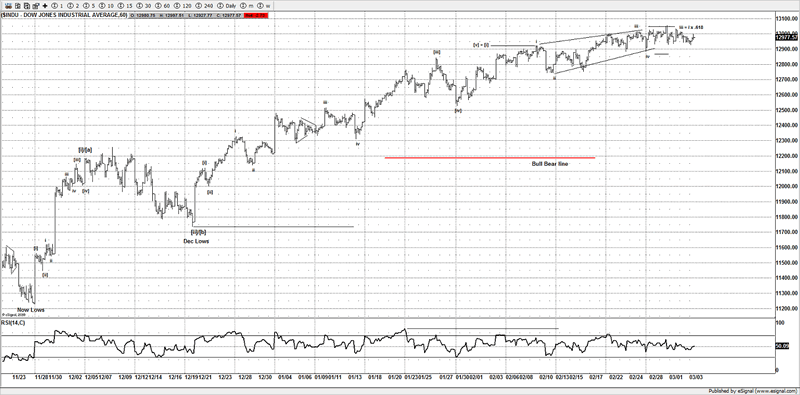

DOW

The US markets continue to chop around in what I still think is an ending diagonal (ED).

Although its taking its time and doing a great job of frustrating traders, not so much via price, but more so in time.

Ending diagonals are known patterns to morph and cause great heart ache for traders, but the key still remains that as long as it continues to wedge I still consider this to be setting up for an eventual move lower.

A break above 13154 will negate this pattern, so risk is still relatively tight as the expected move is at least back to around 12500-12600 or far lower if my primary idea is working.

You can see how this is wedging at the top of the trend that is suggesting the market is tired and should be ending its move from the Dec 2011 lows, there are other clues to support this, baring a strong new wave of buying the odds suggest that unless above 13154 a reversal is setting up.

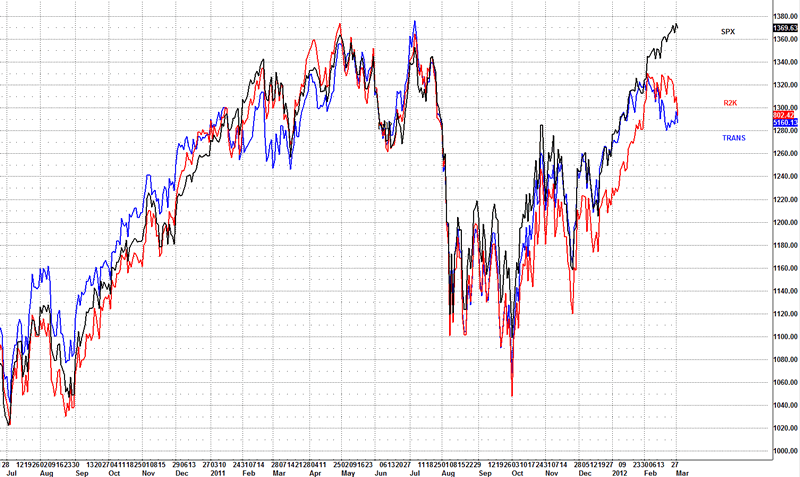

Other parts of the market appear to have already started a move lower, if you compare the SPX with the R2000 and the Dow transports, there is a large divergence taking place.

So I don't think it's going to be long before the other major US markets play catch up.

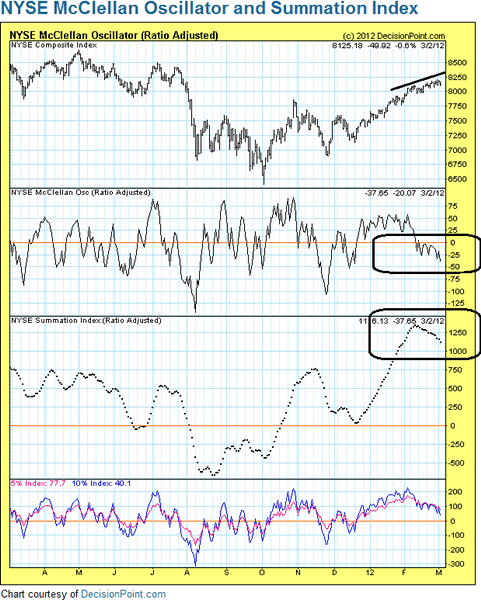

The Summation index and the NYSE McClellan Osc are still in down trends, so price eventually will either need to play catch up or need a new influx of buying to correct this heavy divergence.

Oil

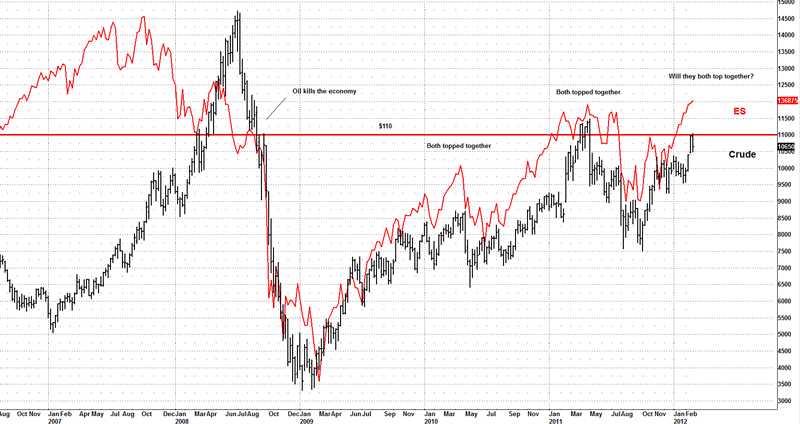

Oil again tried to mount a serious move above $110 but failed, please refer to last week's article for the reasons why I still think that oil is a big deal at these levels, but having rejected this area twice, I now think traders need to be keeping a watchful eye as this could be a great trade over the coming weeks, especially if we see a strong risk off environment as the US$ gets a bid, I strongly suspect oil will get hit hard if we see a "sell off" in risk markets.

Conclusion

A boring a flat week in stocks the action really came from other markets, but I still feel that baring a new wave of heavy buying the markets are still trying to carve out a top at these levels and with the patterns we are watching, we can take some low risk shorts, as the risk can be controlled, or wait for a solid break of our support areas we are watching.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2012 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.