2012 & Beyond: Pain at the Pump is Here to Stay, But it Won't Doom the Economy

Stock-Markets /

Financial Markets 2012

Feb 27, 2012 - 05:54 AM GMT

By: Submissions

Cetin Hakimoglu writes: In April 29, 2011 I wrote an article titled "Dyseconomics: The New Macro Econ and The Greatest Economic Boom Ever" which predicts a huge bull market combined with surging living expenses, surging commodity prices and counterintuitively tame bond market inflation. Immediatly thereafter, we entered a steep correection on European debt fears, but with the dow within striking distance of 13000, oil $109 and gas approaching $4/gallon and treasuries still remarkably strong, the original premise of Dyseconomics remains unchanged. (http://www.marketoracle.co.uk/Article27835.html)

Cetin Hakimoglu writes: In April 29, 2011 I wrote an article titled "Dyseconomics: The New Macro Econ and The Greatest Economic Boom Ever" which predicts a huge bull market combined with surging living expenses, surging commodity prices and counterintuitively tame bond market inflation. Immediatly thereafter, we entered a steep correection on European debt fears, but with the dow within striking distance of 13000, oil $109 and gas approaching $4/gallon and treasuries still remarkably strong, the original premise of Dyseconomics remains unchanged. (http://www.marketoracle.co.uk/Article27835.html)

2012 will be much like 2009 characterized by perpetually rising stocks and commodities with the backdrop of constant negativity by the media about supposed hyperinflation, unsustainable debt, Europe, reckless fed policy, and valuation bubbles.

A few highlights for 2012:

>We're still in an epic profits, productivity, consumerism, earnings, and exports driven economic boom and in new era of economic petpetualism and multilateral asset class inflation affecting gold, oil, stocks, web 2.0 valuations, municipal bonds, and high-end real estate which have all risen together this year in lockstep (as I predicted they would).

> With the 3rd year anniversary of the March 2009 lows approaching, the much maligned TARP program continues to pay dividends. The US is now paying less interest on its debt than it was in the 90's thanks to perpetually low rates, due to huge inflows of liquidity from foreign governments, tax payers, and various institutions.

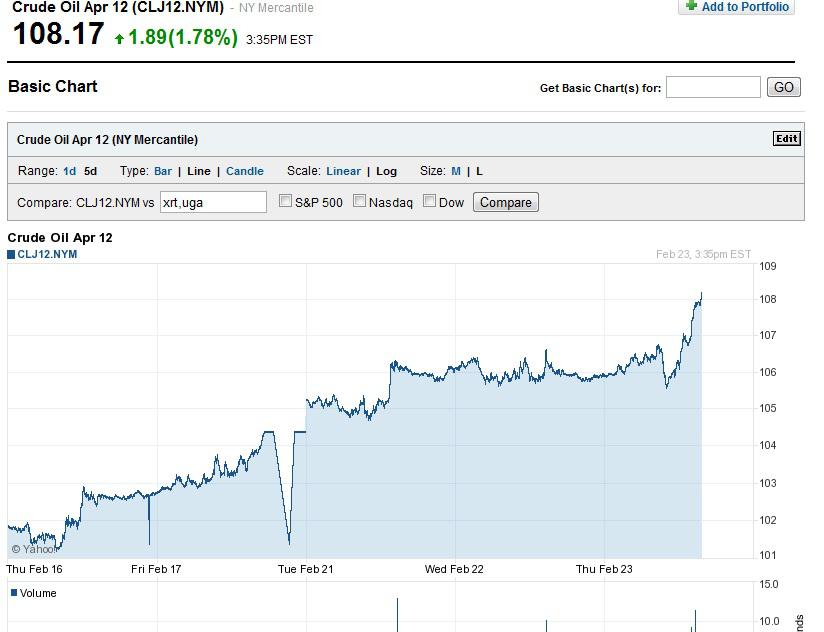

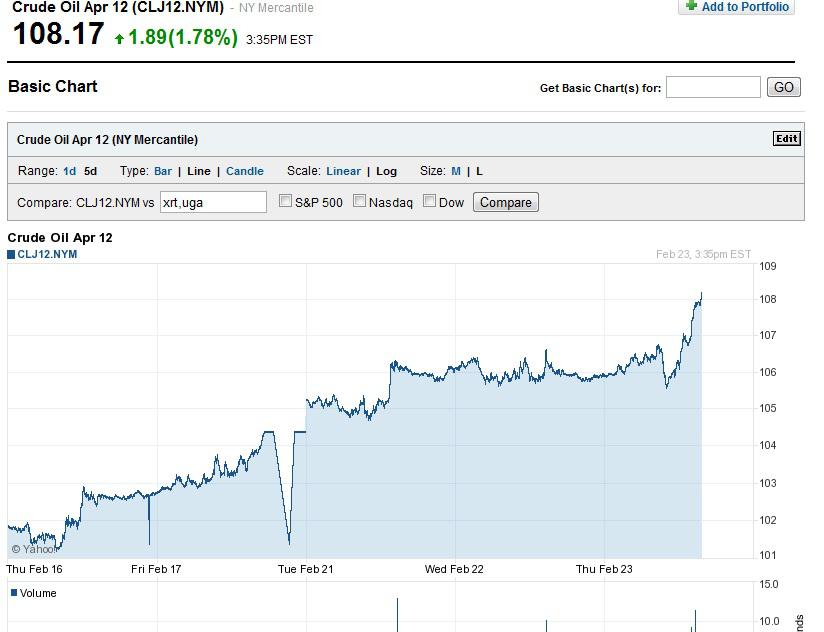

Chart:

Tax payers are earning back their bailout money in the form of one of the largest bull market rallies ever. To put this rally in context, the points gained by the DJIA since March 2009 (around 6300) is about equal to the gains between 1995 and 2000, yet the PE ratio for the DJIA is still only 13, and it did this in only three years instead of five. This is a testament to the enduring resiliency of the global economy and the efficacy and expediency of policy makers when faced with potential crisis.

>Apple well above $500

> Oil at $108 with no signs of slowing. The middle class being squeezed by surging living expenses and policy makers are powerless to do anything about it, not that they would want to due to the economically stimulative benefits of higher living expenses by forcing consumers to spend more money on inelastic goods (as explained later in this article)

The bleating by the media, blogs and 2012 candidates about the need for pipelines, alternative energy, and speculation regulation echoes the angst of 2008, and of course nothing will come of it. There are autonomous global macroeconomic factors outside of the control of policy markers that are relentlessly driving up prices. Trying to curb speculation is short of impossible because first you have to prove that speculators are maliciously driving up prices to an 'unreasonable level' and then you have to draw up legislation and then it has to be enforced, and then there will be loopholes will get around it, etc. The BIRC economies are still on fire and with regards to China the debate over 'soft' vs 'hard' landing boils down to one GDP point for an economy that is growing at 8-9% a year. Any new supply from drilling will take years to get online. Bernanke only looks at the bond market when evaluation inflation, dismissing commodity prices, and with the USA having the ultimate reserve currency status there is no need to create a mountain of interest rate repayments out of what is presently a molehill. Unless the media succeeds in fabricating another crisis, commodities and gas prices will keep rallying for the remainder of the year with only brief pauses, which should be great buying opportunities. Don't look to China, US consumers, or profits and earnings to 'soften' in 2012 and hence bring asset prices down because they won't.

TLT still above 116.5 indicating huge demand for near 0% yielding US paper even with a 14th consecutive quarter of strong profits & earnings and massive asset inflation. You got 'crisis level' yields, but pertinent economic indicators say otherwise. What a great economy we're in when you can have profits & earnings growth that rivals the 80's and 90's and non-existent bond based inflation that is traditionally a side effect of such exceptional growth. Living expenses based inflation, on the other hand, continues its divergence from the bond market, as has been the case since March 2009.

Oh what about those predictions based on the perfectly logical sounding presumption that surging oil and gas prices should hurt consumer spending and the overall economy?

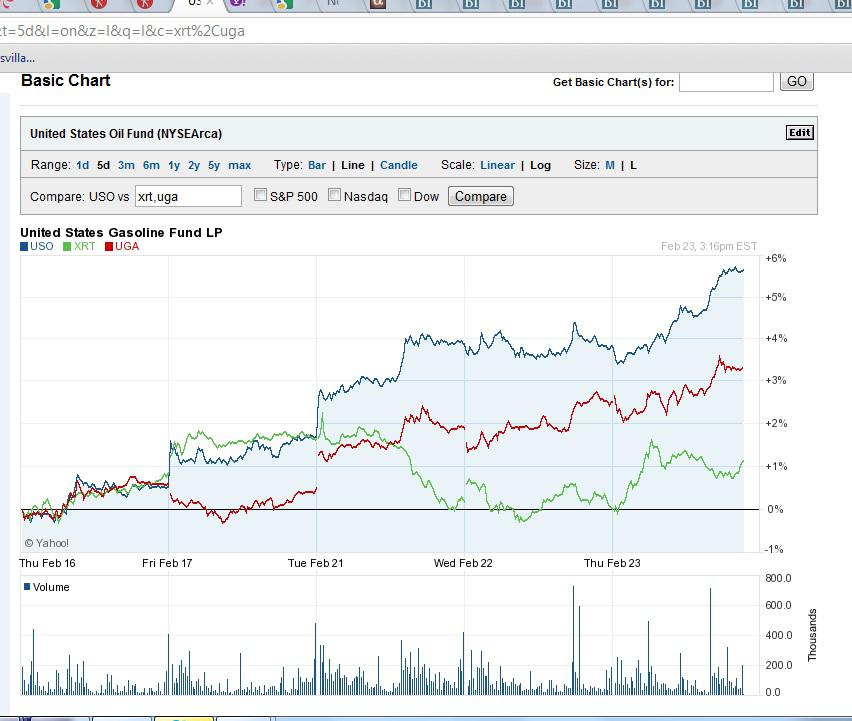

On the contrary, the very fact that the S&P Retailers Spider which as the theory goes is supposed to be hurt the most by oil surging prices and gas prices, is rising in tandem, proves that these populist motivated assumptions about commodities and consumer spending are wrong. Stocks are a future indicator and if the future for consumer spending is supposed to be bleak due to surging oil prices, why are they rallying? Maybe the unpopular reality is that surging commodity and living expenses isn't a ticking time bomb, after all. The reality is that rather than cutting back on total spending consumers will decrease their personal savings rate to accommodate the surging inelastic living expenses based inflation (food, health care, education, insurance, gas, heating energy) in order to avoid having to cut discretionary spending on things things like netflix, traveling and ipads. A less likely possibility is that consumer discretionary spending will fall, but the market isn't alluding to this. As the chart below illustrates, Retailers just aren't losing much sleep over pain at the pump. A silver lining is that massive foreign consumption is offsetting any retail weakness here attributed to pain at the pump. Surging gas prices prices is a by-product of booming growth in China and this emerging middle class is great for multinationals, even if American citizens are feeling more squeezed than ever.

The UGA gas ETF, XRT retail spider. and USO oil ETF are rallying together

Baring an existential event or a media generated crisis gas is on its way to $5.00 gallon very soon and oil $130-$140. The personal savings rate will go negative and there will be no double dip. The same trends that have been in place since March 2009 will continue.

My actionable advice is the same in the Dyseconomics article which to to buy large cap, globalsit tech stocks like AAPL and Google in additional to commodity plays like UGA and GLD.

Cetin Hakimoglu is a stock market, macro economics, and mathematics enthusiast who operates a financial news aggregation website http://iamned.com/ and a personal math page http://iamned.com/math/

Copyright © 2012 Cetin Hakimoglu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Cetin Hakimoglu writes: In April 29, 2011 I wrote an article titled "Dyseconomics: The New Macro Econ and The Greatest Economic Boom Ever" which predicts a huge bull market combined with surging living expenses, surging commodity prices and counterintuitively tame bond market inflation. Immediatly thereafter, we entered a steep correection on European debt fears, but with the dow within striking distance of 13000, oil $109 and gas approaching $4/gallon and treasuries still remarkably strong, the original premise of Dyseconomics remains unchanged. (http://www.marketoracle.co.uk/Article27835.html)

Cetin Hakimoglu writes: In April 29, 2011 I wrote an article titled "Dyseconomics: The New Macro Econ and The Greatest Economic Boom Ever" which predicts a huge bull market combined with surging living expenses, surging commodity prices and counterintuitively tame bond market inflation. Immediatly thereafter, we entered a steep correection on European debt fears, but with the dow within striking distance of 13000, oil $109 and gas approaching $4/gallon and treasuries still remarkably strong, the original premise of Dyseconomics remains unchanged. (http://www.marketoracle.co.uk/Article27835.html)