Gold Rises on Greece Debt Deal: "Kicking Giant Beer Keg Down Road Risks Destroying The Road"

Commodities / Gold and Silver 2012 Feb 21, 2012 - 07:41 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,737.00, EUR 1,313.12, and GBP 1,097.98 per ounce.

Gold’s London AM fix this morning was USD 1,737.00, EUR 1,313.12, and GBP 1,097.98 per ounce.

Yesterday's AM fix was USD 1,729.50, EUR 1,307.36, and GBP 1,090.82 per ounce.

Gold rose to its highest in a week today after euro zone policymakers sealed an agreement for a second debt deal with Greece. Gold remained flat at $1,736/oz in Asian trading after the deal was reached but then saw some buying which saw gold quickly rise to $1,740/oz and then creep up to over $1,743/oz.

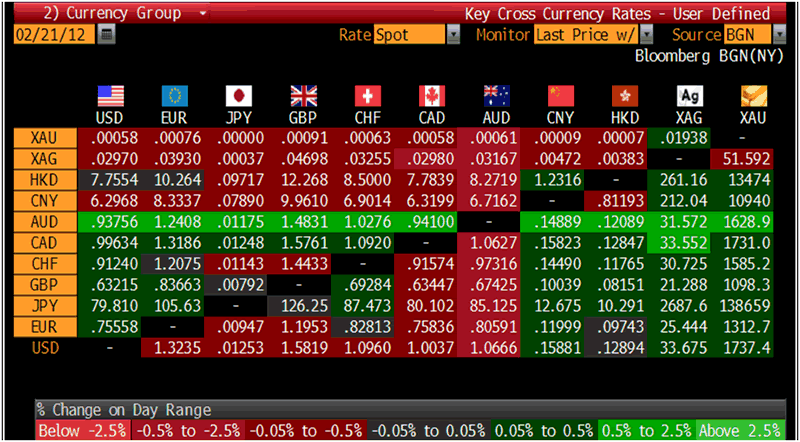

Cross Currency Table – (Bloomberg)

U.S. gold rose 1% from Friday's close to $1,743.5 following the Greek bailout, catching up with gains in cash prices after the U.S. market was shut on Monday for a public holiday yesterday. Gold subsequently fell back to $1,737/oz in mid morning European trade.

Asian stocks were mixed and European indices are lower. This is either a case of ‘buy the rumour, sell the news’ or maybe market participants are beginning to get nervous regarding successive efforts at kicking the much abused can down the road and are nervous about other highly indebted industrial nations.

Gold has consolidated between $1,700 and $1,750 in the past two weeks as Greece has struggled to avoid default which could lead to contagion in the euro zone.

Euro zone finance ministers sealed a 130 billion euro ($172 billion) ‘bailout’ for Greece overnight to avert a chaotic default and likely contagion after persuading private bondholders to take greater losses and Athens to commit to brutal spending cuts.

The decision may help Athens resolve its immediate payment needs, but Greece still faces a very bleak financial and economic outlook in the coming years.

With elections tentatively scheduled in April, Greek politicians may become increasingly wary of standing behind the measures over popular outcry.

Those who have been correct about the crisis in recent years question whether a new Greek government will stick to the deeply unpopular program after elections due in April and believe Athens could again fall behind in implementation, prompting lenders to pull the plug once the eurozone has stronger financial firewalls in place.

The much used phrase "kicking the can down the road" underestimates the risks being created by European and international policy makers. Some have rightly warned that we will likely soon run out of road.

Rather than "kicking the can down the road" what politicians in Europe, in the U.S. and internationally are actually doing is "kicking a giant beer keg down the road".

The giant beer keg is the continual resort to cheap money in the form of ultra loose monetary policies, QE1, QE2, QE3 etc, money printing and electronic money creation on a scale never seen before in history.

The road is our modern international financial and monetary system.

The risk is that attempting to kick the giant beer keg down the road will lead to many broken feet and a destroyed road.

A European, US, Japanese and increasingly global debt crisis will not be solved by creating more debt and making taxpayers pay odious debts incurred through massively irresponsible lending practices of international banks.

The likelihood of continuing massive liquidity injections by the ECB next week and in the coming weeks will help keep the opportunity cost of holding bullion the lowest it has ever been and likely contribute to higher bullion prices especially in euro terms in the coming months.

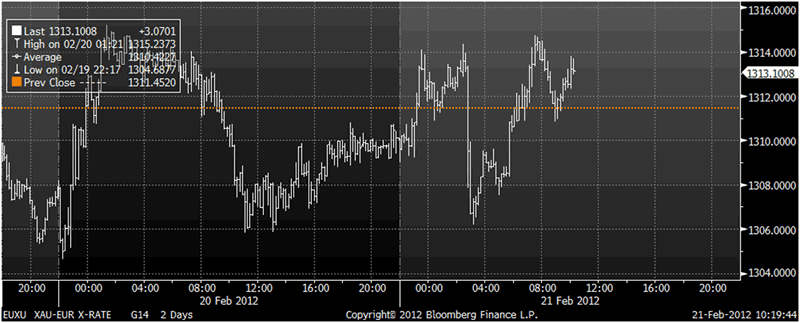

XAU-EUR Exchange Rate 2 Days – (Bloomberg)

While the euro strengthened against the dollar, gold priced in euros fell initially but has edged marginally higher and gold is trading at €1,313/oz.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

OTHER NEWS

(Bloomberg) -- Gold Trading Rose 1% in January as Silver Declined, LBMA Says

Gold trading increased 1 percent to an average of 22.2 million ounces a day in January compared with a month earlier, the London Bullion Market Association said today in an e-mailed report.

Silver trading fell 24 percent to a daily average of 149.2 million ounces, the lowest level since March, the LBMA said.

(Bloomberg) -- The J.P. Morgan View: The return of Asset Reflation

• Asset Allocation –– All assets are beating cash YTD, showing the power of asset reflation, which is being reinvigorated by massive liquidity injections from central banks across the world. We stay long the higher risk-beta asset classes, equities, gold and credit. • Economics –– World growth forecasts remain unchanged, but higher oil prices temper the upside risk bias from recent PMIs. • Fixed Income –– Government yields still out of kilter with improving activity data and the equity rally. • Equities –– Staying long and OW DAX and EM. • Credit –– We stay with overweights in EM $ sovereigns, US HG and US HY. • Foreign exchange –– Our main non-consensus calls for Q2 are a stronger euro and yen, at $1.34, and ¥73, versus the USD. • Commodities –– OPEC should be able to offset any lost Iranian exports but uncertainty around this is pushing oil prices higher. The rally in riskier assets reached a pause mode over the past week on higher oil prices.

(Bloomberg) -- Hedge Funds Boost Bullish Wagers to Five-Month High: Commodities

Hedge funds increased commodity bets to the highest in almost five months on signs that a rescue plan for Greece and faster U.S. growth will buoy demand as supplies shrink for everything from soybeans to copper.

Money managers boosted net-long position across 18 U.S. futures and options by 2.9 percent to 956,313 contracts in the week ended Feb. 14, the most since Sept. 20, government data show. Soybean wagers jumped 29 percent to a five-month high. Silver holdings rose for a seventh straight week, the longest advance in almost three years.

The Standard & Poor’s GSCI Spot Index of 24 commodities reached a six-month high on Feb. 17 as euro-area leaders expressed confidence that an agreement on a Greek bailout can be reached. Reports last week on U.S. housing and manufacturing beat analysts’ forecasts, and claims for jobless benefits dropped to a four-year low. Investments in raw-material futures have jumped 13 percent this year, exchange data show.

SILVER

Silver is trading at $33.71/oz, €25.47/oz and £21.33/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,657.97/oz, palladium at $693.04/oz and rhodium at $1,500

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.