Important Stock Market Investment Drivers for 2008: A Tale of Two Halves

Stock-Markets / Global Stock Markets Jan 10, 2008 - 04:16 AM GMTBy: Hans_Wagner

The beginning of a new year is a good time to make a new assessment of the important investment drivers and themes for the year. If you want to beat the market it is important to understand what is driving the markets and where are the best sectors to find good opportunities. By identifying these factors you will have a solid framework to assess the impact market movements and news events on your investment strategy. This is the first of a five part series on the outlook for the 2008 markets. The first part will discuss the key drivers ending with a mention of what sectors will benefit and those that will be hurt.

The beginning of a new year is a good time to make a new assessment of the important investment drivers and themes for the year. If you want to beat the market it is important to understand what is driving the markets and where are the best sectors to find good opportunities. By identifying these factors you will have a solid framework to assess the impact market movements and news events on your investment strategy. This is the first of a five part series on the outlook for the 2008 markets. The first part will discuss the key drivers ending with a mention of what sectors will benefit and those that will be hurt.

The remaining four parts will review each of these sectors in more detail resulting in more specific sub-sectors to consider and potential companies to invest. For those interested in making money in this market you might want to read Active Value Investing: Making Money in Range-Bound Markets (Wiley Finance), by Vitaliy Katsenelson. The core of Katsenelson's strategy is to break down into three key pieces what you need to look at when analyzing a company: Q uality, V aluation, and G rowth (QVG).

Key Drivers

2008 stock markets will be characterized by the Presidential elections in the U.S., the slowing and then recovery of the U.S. economy and the ability of the global economy to continue to grow at slower, but still rapid rates. And as always there will be unforeseen events that will impact markets both to the upside as well as to the down side.

Looking back to 2007 we experienced a nice bull market that encountered three 10% pull backs. As of Friday, December 28, 2007 the S&P 500 was up 4.2% for the year as the impact of the credit problems caused the financial sector to fall about 21%, dragging down the overall market. So what does 2008 hold for investors?

The first half of 2008 will be more volatile and we will likely see further pull backs, possibly up to 20% as investors deal with the up coming U.S. elections, the slowing U.S. economy and even slower growth in the global economy. As the year passes, we are then likely to see a nice rebound as investors see the U.S. recovering from the weak economy, driven by improving fundamentals for the financial sector, the outcome of the election becomes clearer and global growth continues, albeit at a slower pace.

Political

The Presidential election in the U.S. creates uncertainty on who will emerge as the front runner and then who will win. Stock markets do not like indecision which creates more volatility. As shown in the chart below from Chart of the Day, the stock market tends to encounter more ups and downs early in the election cycle. Then as the outcome becomes clearer and the election gets closer the markets improve their performance.

While Wall Street tends to favor a Republican administration, the stock market usually does well under either administration, once they understand the new rules. If the Democrats win, then we will likely see higher taxes on capital gains and dividends. This will negatively impact companies that have high dividend payouts. In fact professional options traders are preparing to reduce the dividend growth assumptions they use in their pricing models if they believe a change in the tax rate on dividends is coming. This will also affect the pricing of securities that count on dividends to help drive their price.

While Wall Street tends to favor a Republican administration, the stock market usually does well under either administration, once they understand the new rules. If the Democrats win, then we will likely see higher taxes on capital gains and dividends. This will negatively impact companies that have high dividend payouts. In fact professional options traders are preparing to reduce the dividend growth assumptions they use in their pricing models if they believe a change in the tax rate on dividends is coming. This will also affect the pricing of securities that count on dividends to help drive their price.

The healthcare sector is anticipating the outcome of the elections as well. If Democrats take control of the White House, investors expect change to the healthcare system affecting the pharmaceutical companies and the health insurers the most? As a result shares of these companies are likely to languish.

In the energy sector both parties are likely to continue the effort to find alternative energy sources with the Democrats seeking ways to discipline the large oil companies for their high profits.

Global trade will continue as neither party knows how to stop it, though there will be some rhetoric about fairer trade with various countries. In the end the momentum is well underway and will not be stopped. Government officials will also say they want a stronger dollar; however, there is little they can do about it. Eventually the global trade imbalance will work itself out, probably in ways we do not foresee. Speaking of imbalances, neither party will be able to balance the budget as politicians are too addicted to the pork barrel. There will be lots of positioning on both sides but in the end they will continue to spend more than they take in.

In summary once the markets believe they understand who will be in power, then they will adjust accordingly and the stock market is likely to perform better. Until then I expect the political situation to negatively affect stock prices, though only in a minor way.

U.S. Economy

What is interesting to me is that two of the big economic developments this year had diverging impacts on the economy. Rising food and fuel prices were inflationary, whereas declining home prices were deflationary. If you only paid attention to increasing food and energy prices, you might think the Federal Reserve should be raising interest rates in order to fight inflation. On the other hand, if you focused on falling home prices, you might expect the Federal Reserve to be cutting rates faster than they have. Looking ahead into the New Year, the risk of inflation is not as high as food and energy prices alone would suggest. That's because housing deflation and the ongoing credit problems are likely causing the economy to falter, possibly even causing a recession, keeping inflation in check. That is why the Fed seems more concerned about housing deflation than food and energy inflation. In other words, by cutting interest rates in 2007, the Fed acknowledged that the downside risks to the economy from housing deflation are greater than the increased risk of retail price inflation.

Growth in the US has been revised down by most analysts. In November, Consensus Economics revised down its projections for 2008 GDP growth from 2.6% to 2.4%. IMF predictions sour this further with a figure of 1.9% for next year. In the past most analysts error on the high side when the economy falls into a recession. So we need to be careful when hearing this type of predictions. Speaking of recessions, by the time we've officially entered one ( a recession is generally considered to be two back-to-back quarters of negative GDP growth ), the stock market begins to start discounting the eventual recovery and climbs higher.

Wall Street analysts have a wide view for profits in 2008. Some believe we will see double digit growth rates, others forecast negative double digit rates. Right now PE ratios seem to be based on solid profit growth throughout 2008. If this proves to be wrong, as I expect, we could be seeing stock valuations that are higher than the current S&P 500 PE ration of around 16. If true then stock prices are likely to decline as investors realize profit growth is falling. We should know more as we see the results of earnings beginning in January 2008.

However, the Federal Reserve seems to be inclined to avoid a recession or at least making it a mild one if it occurs. As a result I expect the markets will realize this and then respond accordingly with the market rising in the second half of 2008.

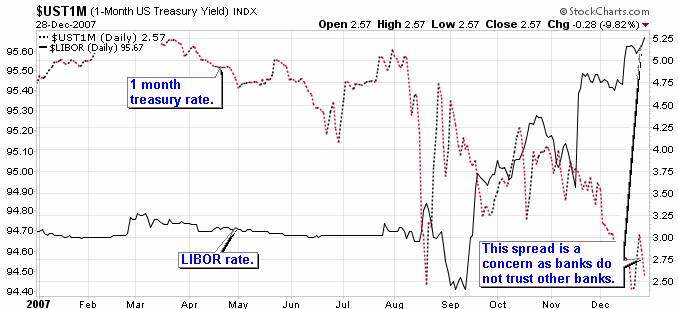

One of the problems facing the credit markets and the Fed is the rate differential between the LIBOR (London Interbank Offered Rate) and the short term U.S. treasury rates. The LIBOR rate normally stays even with the Fed Funds rate and other short term rates. However, since September we are seeing the LIBOR rise while U.S. short term rates are falling. This indicates that the banks are worried about other banks and their credit problems. The current high rate indicates this worry continues, despite what the authorities are saying. A significant part of the adjustable rate mortgages are priced off of the LIBOR, so this rise is a problem for those borrowers. This is further proof of the tightening in the credit markets world wide and not just in the U.S.

As I have mentioned earlier there has been a positive relationship between Fed easing and rising stock prices. Going back every recession and every easing cycle since the Great Depression, there has been a heavy bias of stocks doing well during periods of Fed ease. Unfortunately, it hasn't worked in the last 10 years. The Fed raised rates in 1998-99 when the market was rose dramatically. They started lowering rates in 2001 continuing through 2003. This occurred right through bear market caused by the dotcom bubble. They raised rates 2004 to 2006, and the market continued to do well. So the question remains will the housing/credit bubble be the same as the dotcom bubble or will stocks return to their former relationship when the Fed lowers rates. I am thinking the latter as stock values outside of the housing and financial areas did not participate in the most recent bubble.

Credit & Housing problems will cause further weakness in the economy, especially financial institutions and home builders and those companies that depend on these industries. The financial problems will start to clear up in the second quarter of 2008, though housing will take longer. Keep in mind that any near-term recovery in housing must now fight a record supply availability, falling prices, higher insurance costs and restricted credit

The slowdown in residential and commercial construction will send secondary ripple effects throughout the economy. Laid-off construction workers don't spend money. Construction and home furnishing suppliers sell less output and make fewer investments. Even local governments will be pinched by declining property-tax assessments and fewer developer fees. Things are likely to get worse before they get any better.

Inflation starting at 4.3% will begin to fall giving the Fed room to lower the Fed Funds and Discount Rate to 3.25% before flattening out.

Of interest after Benizar Bhutto was assassinated, investors sought safety in the EURO rather than the Dollar as they have in the past. This implies the dollar is no longer the primary place to be when seeking safety. Speaking of the dollar, it will rebound in the first half as traders cover their shorts, then it will level off before it starts to fall again.

In summary, as the year rolls on investors will start looking to an economic rebound in the second half of 2008 ad 2009, especially if the Federal Reserve continues the cycle of interest-rate cuts that began in September 2007. Large -cap companies will fare the best in the first half of the year as investors flock to them over small-cap companies in times of uncertainty. Also, look to enter selected financial stocks as they find a bottom and begin the long climb up.

Global Economy

According to the McKinsey Global Institute, from 2005 to 2010 alone worldwide financial wealth will soar from $118 trillion to more than $200 trillion - with the newly capitalist markets of Asia and Europe accounting for the biggest portions of that increase. Right now, the U.S. economy and that of Asia each account for about 28% of the global economy. But over the next 25 years, the United States will see its share of the global economic pie slip from the current 28% down to 24%. At the same time, however, Asia's share will almost double - to 55% of the worldwide economy. And as its size grows, so will its political and financial influence.

According to a recent survey, economists currently forecast that U.S. gross domestic product (GDP) will grow about 2.4% in 2008, roughly equal to the growth rate in 2007. The U.S. economy is expected to slow in the fourth quarter of 2007 (primarily reflecting the ongoing housing recession and tightened lending standards), but activity is expected to recover and accelerate by the end of 2008. As shown below, most other regions and countries are at an earlier stage in their economic cycle, and they are generally expected to slow throughout the coming year. The Asia-Pacific region will probably remain the world's most dynamic economic area, followed by Eastern Europe and Latin America. In all regions, however, activity is expected to slow in response to elevated energy prices, high interest rates, strong currencies and weaker demand from the United States.

| GDP Growth Rates (%) | |||

| Selected Countries and Regions | |||

| Region/Country | 2006 | 2007 | 2008 |

| Asia-Pacific | 7.8 | 7.9 | 7.2 |

| Japan | 2.2 | 2.0 | 1.7 |

| Australia | 2.7 | 4.4 | 3.8 |

| Taiwan | 4.7 | 4.1 | 3.8 |

| Hong Kong | 6.9 | 5.7 | 4.7 |

| Korea | 5.0 | 4.8 | 4.6 |

| China | 11.1 | 11.5 | 10.0 |

| India | 9.7 | 8.9 | 8.4 |

| European Union | 3.2 | 3.0 | 2.5 |

| Germany | 2.9 | 2.4 | 2.0 |

| France | 2.0 | 1.9 | 2.0 |

| United Kingdom | 2.8 | 3.1 | 2.3 |

| Hungary | 3.9 | 2.1 | 2.7 |

| Czech Republic | 6.4 | 5.6 | 4.6 |

| Poland | 6.1 | 6.6 | 5.3 |

| Americas (Ex-U.S.) | 4.9 | 4.5 | 3.9 |

| Canada | 2.8 | 2.5 | 2.3 |

| Mexico | 4.8 | 2.9 | 3.0 |

| Brazil | 3.7 | 4.4 | 4.0 |

| Argentina | 8.5 | 7.5 | 5.5 |

| United States | 2.9 | 1.9 | 1.9 |

| World | 5.4 | 5.2 | 4.8 |

Source: International Monetary Fund, October 2007 |

|||

Prior to the recent turbulence in financial markets, the global economy has been expanding vigorously, with growth exceeding 5% for the first half of 2007, according to the World Economic Outlook from the International Monetary Fund (IMF) (October 2007). Significantly, the emerging markets, in particular China, India and Russia, were the key drivers. First half 2007 GDP growth numbers hit an impressive 11½% for china and 8% for Russia. Including India, these three countries alone accounted for one-half of global growth over the past year. This robust growth counterbalanced continued moderate economic expansion in the U.S. of around 2¼% in the first half of 2007 (IMF World Economic Outlook, October 2007). Indeed, growth in the developed markets of the Europe and Japan also slowed in the second half of 2007, having experienced two strong previous quarters of growth.

Looking into 2008 the IMF estimates global growth will continue into 2008 although slowing from an estimated 5.2% in 2007 to approximately 4.8% in 2008 (and down from the 2006 figure of 5.4%). With developed markets' growth moderating further, they estimate emerging market economies will remain as the primary source of world economic growth.

China's middle class is 100 million strong and is expected to double in size by 2010. Chinese consumers are well educated, have good jobs and have cash they will spend. Consumer spending in China is projected to reach $2.3 trillion this year, compared to the much-larger U.S. economy, which is $13 trillion in size. Consumer staples are a growing commodity as are such consumer items as Nike athletic shoes, jewelry, iPods and iPhones, GPS devices for cars, and all sorts of gadgets. Retail sales in China rose by 18% in October, and will rise by an average of 16% for all of 2007. Speaking of Nike, their growth from the U.S. is essentially zero while in china it is achieving 20% year over year.

It is estimated that more than 270 million Chinese have risen above the absolute poverty line in recent years. In China as in other emerging countries this growth is driving demand for infrastructure and energy. Also, it will increase the per capita income allowing people to eat better driving the demand for grains, meat and the products necessary to grow them such as seeds and fertilizer.

There is a concern expressed by several analysts that China's growth will slow dramatically after the 2008 Summer Olympics. Certainly there will be less spending after the Olympics, however, the Chinese government expects to build and expand its cities to accommodate the growing urbanization in the country. For example, they intend to build up to 30 new airports and more new cities of over one million people that currently exist in the United States. This will require significant new materials to provide the infrastructure, energy to power the buildings and transportation systems, and equipment to build all the new facilities. Much of this will come from outside of China as they spend their large holdings of foreign currency.

The emerging countries with substantial excess financial assets will look for places to invest them, seeking the best value for their money. We are already seeing this take place as several U.S. based financial institutions have received multi-billion dollar infusions of capital from the Middle East and Asian countries. This will continue and should further strengthen the global economy.

In summary the global economy will continue to grow though at a slower pace. Companies that offer infrastructure, goods and services that are in demand by these countries will benefit. Oil prices are likely to remain high due the growing demand. Coal will also continue to be necessary as China builds new power plants to provide the growing demand for electricity. Iron Ore and other building materials will continue to be in demand as long as this growth in infrastructure keeps going. Industrial companies that provide the necessary equipment and services that are in demand should do well. So will consumer companies that provide the products we take for granted but are new to many people. This includes soft drinks, fast food, consumer staples and electronic devices such as cell phones and computers. As people become better off financially they will eat better which includes meat and higher priced food items. This will increase the demand for farming related products such as seed, fertilizer and tractors. However this might run into a problem should the price of many of these products rise due to the demand for alternative fuels.

Sector Plays

In 2008 Energy will continue to be a good sector as will Materials, each driven by global demand. Technology will follow along, especially in the alter part of the year. Consumer Discretionary will find difficult going in the first half of 2008 and then begin to pick up. Utilities will remain stable throughout the year, though the will be negatively affected by the potential for higher taxes on dividends. Financials will continue to suffer in the first half of 2008 and then do well as the year moves on, likely becoming the best performer of the year. Consumer Staples will do well in the first half of 2008 as the U.S. economy weakens. Companies with significant international exposure such as Coca-Cola will continue to benefit from global growth. Much of Healthcare will lag as worries about future legislation drag on the industry, though selected companies with strong franchises and solid growth prospects should continue to do well. Industrials with significant international exposure will do well

Readers interested in learning more about Sector investing should read Sector Investing, 1996 ![]() by Sam Stovell. It discusses how to use sector rotation in your investing endeavors. An expensive book, but worthwhile for those interested in using sector rotation strategies to improve the performance of their portfolios.

by Sam Stovell. It discusses how to use sector rotation in your investing endeavors. An expensive book, but worthwhile for those interested in using sector rotation strategies to improve the performance of their portfolios.

Look for the next edition where I will review in more detail my prospects for the Energy and Financial Sectors. The remaining sectors will be covered in Parts Three, Four and Five.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.