Of U.S. Jobs, Debts and Budgets

Economics / US Economy Feb 10, 2012 - 09:06 AM GMTBy: Richard_Mills

Consumer confidence spiked last December. Gas prices were lower for the third straight month, a mild early winter meant that many consumers paid less to heat their houses, the auto sector posted another strong month, consumers spent more on recreation and demand for student loans increased.

Consumer confidence spiked last December. Gas prices were lower for the third straight month, a mild early winter meant that many consumers paid less to heat their houses, the auto sector posted another strong month, consumers spent more on recreation and demand for student loans increased.

Consumers seemed inclined to spend and get deeper into debt.

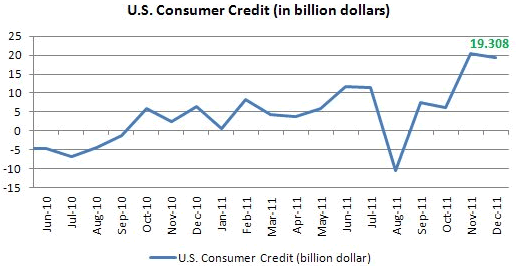

November 2011 was a bad month for consumers: evolving debt went up more than eight percent (the largest month-to-month percentage increase since 2008) and this dubious accomplishment was accompanied by the biggest month to month growth in overall consumer debt since 2001. December's consumer credit debt increased $19.3 billion to $2.5 trillion. This rise in credit card debt was the fourth month in a row card balances grew.

U.S. Consumer Credit: June 2010 to Present Trang Nguyen www.dailyfx.com

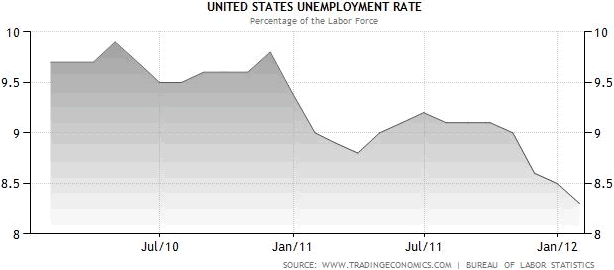

"In a long-awaited surge of hiring, companies added 243,000 jobs in January - across the economy, up and down the pay scale and far more than just about anyone expected. Unemployment fell to 8.3 percent, the lowest in three years. At the same time, the proportion of the population working or looking for work is its lowest in almost three decades." Christopher S. Rugaber, AP Economics Writer

Why did consumers start taking on more debt since August 11th 2011? Was it because an improving job market is giving people the courage to take on more debt?

Maybe the increasing dependence on borrowing is an indication consumers are relying on their credit cards to make ends meet? There were almost four unemployed Americans vying for each job vacancy in December, year over year (yoy) January's hourly wage increase was only 1.9 percent - the smallest yoy gain since April 2011. Production workers fared worse, their 1.5 percent increase was the smallest on record going back to 1965. Food cost more in December, so did medical care.

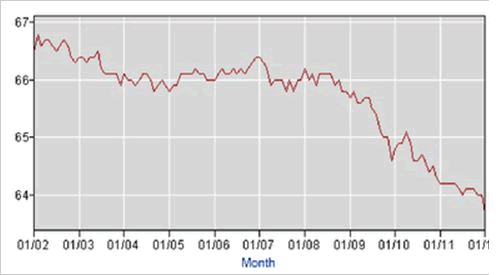

The Labor Force Participation Rate (LFPR) is a key economic statistic and it just hit a new record low.

"The plain fact is that we are warehousing a larger and larger population of adults who are one way or another living off transfer payments, relatives, sub-prime credit, and the black market. My suspicion is that this negative trend and many others like it get buried by the monthly change chatter from mainstream economists and on bubble vision, and that these monthly deltas are so heavily manipulated as to be almost a made-up reality. Call it the economists' Truman Show." David Stockman, Former Reagan budget director talking about the BLS jobs reports

Consumers aren't the only ones going into debt at record rates.

US debt increased by $1 trillion in 2008, $1.9 trillion in 2009, and $1.7 trillion in 2010. As of August 3, 2011, the country's debt was $14.33 trillion dollars.

The federal government recorded a budget deficit of $349 billion through the first four months of fiscal 2012. The Congressional Budget Office (CBO) said it expects the fiscal 2012 deficit to narrow to $1.1 trillion from $1.3 trillion in fiscal 2011. Deficits are the difference between revenue and expenditures, every time the US deficit is above zero - expenditures are greater than revenue - money must be borrowed and the debt is increased.

Below is today's debt breakdown:

United States National Debt: $15,348,967,446,234.75 United States National Debt Per Person: $49,015.94 United States National Debt Per Household: $126,951.29 Total US Unfunded Liabilities: $123,260,918,052,258.50 Total US Unfunded Liabilities Per Person: $393,625.84 Total US Unfunded Liabilities Per Household: $1,019,490.95

Late in 2011 the world's population reached 7,000,000,000 people. That means the US debt would take $2,192.70 dollars out of each and every persons pocket to pay off.

The CBO has estimated the US deficit will reach $1.5 trillion by 2022. US debt has increased, just since August 2011, by over one trillion dollars.

Conclusion

Lawrence Summers, the former Treasury secretary under Bill Clinton and President Barack Obama's former top economic adviser says the U.S. is not only in the midst of a debt crisis, but also a jobs crisis and that the US needs to take advantage of low interest rates to finance a massive infrastructure retrofit and build program to put people back to work - cutting spending is not the answer.

John Taylor, Taylor Rule discoverer says "We could get into a situation like Greece, quite frankly. People have to realize it is a precarious situation. The debt is going to explode if we don't make some changes. What seems to be more important is that people can get back on track, the country can get back on track, with just some sensible adjustments. I argue just bring spending back to where it was in 2007. That's not so long ago. We've had an enormous spending binge in the last few years. If we undo that binge, shouldn't be that hard, we can get back to some sensible pro-growth policies."

Carmen Reinhart and Kenneth Rogoff co-authors of "This Time is Different: Eight Centuries of Financial Folly" are sceptical of any fix and think we should get use to present conditions because nothing is going to change for the good anytime soon.

President Obama's budget for fiscal year 2012 would have increased the country's debt by nine trillion over ten years - even Democrats rejected it. Obama will deliver his budget this Monday, last year he claimed one trillion dollars in deficit reductions from winding down the wars in Afghanistan and Iraq but that money hadn't even been approved.

The truth regarding the true status of US employment, debt and budget chicanery should be on everyone's radar screen. Is it on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.