Brazil Stock Market Looks Like A Buying Opportunity Again

Stock-Markets / Brazil Jan 14, 2012 - 07:06 AM GMTBy: Sy_Harding

Brazil continues to impress as a country and economy, due in no small way to its government’s multi-year efforts and determination to make it an important global presence.

Brazil continues to impress as a country and economy, due in no small way to its government’s multi-year efforts and determination to make it an important global presence.

Brazil is the fifth largest country in the world by geographical area and population (190 million), and now has the sixth largest economy, having surpassed the United Kingdom last year.

It’s long been known for its dirt-poor city slums, which are appalling. But its booming economy of recent years has increased the purchasing power of its population and moved an estimated 20 million out of poverty, with the majority of the population now in the middle class for the first time ever.

The increasing purchasing power of its population, and pent-up demand for goods, is an important factor in its solid economy and relative protection from the woes of the world.

The country is blessed with an abundance of natural resources, including huge and growing reserves of oil and gas, is the world’s largest producer of sugarcane, coffee, and tropical fruit, and has the largest commercial cattle herd.

Yet exports account for only 14% of its economy, which should leave it less affected by threatening economic slowdowns in Asia and Europe.

Manufacturing, including automobiles, steel, petrochemicals, computers, aircraft and consumer durables, account for 31% of GDP. Agriculture, construction, and services, including healthcare, banking, insurance, retailing, etc., account for the rest.

Over the years Brazil’s government has undertaken several timely measures that are probably the envy of many global central banks. Among them, the Brazilian government strived to pay off debts before the credit crisis hit.

Although its stock market plunged with the rest of the world in 2008, Brazil’s economy experienced solid performance during the global financial crisis and a strong and early recovery. The result was that in 2010, while Europe and the U.S. were just beginning to anemically recover from the ‘Great Recession’, Brazil’s economy was already over-heated, humming along at 7.5% growth. Taking quick action, Brazil’s government began aggressive measures, including raising interest rates, to slow the growth to a more sustainable level, and did so, with economists expecting its GDP growth slowed to 3% or so in 2011.

Now with global concerns about a possible recession in Europe that might spread out into Asia and even the U.S., the government of Brazil, unlike those of Europe and the U.S. where interest rates are already at record lows, is in a position of being able to cut interest rates and loosen policies to further stimulate its economy.

It began those policy reversals in August, and Brazil’s economy is forecast to continue to grow at roughly a 3% rate this year and in 2013.

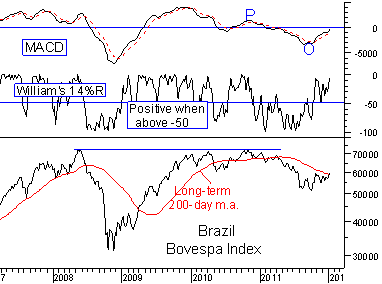

Meanwhile, Brazil’s stock market plunged into another bear market in 2010 when its government began those tightening measures to slow its over-heated economy. The Bovespa Index declined 45% to its early October low. It began rallying strongly off that low, triggering a buy signal on our momentum reversal indicators, and we believe Brazil’s economic growth prospects support the buy signal. Brazil should be in a better position to continue its long-term economic growth than most other countries, and is not likely to be affected as much by the eurozone debt crisis, or a possible recession in Europe, which would be a larger problem for countries with economies more dependent on exports.

The International Monetary Fund estimates that Brazil, having passed the United Kingdom last year to become the world’s sixth largest economy, will next pass France, the world’s fifth largest economy, by 2015. It could happen even sooner.

We believe Brazil is again presenting a buying opportunity, and we like the iShares Brazil ETF, symbol EWZ.

In the interest of full disclosure, I and my subscribers already have positions in EWZ.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2012 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.