Distressed Properties Continue to Hold Down U.S. House Prices

Housing-Market / US Housing Jan 11, 2012 - 04:57 AM GMTBy: Asha_Bangalore

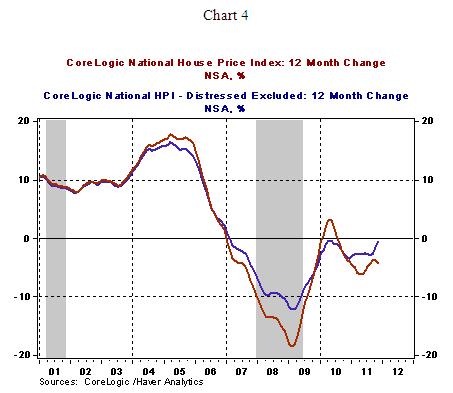

The CoreLogic Home Price Index inclusive of distressed properties (foreclosures and short sales) fell 4.3% from a year ago after showing a decelerating trend in the three months ended October. Excluding distressed properties, the CoreLogic Home Prices fell only 0.6% from a year ago and it shows of stabilizing (see Chart 4).

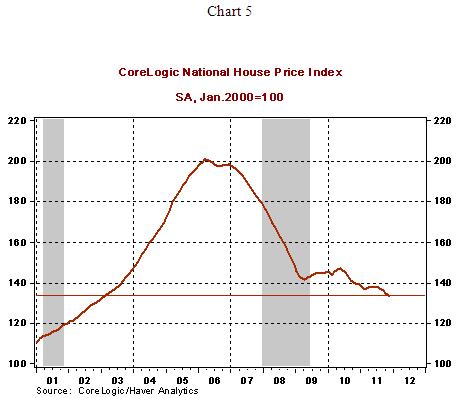

The excess supply of homes, partly from distressed properties, is the major factor leading to a sustained drop in home prices. The CoreLogic Home Price Index is down 34% from its peak in March of 2006 (see Chart 5). The large reduction in home prices has reduced household wealth substantially and "weakened household spending." The Fed in a wide ranging paper addressed to lawmakers offers ways to reduce the housing market problems. The Fed proposes large scale purchases of foreclosed properties, mortgage reductions and less restrictive refinancing for mortgages underwater. The Fed succinctly concludes in this paper that "restoring the health of the housing market is a necessary part of a broader strategy for economic recovery."

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.