An Options Strategy That Will Save You Some Money

Companies / Options & Warrants Jan 10, 2012 - 12:24 PM GMTBy: Money_Morning

Larry D. Spears writes:

Whether you credit a Santa Claus rally, an early January Effect, or some other driving market force, there's no disputing the strong finish posted by stocks in 2011 - or the healthy 2012 opening advance added in the first week of January.

Larry D. Spears writes:

Whether you credit a Santa Claus rally, an early January Effect, or some other driving market force, there's no disputing the strong finish posted by stocks in 2011 - or the healthy 2012 opening advance added in the first week of January.

To be specific, stocks - as measured by the Standard & Poor's 500 Index - rose from 1,204.00 at the close on Monday, Dec. 19, to 1,257.60 on Friday, Dec. 30, then jumped to 1,280.15 at midday yesterday (Monday), a gain of 6.32% in just three weeks. The Dow Jones Industrial Average did almost as well, climbing from 11,751.96 on Dec. 19 to 12,398.29 in Monday trading, a 21-day gain of 5.50%.

While those short-term moves are certainly impressive, they're hardly unique in today's volatile market environment. Three similar advances have occurred in the past five months alone - in late August, early October and late November - but each was followed by a sharp short-term pullback that wiped out much of the value gained in the rallies.

And, while few things in the market are certain, there's a strong probability this current market advance will also be followed by a sizeable retracement in the very near future.

So, how do you protect your most recent gains?

One answer is to turn to the options market.

A Defensive Options Play

As veteran Money Morning readers know, two of the most effective and often-used strategies involving options are writing covered calls to bring in added income and buying put options as "insurance" against possible price pullbacks.

As such, investors would typically look to the latter strategy - buying puts - for protection in the present market situation. However, there are times when unusual conditions can force investors to take an alternative approach to option strategies - and that has certainly been the case recently, thanks to the market's extreme short-term volatility.

To illustrate, let's look back to the last big short-term advance in late November and early December. From Friday, Nov. 25, to the close on Wednesday, Dec. 7, the Dow climbed from 11,231.78 to 12,196.37, a gain of 8.58%, while the S&P 500 rallied from 1158.67 to 1261.01, an 8.83% advance.

After a move of that size, another short-term downturn was almost inevitable - especially given the likelihood of year-end tax selling. That sent many investors in search of protection for their stock holdings, which would normally have meant purchasing at-the-money put options on their shares - put options that would gain in price on any market retreat, providing profits to offset their short-term losses on the underlying stocks.

But, because of the market's sharp increase in volatility over the past year, premiums on stock options have risen to historic levels - and that makes purchasing puts for protection a very pricey proposition. As an example, look at the situation with Caterpillar Inc. (NYSE: CAT).

At the close on Nov. 30, CAT stood at $97.88 a share - the stock having climbed all the way from $86.72 on Nov. 25. Obviously, that gain of $11.16 in under a week was worth protecting - but the volatility had pushed the price of the at-the-money December 97.50 put option to $3.70, or $370 for a full 100-share option contract.

That meant the price of Caterpillar's stock would have to fall to $93.80 a share (the $97.50 strike price minus the $3.70 premium = $93.80) before the "insurance" protection would begin to pay off - and it would have to do so in just 12 trading days since the December options expired on Friday, Dec. 16.

What's more, since options can't be purchased on "margin," you would have had to put up the full $370 for each 100 shares of Caterpillar stock you wanted to protect - i.e., if you owned 300 shares, you'd have had to put up $1,110 in out-of-pocket cash to buy three puts. And, if the market didn't reverse, you could lose it all.

Even in these days when 300-point Dow drops are commonplace, that's not a particularly attractive proposition. Fortunately, for times when you're expecting only a short-term downward swing, there's a better alternative - writing call options on your stock.

As already noted, selling covered calls is normally a longer-term income-producing strategy - one in which you sell one out-of-the-money call for each 100 shares of an underlying stock you own. (Note: There's no added margin requirement or out-of-pocket cost since the stock you own "covers" the call you sell.)

If the stock fails to rise to the call's strike price by expiration, you get to retain ownership of the shares and also keep the premium you receive. If the stock does rise above the strike price, you either have to buy the call back - which you can often still do at a profit - or you have to sell the stock at the strike price, garnering a small gain on the shares.

However, you can also sell covered calls as a defensive strategy - though the positioning is slightly different. Specifically, rather than writing an out-of-the-money call, you'd write one with an at-the-money or slightly in-the-money strike price.

To illustrate, let's again look at Caterpillar. As noted, CAT stock was trading at $97.88 a share late in the day on Nov. 30, but a correction seemed probable in the first few days of December given the hefty gain in both the overall market and Caterpillar share prices. Finding the price of the December 97.50 put too high to offer really affordable protection, you decide to instead sell the at-the-money December 97.50 call, which was trading around $3.90, or $390 for the full option.

That call had just 12 trading days of life left, and you'd get to keep the entire $390 if Caterpillar closed below $97.50 a share at expiration - offsetting any loss you'd suffer on a drop in CAT's share price down to $93.98 ($97.88 - $3.90 = $93.98).

As it turned out, both Caterpillar and the market as a whole traded flat for a few days, then took a hit the following week. The Dow fell 372.89 by the close on Wednesday, Dec. 14, retracing 38.6% of its late-November advance, while the S&P 500 lost 49.19 points, a 48.0% retracement.

CAT dropped all the way to $87.00, giving up $10.88 a share.

As a result, you could have repurchased the 97.50 calls you sold on Nov. 30 for just 10 cents, or $10 for the full contract. That would have given you a profit of $3.80 on each call to offset part of the loss on the stock. (Note: As an alternative, you could have held the position for two more days and let the options expire worthless. In most instances, however, with the calls having almost no value left, the decision to repurchase should be essentially automatic as the risk of holding far outweighs the potential reward.)

By contrast, the 97.50 put you could have purchased for $3.70 on Nov. 30 rose to $10.60 at the close on Dec. 14, giving you a profit of $6.90 to offset the loss on the stock. In this case, that would have been the better deal - but had your timing been just slightly off, you could have given back all of the gain as CAT rallied back near $95 the following week. And, again, you would have had to pay $390 out of pocket to buy the put in the first place, whereas you had no added cost for the call.

The following table illustrates the full scenarios for both selling the CAT call and buying the CAT put:

Play Even More Effective on Smaller Moves

Selling the near-term at- or slightly in-the-money call provides an even more effective short-term hedge if the underlying stock makes a smaller move.

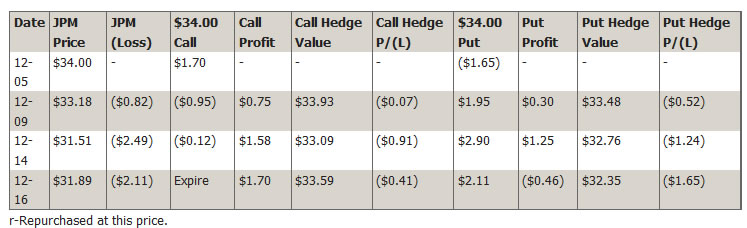

For example, consider the same situation with JP Morgan Chase & Co. (NYSE: JPM), which had rallied from a low of $28.38 on Nov. 23 to $34.00 near the close on Dec. 5. Anticipating a near-term pullback, an investor could have either bought the December 34 put, priced at $1.65 near the close on Dec. 5, or sold the December 34 call, bringing in a premium of around $1.70.

The following table illustrates what would have happened in each case, given JPM's subsequent drop to $31.51 - a loss on the stock of $2.49 a share - on Dec. 14:

Obviously, the 41-cent loss on the call hedge is far preferable to the $2.49-a-share loss on the stock alone -- especially when you consider that the $1.70 received for the hedging call turned to pure profit when JPM rebounded again the following week.

In short, in times of high volatility, selling a covered call frequently proves far more effective for hedging a steep short-term drop than buying a protective put.

Not only do you get to capture the rich option time premium, but it's much easier to recognize when to repurchase a near-worthless call than to determine when to cash in a deep in-the-money put. Plus, you don't have to invest any more actual cash, as is required when you buy a protective put.

If you feel like trying this strategy, both of these stocks are once again positioned nicely for such a play:

•Caterpillar rallied to $97.01 a share shortly before the close on Monday (up from $87.20 on Dec. 16), and the January 95 call, with just nine days of life left, was quoted at $2.90 - meaning you'd bring in $290 for each call sold, as well as getting pullback protection on your stock down to $94.11.

•J.P. Morgan stood at $35.35 late Monday (up from $31.29 on Dec. 13), and the January 35 call was priced at $1.05 - meaning selling the call, again with nine days of life left, would bring in $105 per 100 shares, and give you price protection down to $34.30.

If you don't own either of these stocks, apply this strategy to ones you do as this year's January Effect rally comes to an end.

Then, in the future, whenever you feel the market - or a particular stock you own - is due for a quick drop, consider selling a covered at- or slightly in-the-money call rather than automatically rushing to buy a put as insurance.

Source :Source :http://moneymorning.com/2012/01/10/an-options-strategy-that-will-save-you-some-money/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.