Gold And Silver Seasonal Trends

Commodities / Gold and Silver 2011 Dec 16, 2011 - 06:05 AM GMT For market insights many investors focus on the “historical/backward” looking news but fail to realize other exceptionally powerful forces that are also at work; such as “Seasonal Trends”. We believe there is some validity to paying attention to the News events that can impact ones investments; however seasonal factors may provide a simpler and more reliable market insight.

For market insights many investors focus on the “historical/backward” looking news but fail to realize other exceptionally powerful forces that are also at work; such as “Seasonal Trends”. We believe there is some validity to paying attention to the News events that can impact ones investments; however seasonal factors may provide a simpler and more reliable market insight.

To keep things simple we will first display a few charts and then discuss what they may be indicating:

When we look at the red line in the above chart we can see that the price of silver usually performs strongly from about November to April. Around this time of year we typically see the price of silver pushing higher and higher with relatively small corrections.

In this gold chart we can see a similar result to silver. In the typically strong month of November we are seeing gold price performance that is “weak” instead of “strong”. This summer (not shown in the chart above) when one would expect the price of gold to correct, it remained very strong and it really didn’t have any kind of a “pull back” until September.

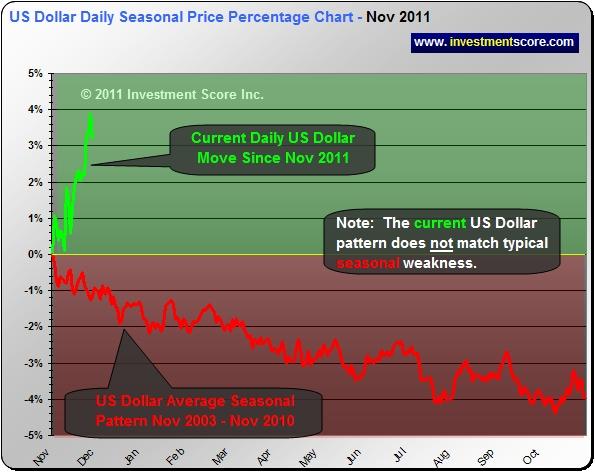

Here we see the US Dollar illustrating unusual price strength instead of typical seasonal weakness. Because precious metals and other markets are “priced” in US dollars, when the US dollar heads up, the” price” of the asset it is measuring tends to fall.

So what does all of this mean? To be clear we are extremely bullish on the price of silver and gold in the big picture. We believe that both silver and gold will eventually advance into a full fledged bubble market that will surpass most investor’s wildest dreams. However, in the short term unusual market action is usually a “warning sign” more than it is a “green light” to load up on new positions. Although we believe seasonal trends are a very powerful force and the metals may very well be higher in February than they are here in November, the unusual price action does raise the caution flags that perhaps something a little different is brewing this year. It has been a long time since silver, gold and commodities in general have had a very meaningful correction. There are a lot of warning signs in the markets these days and at this time it may make sense to proceed with caution.

Ultimately we expect to make our largest profits from the huge macro moves in the markets. At investmentscore.com we try to identify long term macro trends such as the current silver bull market, identify intermediate term entry points and watch for our ultimate exit point. We not only want to identify and profit from the coming bubble market, we also want to keep our profits for the next low risk opportunity. To read more free commentaries or to sign up for our free or paid newsletter please visit us a www.investmentscore.com.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.