ETF and Central Bank Gold Lent to Banks Being Relent Into Market?

Commodities / Gold and Silver 2011 Dec 12, 2011 - 10:26 AM GMTBy: GoldCore

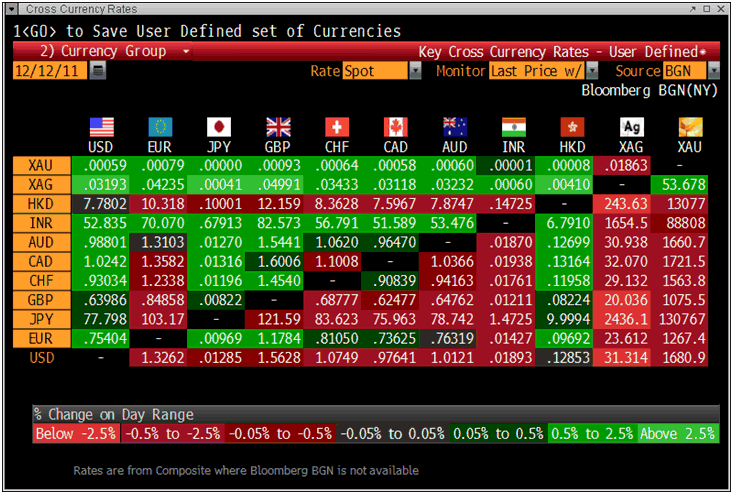

Gold is trading at USD 1,680.90, EUR 1,267.70, GBP 1,075.30, CHF 1,564.40, JPY 130,750 and AUD 1,659.0 per ounce.

Gold is trading at USD 1,680.90, EUR 1,267.70, GBP 1,075.30, CHF 1,564.40, JPY 130,750 and AUD 1,659.0 per ounce.

Gold’s London AM fix this morning was USD 1,680.00, GBP 1,077.06, and EUR 1,266.49 per ounce.

Friday's AM fix was USD 1,712.00, GBP 1,094.49, and EUR 1,281.34 per ounce.

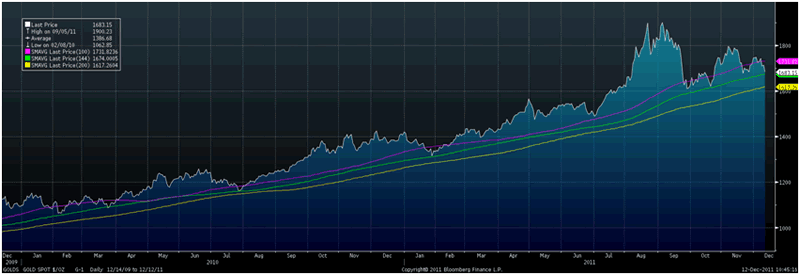

Gold in USD – 2 Yrs (100, 144, 200 DMA)

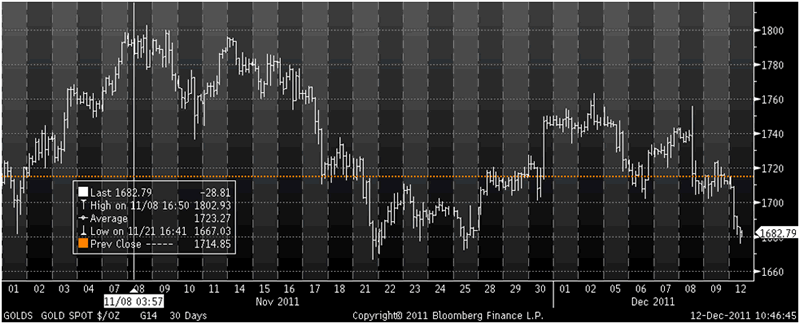

Gold was steady in trade in Asia until 0322 GMT when sharp selling saw gold fall 1.3% from $1,708/oz to $1,684.75/oz in minutes. The fall may have been technical in nature after last week’s 2% fall in US dollar terms. The selling had the hallmarks of a large sell order or liquidation and Reuters reports that “the approaching year-end and funding difficulties caused by financial market turmoil have reduced liquidity in the gold market.”

Market reaction to the failed EU Summit was that gold, the euro, European equities and ‘PIGS’ debt all came under selling pressure this morning.

Gold is again testing support at the 144 day moving average at $1,674/oz. Below that is the major support of $1,617.25/oz (see chart above).

Gold Spot $/oz (30 days)

With concerns about liquidity and solvency in the European banking system, there is lending and possibly even selling of gold by banks to raise much needed cash. This may be creating short term weakness in gold bit is bullish for gold in the long term.

The FT reported last week that “gold dealers” said that banks – “primarily based in France and Italy – had been actively lending gold in the market in exchange for dollars.”

The key question is who is lending and is their lending simply liquidity driven - to raise dollars or euros?

John Dizard, who frequently comments on gold in the Financial Times wrote on Saturday that,

“Gold market people say European commercial banks are being driven to lend gold for dollars at negative interest rates just to raise some extra cash for a few weeks.

There’s not a lot of transparency about where the banks are getting the gold they are lending out, but it could be lent to them by either their national central banks, or by gold exchange traded funds.”

Cross Currency Table

If this is the case it will raise further concerns about the possibility of double accounting of gold and concerns that much of the gold investments in the market are in fact ‘paper gold’ and not backed by physical as is believed by investors.

It will add to deepening concerns about the emerging scandal of rehypothecation where some banks, brokerages and dealers have been reusing the collateral pledged by its clients as collateral for their own borrowing.

Owners of gold exchange traded funds (ETFs) would be surprised and worried to discover that certain banks might be lending out gold that they have bought and believe that they own.

The leading gold ETF, GLD has been criticized by many analysts for its extremely complex structure and prospectus. Critics have also pointed out the possible conflict of interest in its relationships with HSBC and JPMorgan Chase which are believed to have large short positions in gold and overall lack of transparency.

If as has been suggested, European banks are lending gold into the market that has come from exchange traded funds then this would validate the many concerns raised about the gold ETF market. Questions would again be asked as to whether many of the ETFs are fully backed by the gold that they claim to own in trust on behalf of clients.

Already some hedge funds managers and investors have liquidated their ETF positions in favour of allocated physical bullion and we would expect that trend to accelerate as prudent investors rightly seek to avoid counter party and systemic risk.

OTHER NEWS

● The flow of gold from Hong Kong to mainland China rose 51 pct in October to a record 85.7T, bringing the total amount of gold shipped for the year to October to 286.6T. (Reuters)

● Economist Dennis Gartman said he’s “being taken out of the remainder” of his gold position and investors should not own the metal priced in euros. Gartman had previously owned bullion priced in euros “Those not already out of the gold side of this trade should be out immediately,” he said today in his daily Gartman Letter. (Bloomberg)

● Gold could hit $2,500 if Euro fails in what would be a ‘horror story’ said Citigroup in a note. The Euro failing is a “low probability” event. Citigroup emphasizes it’s not forecasting $2,500/oz, though it says this could occur were the Euro to collapse. (Bloomberg)

● Gold’s premium to platinum may widen in months ahead, UBS Says. Gold’s premium to platinum “has room for further widening over the next few months,” Edel Tully, an analyst at UBS AG, wrote today in a report. The premium was at 12.4 percent today, Bloomberg data show. (Bloomberg)

SILVER

Silver is trading at $31.13/oz, €23.51/oz and £19.93/oz

PLATINUM GROUP METALS

Platinum is trading at $1,483.75/oz, palladium at $662.75/oz and rhodium at $1,450/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.