The Catfish, Your Savings and Japan's Gold Coin Giveaway

Commodities / Gold and Silver 2011 Dec 08, 2011 - 02:45 AM GMTBy: Adrian_Ash

Don't be greedy, or a giant catfish might force you to spew out your savings...

Don't be greedy, or a giant catfish might force you to spew out your savings...

UNLIKE us – who are so smart today – ancient folk in ancient times used to believe the oddest things about how the world worked.

The Japanese, for instance, long thought that earthquakes were caused by a giant catfish, shuffling and shifting whenever the great god of Kashima forgot to keep his foot on a heavy stone which held the beast down, deep beneath the coast of Honshu. Honoring the Kashima shrine, some 80 miles north-east of what was then Edo (modern-day Tokyo) was therefore a good idea. Because tectonic upheaval, causing death and destruction, was a sign that the god was neglecting his duty.

November 1855 saw Kashima skip town, or so legend soon had it, leaving the god of fishing in charge of the stone and the catfish. What a mistake! The Great Ansei Earthquake killed 7,000 people at a stroke, and many more in the days and weeks after.

But it wasn't all bad...

"Don't be greedy!" one of the laborers urges his mates in this popular print, Mr.Moneybags launches forth his ship of treasure. "You'll regret it if you save this money and an earthquake comes.

"Don't be greedy!" one of the laborers urges his mates in this popular print, Mr.Moneybags launches forth his ship of treasure. "You'll regret it if you save this money and an earthquake comes.

"Better go and spend it at the brothels and keep it circulating."

The Kashima shrine itself was damaged in March 2011's catastrophe. But the poor idiots of old-time Japan would still find a silver lining. Although some of the hundreds of namazu-e (catfish pictures) from 19th-century Japan show the beast captured and beaten – or even committing hare-kiri to say sorry – he also became a folk hero to laborers and shopkeepers, because he forced the wealthy to spend money on repairs and rebuilding.

Think of it as a divine take on Bastiat's "broken windows" parable. Knocking things down is good for society (or so society says), since the glazier is paid and then spends that money in turn. Earthquakes are great for production, because they force cash out of locked chests into the pockets of carpenters, plasterers, bricklayers and masons – just the right type to keep it circulating again.

"For Edo residents," one scholar explains, "the earthquake of 1855 was an act of yonaoshi, or 'world rectification'." In print after print, catfish shake or squeeze wealthy old hoarders who vomit or shit out gold coins, quickly scooped up by dancing laborers eager to spend it on booze, noodles and trips to what's now known as Soap Land.

"Like typhoon-season floods and dry-season fires," notes another 2011 look back, "earthquakes and tsunamis were understood as corrections of temporary imbalances in the vital force perpetually flowing through the world (known in Japanese as ki and in Chinese as qi). Periodic eruptions of natural violence released pent-up force and kept both nature and human society healthy by renewing them...Confucian philosophers as well as ordinary people believed that the economy followed the same principles. Just as ki flowed continuously in nature, money should be kept moving in the economy too, not allowed to stagnate and foster greed. For this reason, many people viewed capital accumulation distrustfully. Nature, they believed, censured it."

Could anyone hold such a medieval view of economics today? Not outside a central bank or university, you might think. But greed is central to our depression's mythology. From there, the attack on capital accumulation can't be far off. And it's ironic that to help keep money moving after the terrible earthquake and tsunami which hit Honshu this spring, Tokyo is now offering gold coins to investors buying its reconstruction financing bonds. On the minimum ¥10 million investment ($150,000) needed to qualify, however, Japan's reconstruction bonds pay 0.05% per year without the coin, and a barely less miserly 0.3% with it if gold stays at today's prices by the end of 2014. So the net effect is still to shake down Mr.Moneybags – otherwise known as Japan's diligent household savers today.

Anyone calling this special half-ounce commemorative gold coin an "incentive" might sound like they need to raise money themselves to buy a calculator. But it's not the first promotional effort tied to Japanese government bonds. Word reaches us here at BullionVault that special flyers – posted by door-drop in Tokyo – have recently been advertising government debt straight through the mailbox. As for coupons and premia, the Nomura brokerage is already offering its retail clients free shopping vouchers if they buy JGBs and lend to the government, too.

"The wealth of the realm belongs to the realm," wrote Confucian scholar and advisor Yamaga Soko – who also developed the Samurai code of chivalry, bushido – in the mid-17th century. "It is not the wealth of a single person. Well should it circulate."

Now compare and contrast French politician and essayist Claude Frédéric Bastiat writing 200 years later. "What would become of the glaziers, if nobody ever broke windows?" he asked in his famous parable of 1850, paraphrasing the "vulgar" mob who applaud the shards of glass on the street. Yet it is the shopkeeper needing to get his window fixed, "the shoemaker (or some other tradesman), whose labour suffers proportionably by the same cause...who is always kept in the shade...who shows us how absurd it is to think we see a profit in an act of destruction." It is also the tradesman who stands for the capitalist, the diligent drudge minding his business. Shaken down like old Tokyo's Moneybags, he can only watch in horror as his money – his treasure – is launched forth to common approval.

Here in the early 21st century, Occupy Wall Street think they know just who to choke with a catfish. "Hey, Paulson, you can't hide, we can see your greedy side!" chanted the self-declared 99% at the hedge-fund manager in October, little caring that his fund has halved in value in 2011-to-date. The echo-chamber of TV news and financial blogs reckons the entire system is run by greedy bastards anyway. No doubt they're right, but even before the crisis blew up, Fed chairman Ben Bernanke long ago blamed Asia's savings glut for building imbalances in the global economy.

So how to shake cash from the hoarders? A Tobin tax on financial transactions looks a good start, even though retirement savers will end up paying, of course, as their pension-fund managers pass on the cost. Capping bank dividends only hurts savers again, because their income depends on such yields. Setting interest rates at zero aims to scare (or at least hurt) them for not spending money today. So too does printing more money, as Japan's modern-day Moneybags know only too well.

"Your key financial asset, your medium of exchange – money – is also a savings vehicle (a store of value) and a safe asset (a unit of account)," explains Berkeley professor Brad DeLong. So "if an excess demand for financial assets is seen to cause a collapse in production and employment" – especially money hoarded in money, rather than being spent on new windows and brothels – "then it would seem immediate and obvious that generating an excess supply of financial assets would cause a revival."

Immediate and obvious like a giant catfish making the rich puke gold coins, perhaps. Forcing a revival of spending by flooding the market with cash still hasn't worked in Japan, but it has led to door-drops and vouchers to try and find new loans for the State. And further to DeLong's proposal, our key financial asset and means of exchange is now something else, too: money is first and foremost a credit, held on deposit rather than hoarded in sock drawers at home. And being a credit, rather than tangible property, the vast bulk of money today is already out of the savers' control.

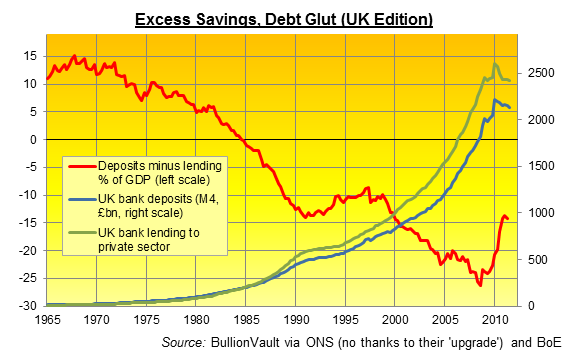

Today's Mr.Moneybags is by definition a lender. Indeed, his money's already been lent out with gusto. The old miser has no choice; cash on deposit is owed to him, he does not own anything inside the bank's vaults. On the bank's balance-sheet, his savings are deemed "liabilities", while on the other side of the ledger sit the banks' "assets" – the loans it has made, using Moneybags' cash. If the old miser (aka retiree or saver) withdraws all his cash, some debtor somewhere must repay their loan. And debt forgiveness is already being talked up – whether for governments in Europe or over-spent US consumers.

So blame greedy hoarders if you like. Just watch for the mob gathered round your broken windows, ready to choke you with a metaphorical catfish.By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.