Gold Tsunami on the Cusp of $3,000+?

Commodities / Gold and Silver 2012 Dec 08, 2011 - 02:21 AM GMTBy: GoldRunner

The Gold Tsunami analogy continues, and it goes like this……..

The Gold Tsunami analogy continues, and it goes like this……..

“The Dollar Inflation psychology pulled back out into the sea, taking the price of Gold with it.

Those of a deflation bent ran amok on the naked sea bed for a bit, acting like the Dollar Inflation and Gold Price run was over.

Suddenly, the new wave of paper currency inflation popped up on the horizon last week, and many Dow Stock ‘Crashers’ were mowed down with the early start of the tidal wave of Dollar Inflation and rise in Gold.

Many ran back to the shore and looked back to watch as the waters approach the shore, but the tidal wave of paper currency inflation is just starting its acceleration that might well propel Gold much higher into the middle of 2012 than practically anyone thinks.

Everybody can see the symmetrical triangle forming on the Gold chart, but few really believe the size of the move in Gold that is possible on this door step of the ‘Fractal Gold Cycle’ as seen in the late 70’s.”

The story of the developing gold tsunami will be remembered as the Paper Currency inflation gains speed and volume driving the price of Gold into the next more parabolic leg on the chart as the dollar devaluation accelerates in an attempt to deflate away the massive debts world-wide.

Early this year we suggested a 50% rise in Gold to $1860 - $1,920 into mid-year (see here). Now, we see the Gold tsunami will realizing an approximate 100% rise that will crest at $3,000+ into the middle of 2012, drowning any doubters in its wake. Below are a number of factors that support that view:

- Last week we saw a sudden sharp change in market psychology as a group of Central Banks announced that they would provide liquidity to Europe. The Fed announced that it would provide hundreds of billions of Dollars to the EU Central Bank in terms of low interest loans so the EU Central Bank could make loans to the European Banks. This really amounts to the Fed printing new Dollars - a huge new round of US Dollar Inflation is starting.

- This follows on the footsteps of the European Banks bundling up crappy assets into securitized bundles to present to the EU Central Bank as collateral for loans - sort of a “European Begging Bowl” move that smacks of what the Fed did back in the 2008 deflation scare for the US Banks. That Fed Begging Bowl ruse led to massive US Dollar Inflation as the Fed printed somewhere up to 7 trillion Dollars over time.

- Interestingly enough, one source claimed that the European Banks need about $7 trillion this time - approximately the same amount as the US Banks back in 2008. If so, the current reflation via paper currency inflation might well match what we saw back in late 2008/ early 2009. Any new program by the Fed would be additive, and it would dwarf that figure. This would be huge for Gold, for Silver, and for the PM Stocks; especially with Gold and the PM Stock Indices sitting at a high level with little chart resistance above.

- Gold appears to be deep in a triangle correction where we’d expect to see a break-out to the upside as a continuation of trend. The Dow made a sharp move higher last week as we saw what paper currency inflation can do to the markets in this environment. Many see this last week as the Fed precursor to the next round of aggressive, world-wide debt monetization.

- The US Banks wrote the credit default swaps for the European Debt, and thus are the counterparty should the Europeans default on those loans. In no way will that be allowed to happen.

- All of the above comes at a point in the cycle where Gold started a sharp momentum run higher in the late 70’s. The HUI and other PM Stock Indices have been tracing out a huge expanding triangle for some time. This reminds me of the inverse of the Real Estate Market just before it made a huge move down in 2007 because everybody knows that the PM Stock Indices are going to break higher, but Mr. Market is sometimes slow with the timing. When the expanding triangle for the PM Stock indices busts to the upside, it will do so via aggressive 3rd wave dynamics.

- Copper appears to be bottoming consistently with a similar point in the late 70’s Fractal Cycle. Back then, Copper soon started a rally that eventually broke to new highs with Copper eventually doubling in price from the last top before its Bull run was over. Since many PM Stocks produce copper as a by-product, such a move in copper would support a big move up in earnings for most PM Company producers over the next couple of years as well as add huge value in terms of resource valuations for most PM Explorers.

THE GOLD CHARTS

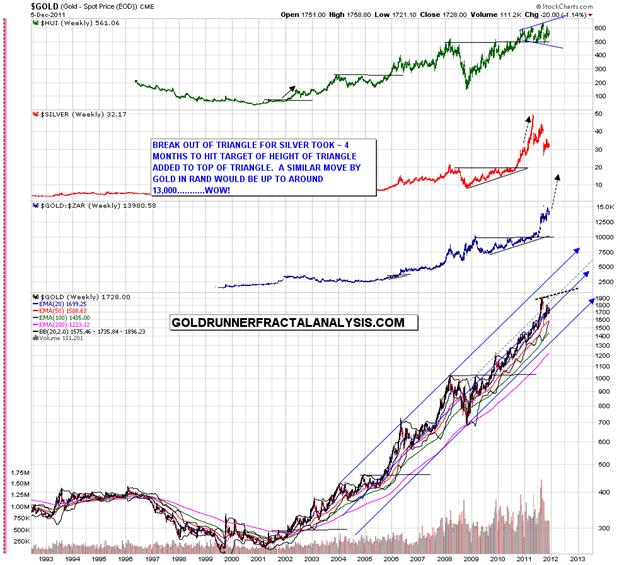

The first Gold chart is an arithmetic chart of Gold from Netdnia.com. The triangle on this chart can be drawn a few different ways, but this is one viable representation. As of Friday, 12-02-11, Gold hit the top of the triangle and started to reverse with what appears to only be 2 to 3 weeks left in the triangle. We have already laid out our expectations for the Gold triangle to break to the upside based on the similar fractal triangle in the late 70’s. The only question I have is this: if this triangle termination is so obvious to the many, what will be the ‘hook?’ (The 70’s charts are reserved for our subscribers see below for subscription link.)

The next chart is Gold in Rand (the currency of South Africa, a major gold producer) which currently exhibits many of the characteristics as it did just before the start of the huge run upward in the HUI Index and the SA Gold producers in the fractal period in 2002.

It looks like it is going to be déjà vu, all over, again.

We are moving well into seasonal strength for Gold and for Silver. We are well into the part of the cycle where global competitive currency devaluations are in full swing so the Dollar Index tainted “pricing index” is reduced to an oscillator.

The final chart shows Log Gold in the main chart:

The chart above suggests that:

- Gold will break to the upside out of the current triangle formation to initially find resistance around $2,000 to $2,040 at the angled black line, then move up to $2,250 to $2,350 at the blue top channel. After those resistance levels are penetrated, we’d expect Gold to be off to the tsunami races.

- The HUI, shown in green, is mired in its expanding triangle over the ‘cup formation.’

- Gold in Rand, shown in blue, is tracking the Silver chart ascending triangle breakout and run, but trailing by about 6 months.

Goldrunner maintains a subscription (go here for information) at www.GoldrunnerFractalAnalysis.com where he has posted this article on the public part of the site and on the site of his editor, Lorimer Wilson , at www.munKNEE.com.

Disclaimer: Please understand that the above is just the opinion of a small fish in a large sea. None of the above is intended as investment advice, but merely an opinion of the potential of what might be. Simply put:

The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.