Gold FIX Driving the Price

Commodities / Gold and Silver 2011 Dec 06, 2011 - 04:29 PM GMT In the last couple of weeks, we've noticed the variance of the gold Fixing price and the open market price. In the past, the two tended to dovetail giving the appearance of synchronicity. But in the last week, open market prices have tried to take the gold price down only to be pulled up by the price established at the London gold Fixing. There is a structural change happening in the market, bringing the relevance of the physical market to a far more important pricing role that it has had before. As with other markets, it is the small amounts of gold sought after in the open markets -to top-up unforeseen needs, as opposed to the amounts directly contracted with suppliers that dictates the gold price. With these alterations, that pattern is beginning to change. Why?

In the last couple of weeks, we've noticed the variance of the gold Fixing price and the open market price. In the past, the two tended to dovetail giving the appearance of synchronicity. But in the last week, open market prices have tried to take the gold price down only to be pulled up by the price established at the London gold Fixing. There is a structural change happening in the market, bringing the relevance of the physical market to a far more important pricing role that it has had before. As with other markets, it is the small amounts of gold sought after in the open markets -to top-up unforeseen needs, as opposed to the amounts directly contracted with suppliers that dictates the gold price. With these alterations, that pattern is beginning to change. Why?

First we look at what the Gold Fixing is and why it's important, then at the speculative trading hedging gold/silver markets on COMEX to see what influence they're having on the precious metal prices.

The London Gold Fixing

Above are the logos of the five member bullion banks that make up the Gold Fixing at which around 90% of the world's physical gold transactions take place.

These are prime gold bullion banks, globally. Their role in the Gold Fixing assures that because it's at this Fixing, that 90% of the world's physical gold transactions are transacted. The reason lies primarily with the processes involved that ensure that these gold buyers and sellers achieve a price for gold that's the most accurate reflection of the current supply and demand for gold.

There are two Fixing sessions -one in the morning at 10.30 hours GMT and then, to ensure inclusion of U.S. participants, one at 15.00 hours GMT. In these, the five members used to sit linked to their offices and looking at each other in a fairly small room, each with a desk on which there is a flag. Now they are connected to each other through a dedicated conference line, while also connected to their clients, who are kept informed of the price as it's moved in line with the buying bids and selling offers.

At the start of each fixing, the Chairman announces an opening price to the other 4 members who relay this price to their customers, and based on orders received from them, instruct their representatives to declare themselves as buyers or sellers at that price. Provided there are both buyers and sellers at that price, members are then asked to state the number of bars they wish to trade.

Bear in mind that each member's office is netting out the orders in the office and only submitting the 'net' order to their dealer at the Fix. If at the opening price, there are only buyers or only sellers, or if the numbers of bars to be bought or sold does not balance, the price is moved, and the same procedure is followed until a balance is achieved. The Chairman then announces that the price is fixed. It should be noted that the Fix is said to balance if the buy amount and the sell amount are within 50 bars [2000 ounces, 400 ounces each] of each other. The Fixing will last as long as necessary to establish a price that satisfies both buyers and sellers.

Customers may leave orders in advance of the Fixings. Alternatively, they may choose to be kept advised of price changes throughout the Fixing and may alter their orders accordingly at any time until the price is fixed. To ensure that the price is not fixed before the member has had an opportunity to communicate any changes each member has a "verbal" flag. As long as any flag is raised, the Chairman may not declare the price fixed. These negotiations go on for as long as it takes to reach a balance of demand and supply. It appears that the longer the time taken to Fix the gold price, the larger the amount of gold being dealt.

This ensures that every buyer or seller of gold gets not only the best price at that time but also allows large orders to be met without driving the gold price one way or the other by dealers with limited amounts to supply or provide as is the case outside the Fixing.

For instance, when the SPDR gold Exchange Traded Fund buys gold for its shareholders, it buys through HSBC, a gold Fixing member who holds it in its vaults for the shareholders.

This is how gold has a global but centralized market.

COMEX

It may seem reasonable to you to assume that the 'net' position on COMEX would be covered by COMEX actually ensuring that this amount of gold or silver is held in one of their four COMEX-approved depositories, all located in New York City. After all, delivery of the gold and silver is affected via electronic warrant. This would reassure us that COMEX dealings did affect the gold or silver price, would it not? After all, supposing someone went short and could not deliver -who would supply the metals? The implications: COMEX is constantly adjusting their gold & silver holdings to make sure that no-one would be left without the metal they bought there. Not so!

Find COMEX warehouse stocks on a daily basis on its website: http://www.cmegroup.com/trading/energy/nymex-daily-reports.html

The COMEX gold and silver markets are a futures and options market place where speculators and commercial dealers buy or sell for future delivery of the metal. Originally, an ideal market where both miners and manufacturers (via the Commercials) could remove the risk of gold and silver prices from their physical positions--by opening an opposite and equal futures or options position to their physical one--it filled a secondary function of allowing speculators and traders to make money through 'open' (not 'hedged', but 'long' or 'short' positions) from highly leveraged positions. These players included major banks and small individuals.

The COMEX gold and silver market is not a physical gold or silver market, except for approximately 1% - 5% of its dealings. Even on those contracts, traders must first stipulate that they will take delivery of the underlying metals so that the counterparty is aware that they too are involved in a physical transaction. The balances of 95% of the transactions are simply financial transactions that are usually closed out before maturity, so that no physical delivery need take place.

How COMEX Affects Gold, Silver Prices

The larger speculators, such as the banks, may also be dealing in the physical metal -not simply to hedge positions as is usual with the 'commercials' but to act in the physical markets to move the price to make their COMEX positions profitable, when they close their positions.

The large U.S. banks used to do this on a large scale, but once they were challenged in public as 'price manipulators' they have retreated from these markets, leaving individual and smaller speculators dominating the markets.

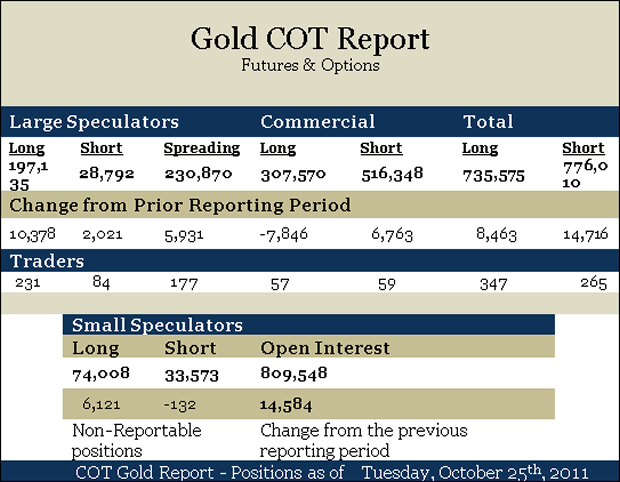

Consequently, the size of the gold and silver COMEX markets has shrunk tremendously. There was a time when for every $100 on the gold price, 100 tonnes of gold was held in the 'net long speculative position.' Since the banks have retreated from these markets, the 'net long speculative position' has dropped to 649 tonnes [see this drawn from the figures above] while the gold price is around $1,750.

The conclusion that can be drawn from this is that the accompanying trades in the physical gold markets in support of their COMEX positions has also lowered, reducing the impact of large traders on the gold price. With lower volumes involved in these markets and lower physical market trades to support these positions, the trading market has thinned out, whereas the physical market continues to grow. This is important, as it reduces the extent and the size of traders in the precious metals markets, allowing the physical market in these metals to increase their influence on the gold and silver prices. It also makes market prices better reflect the overall demand and supply patterns without the exaggerating influence of short-term traders.

Which is More Important: London Fixing or COMEX?

With the entire futures and options markets shrinking in size and influence and the presence of the large banks diminishing drastically, COMEX influence, both directly and indirectly, on precious metal prices, has shrunk. As the global gold and silver trade has expanded over the last few years and promises far more expansion, the size of the London physical gold market in London is growing steadily. In the future, expect to see the Hong Kong physical gold market grow and perhaps see HSBC establish a far eastern gold Fixing there to compliment the one in London, perhaps even with the same member banks? As Chinese and Indian demand grows this would be a logical step.

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2011 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazin![]() es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

es such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.