CFTC Data Shows Total Gold Futures and Options Positions Back at 2009 Levels

Commodities / Gold and Silver 2011 Nov 29, 2011 - 06:58 AM GMTBy: GoldCore

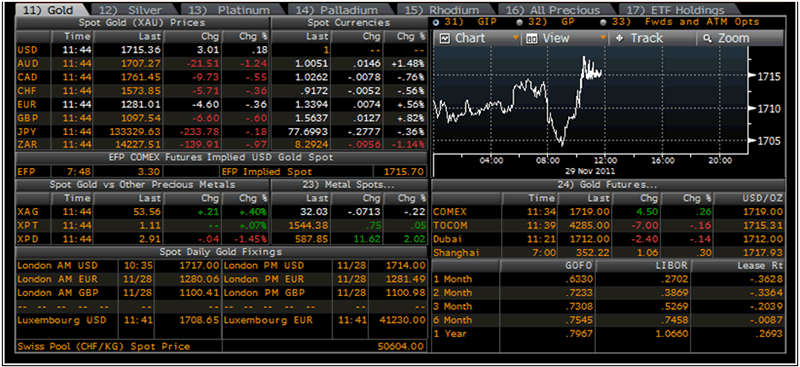

Gold is trading at USD 1,715.60, EUR 1,280.80, GBP 1,097.00, CHF 1,574.10 and JPY 133,280 per ounce.

Gold is trading at USD 1,715.60, EUR 1,280.80, GBP 1,097.00, CHF 1,574.10 and JPY 133,280 per ounce.

Gold’s London AM fix this morning was USD 1,717.00, GBP 1,098.32, and EUR 1,278.67 per ounce.

Yesterday's AM fix was USD 1,714.00, GBP 1,100.41, and EUR 1,280.06 per ounce.

Gold Prices/ Fixes / Rates

Gold is marginally higher in dollars but lower in most currencies today. Gold is being supported by the dollar coming under pressure again and oil prices (WTI) rising 0.7%.

Asian stocks markets were mixed and European indices are tentatively higher.

Gold posted its second-largest one-day gain of the month yesterday on safe haven buying due to lingering concerns about the global debt crisis.

Gold has steadied despite the renewed increase in risk aversion as seen in higher stocks and the euro trading higher against the dollar after Italy sold 3 and 10 year debt ahead of a key meeting of euro zone finance ministers.

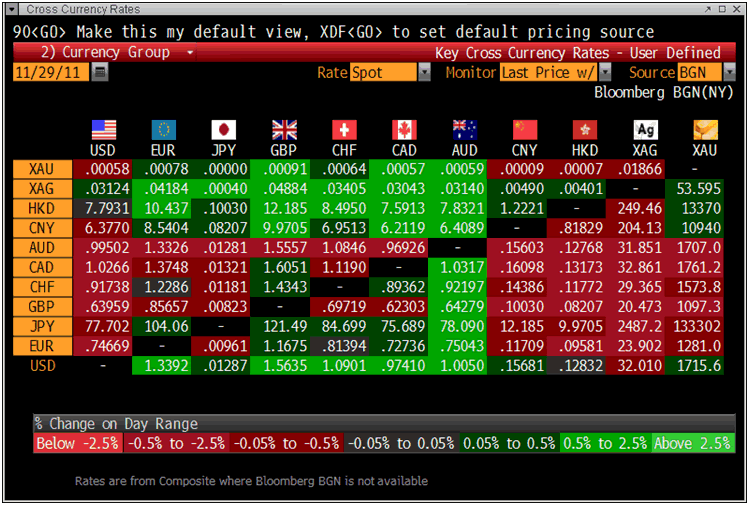

Cross Currency Rates

High hopes that the meeting could result in a comprehensive plan for leveraging the European Financial Stability Facility rescue fund look set to be dashed again.

Too much debt and leverage led to the financial crisis and has led to fiat currencies falling 11 years in a row against gold.

Further increases in debt and leverage will lead to a prolongation of gold’s bull market.

While gold has again displayed a short term correlation with risk assets such as equities, gold is set to outperform most equity indices again in November.

Reuters’ Amanda Cooper reports on the Reuters Global Gold Forum that so far in November, gold in Aussie dollars is set for the strongest performance, with a month-to-date gain of 5.4%, followed by gold in rand, up 4.8% and gold in Euros, which is up 3.5% in November.

Gold in yen is down 0.7% and gold in US dollars has fallen 0.3 %.

The MSCI World index is down 7% and the S&P is down 4.8% in November which again shows gold’s safe haven role in market turmoil.

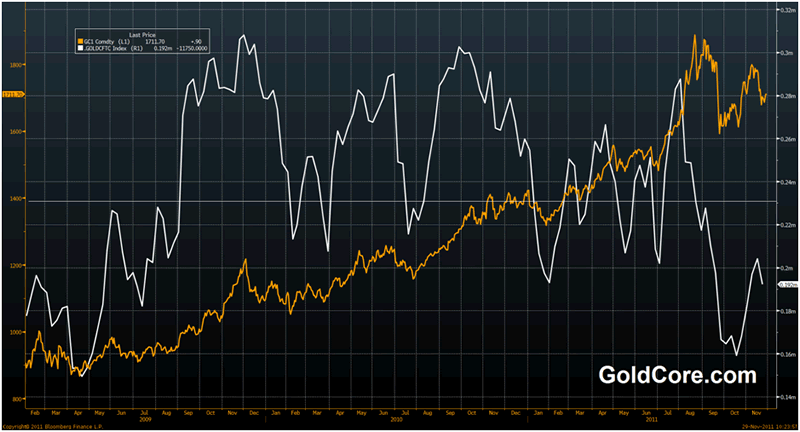

Net Long Gold Positions – (CFTC)

Concerns about whether gold is a bubble that is petering out continue despite a wealth of facts, data and clear evidence suggesting otherwise.

Another important data point that strongly suggests gold is far from a speculative bubble (where speculators and investors pile in - to make a ‘guaranteed’ profit) not based on fundamentals is the CFTC data released on Monday.

It showed that speculators, hedge funds and money managers pared their holdings of Comex gold futures and options in the week ended Nov. 22. The CFTC data, typically released Friday, was delayed because of the Thanksgiving holiday.

In gold futures and options, managed funds cut 21,697 long positions(or bets prices will rise) and added 679 short positions, beting prices will fall.

This reduced their net position by 13% to 149,256 long contracts, from 171,632 long contracts a week earlier.

The managed fund net long position represents around 14.9 million troy ounces of gold.

Any short term, speculative froth that was in the gold futures market as gold rose above $1,800 and then $1,900 has well and truly been diminished.

Total holdings of Comex gold futures and options are back at levels seen in 2009.

This shows that gold remains far from the speculative bubble alleged by Nouriel Roubini and some other vocal non gold experts.

Indeed, gold ownership remains extremely low amongst retail investors and the preserve of smart institutional money – including pension funds, hedge funds, banks, family offices and central banks.

SILVER

Silver is trading at $31.92/oz, €23.90/oz and £20.41/oz

PLATINUM GROUP METALS

Platinum is trading at $1,537.00/oz, palladium at $581.50/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.