Gold Supported as Eurozone Contagion Deepens After Disastrous German Auction

Commodities / Gold and Silver 2011 Nov 23, 2011 - 09:55 AM GMTBy: GoldCore

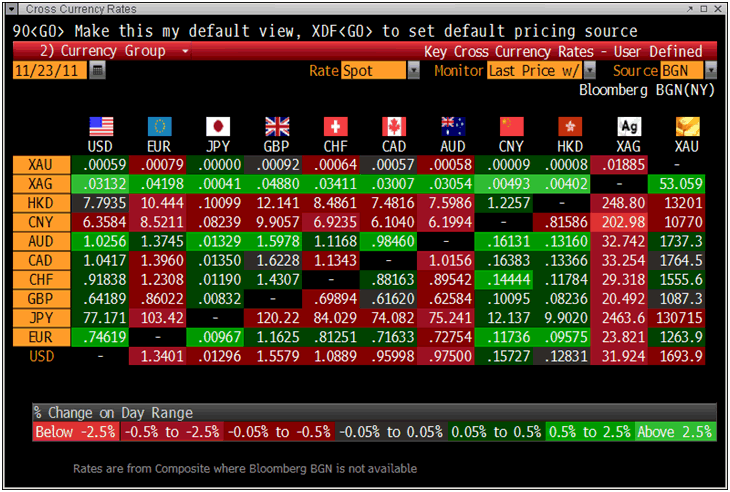

Gold is trading at USD 1,687.10, EUR 1,262.60, GBP 1,086.30, CHF 1,554.20, JPY 130,590 and CNY 10,760 per ounce.

Gold is trading at USD 1,687.10, EUR 1,262.60, GBP 1,086.30, CHF 1,554.20, JPY 130,590 and CNY 10,760 per ounce.

Gold’s London AM fix this morning was USD 1,686.00, GBP 1,083.55, and EUR 1,260.46 per ounce.

Yesterday's AM fix was USD 1,697.50, GBP 1,083.90, and EUR 1,253.14 per ounce.

Cross Currency Rates

Gold is lower in all major currencies today except euros with euro gold having risen 0.25% to EUR 1,263/oz.

The euro came under pressure due to the surprise collapse in new Eurozone industrial orders which led to Germany failing to get bids for 35% of bunds offered. The German 10-year bund yield rose sharply from 1.92% to over 2.06%.

This is one of Germany's worst auctions since the launch of the Euro with the Bundesbank having to pick up nearly 40% of the 6 billion euros on offer.

The German auction in turn led to further weakness in European equity markets. Asian equity indices followed US equities lower after news of a new US bank stress test and then the poor Chinese manufacturing data.

Gold will be supported at these levels as the euro zone debt crisis continues to degenerate with the periphery increasingly affecting the core – leading to contagion.

The bond auction in Germany is a disaster. If Germany has to buy its own bonds, it is frightening to think how other European nations, including France, will fare at bond auctions in the coming weeks.

Gold remains possibly the most under-owned asset in the world, and definitely the most infrequently and poorly covered in the mainstream media.

The specialist financial press and media (FT, Bloomberg, Reuters, WSJ, CNBC, Dow Jones etc.) covers gold, but the mainstream media continues to report on gold sporadically at best. When the mainstream media does cover gold it is covered badly with poor analysis and a continuing simplistic suggestion that "gold is a bubble". It fails to comprehensively cover the gold market.

The vast majority of investors and savers in the western world have no allocation to gold whatsoever and know little or nothing about gold.

Daytime TV and the popular press and media almost never have segments about how to invest in, or own gold.

The western public is not familiar with the gold market, let alone familiar with how to invest in or own gold bullion, gold coins or gold bars. This leads to a large number of the public who don't trust what they are not familiar with, or what they simply do not understand.

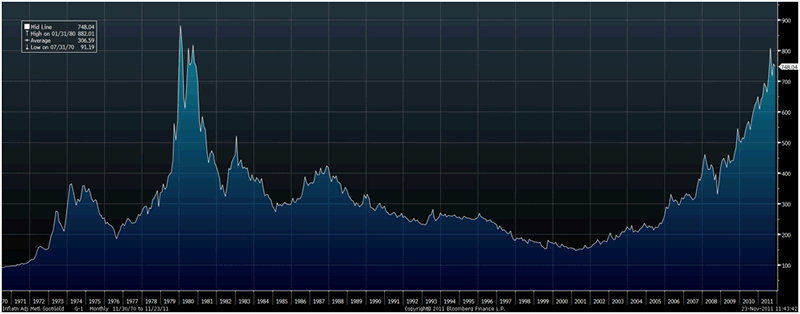

Gold in USD – Bloomberg Inflation Adjusted (1970-2011)

The 'woman and man in the street' in much of the western world continues to sell gold as seen in the 'cash for gold' phenomenon. This is in marked contrast to the Chinese and Indian public that has been aggressively buying bullion as a store of value.

Inquiries and sales from the general public remain anemic and there has been only a very slight pick up in demand from the public - despite the real deterioration in the outlook for the Eurozone, the US and the global economy.

GoldCore remains confident that most of our business is coming from educated investors.

This means existing clients who already have allocations are increasing their allocations, high net worths and some corporates concerned about deposits due to currency and systemic risk.

The majority of the public does not understand gold and the importance of diversification.

There continues to be a lot of preconceived notions, lack of knowledge and ignorance about gold as a safe haven asset and as an important diversification.

A plethora of excellent research articles by the World Gold Council, Casey Research (see their excellent report on gold in commentary today), major banks, ourselves and many others continue to be ignored by most of the media.

Comprehensive research is ignored. Singular and minor news events such as a few gold ATMs globally or comments by George Soros or Nouriel Roubini are focused on in a lazy fashion and used to suggest that gold is a bubble.

Financial ‘experts’ and ‘advisers’ with little or no experience or knowledge of the gold market often speak authoritatively about gold and generally in a negative manner which dissuades investors and savers from properly diversifying.

The case for owning gold has never been stronger and yet popular media and public skepticism remains high.

The lack of coverage in the mainstream media and the occasional poor coverage is symptomatic of a bull market in its infancy.

Animal spirits and public participation remain negligible.

From the GoldCore Trading Desk

There are reports of some US and UK bullion dealers not having supply of certain bullion product – particularly silver bars.

We currently have stock of nearly all major bullion products in volume and ready for immediate delivery.

However, supply issues are developing with regard to 10 oz silver bars which are not available for now. 100 oz silver bars in volume require a 2 week wait.

With regard to gold product, there are 1 week delays for kilo bars and for 1 ounce Krugerrands and Philharmonics.

SILVER

Silver is trading at $31.66/oz, €23.64/oz and £20.34/oz

PLATINUM GROUP METALS

Platinum is trading at $1,545.20/oz, palladium at $584.00/oz and rhodium at $1,575/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.