Gold Caution on Building Deflationary Forces

Commodities / Gold and Silver 2011 Nov 20, 2011 - 03:08 PM GMTBy: Clive_Maund

Gold has behaved as predicted in the last update, which was two weeks ago. It advanced a little further into nearby resistance, before reacting back quite sharply on Thursday. However, whereas in the last update we were looking to buy on this dip in the expectation of renewed advance, we are now more cautious, due to mounting evidence that politicians and world leaders may soon be overwhelmed by deflationary forces despite their strenuous efforts to keep them at bay by means of endless QE.

Gold has behaved as predicted in the last update, which was two weeks ago. It advanced a little further into nearby resistance, before reacting back quite sharply on Thursday. However, whereas in the last update we were looking to buy on this dip in the expectation of renewed advance, we are now more cautious, due to mounting evidence that politicians and world leaders may soon be overwhelmed by deflationary forces despite their strenuous efforts to keep them at bay by means of endless QE.

For gold's strong uptrend to continue we need to see continued currency debasement and inflation and the maintenance of sufficient liquidity to head of any incipient credit crises that could quickly cause interest rates, which have been artificially suppressed for years now, to skyrocket. The trouble is, however, that various parties are starting to break ranks and trying to use the quaint old fashioned methods of dealing with debt, such as trying to pay it down and reining in budgets and imposing austerity measures etc. The Republicans in the US are trying to enforce a reduction in the Federal deficit, or least retard its rate of rate of growth, which is now legally mandated if the so called "Super Committee" fails to come up with big cuts by the 23rd of this month. In Europe we are seeing attempts to impose austerity in Greece and Italy and soon other countries. While these efforts are commendable they should have been made years ago - now it is far too little too late, as the debts have grown to gargantuan proportions and are now completely out of control. They are like a giant voracious beast that demands to be fed, and the refusal to feed this beast by the likes of Mrs Merkel of Germany with her matronly "No!" are going to cause it - are causing it - to turn very nasty indeed.

What we are seeing is a revolving credit crisis unfold in Europe where the bluff of one country after another is called, and bond interest rates rise until one country after another buckles and collapses. This is a recipe for total carnage and the complete destruction of the European monetary union, with the one last hope being that the European Central Bank (ECB) backstops everyone and everything with a massive blanket blast of QE which it uses to firefight liquidity problems in every member state and prop up their credit markets. Given the entrenched position of countries like Germany, however, and the inability of European leaders to cooperate to the degree required, not to mention the astronomically staggering quantities of cash that the ECB would be required to manufacture at short notice to achieve this goal, it looks highly unlikely that Europe can be saved - and even if it was we would be staring down the barrel of hyperinflation. Thus, we appear to be confronted with the specter of the economic collapse and implosion of Europe soon, and needless to say, given that Europe's combined economy is even bigger than that of the US, the fallout for the world economy will be severe in the extreme, and it would indeed be appropriate to label this as a deflationary event.

While politicians are scared of deflation, the general public, who have gone soft over the years, are terrified of revolution, yet there are times when these crisis states are a cyclical necessity that clears the way for future stability and growth. Politicians and world leaders are understandably scared of deflation because of the dangers it entails for them, with the risk of angry mobs storming their citadels and palaces etc and dragging them out into the street to finish them off like Gaddaffi or Mussolini. Equally, the average Joe sat on his comfy sofa at home with a beer in one hand and watching football or the Simpsons is terrified at the prospect of the electricity being shut off and the supermarkets being stripped bare during the time of revolution. This is why, at 1 minute to 12, politicians are still fighting tooth and nail to put off the inevitable for as long as possible. They have tried it all - bailouts of defunct and parasitic banks and other institutions, dropping interest rates to the floor in a desperate attempt to stimulate demand and curtail and retard the compounding of debts, Quantitative Easing, or QE, which is counterfeiting money, in order that they can maintain liquidity and keep their crony pals at bankrupt entities in milk and honey for as long as possible, and none of it has worked, beyond buying them some time and enabling them to make leveraged gains in rising markets. All of these desperate measures have simply piled more debt on top of an already unimaginably massive debt mountain, and guaranteed that the collapse, when it comes, will be even more spectacular. It is a gigantic bubble just waiting for a pin to burst it, and that pin looks like it is going to be Europe. Meanwhile the US limps along, nursing gargantuan debts and hoping that foreigners will continue buying Treasuries, which they probably will for a while when Europe goes belly up, or hoping at least that the Fed will, and anyone entertaining the notion that China will be the "train that pulls the world out of recession/depression" looks like they are going to be sadly disappointed. The chinese economy is slowing rapidly and its Real Estate market is going into freefall.

For anyone who still can't grasp all this I am going to set it out in the simplest terms possible using a graphic example. The key point to understand is that the global debt mountain and parallel derivative mountain are now so big, that even with even rates close to zero, they cannot ever be paid down, and the interest payments cannot even be made. There are only two ways to deal with these debts - to either pay them off in worthless coin, i.e. create blizzards of money out of nowhere to pay them off, which means hyperinflation, or simply write them off and tell the creditors "Tough luck, you are not getting paid one cent - so go and take a long walk on a short pier". This process has already started in Greece with the bond 50% haircut. The problem is that the first loyalty of politicians is to their big business crony pals and sponsers in banks and other large corporations rather than the voters, who not unnaturally are pressuring them to push the bill off onto the voting public via bailouts, the idea being that rather than banks etc taking the hit on bad loans, the man in the street picks up the bill via austerity measures. As we have seen in Greece the little guy has figured this game out and is decidedly upset about it, and Italy is next. So it's time for the old "rock and a hard place" cliche - either you write the debts and derivatives off and let the banks and other institutions go bust and slam their doors, resulting in chaos, or you exonerate the banks and large corporations via bailouts etc, and then push the bill off onto the public via higher taxes and austerity measures that lead to chaos. The result either way is pretty much the same and here's the thing - it will also be the same, only delayed, if the "easy way out" of hyperinflation is followed, since this will result in Zimbabwean style collapse and widespread destitution, but as we have seen the forces of deflation are already starting to close in rapidly.

Now here is the graphic example. Many of you will know that if you are using a computer that "locks up" as a result of you having loads of applications and programs open at once, you can't solve the problem by trying to close this or that file or program - you quickly find that you can't go forward or back - you have to hit the reset or restart button. That is the situation that we have arrived at with this debt crisis - the world needs a "reset" and however anarchic and unpleasant it will be it is going to get it - the complete elimination of all the dross and overhang of debt and derivatives, and very probably the parasitic entities that foisted all this stuff onto the world as well. It is thus wholly appropriate that this is going to occur in the year of catastrophe, 2012, and while it is unlikely to be as dramatic as a giant tsunami sweeping over the Himalayas, it promises to be dramatic enough.

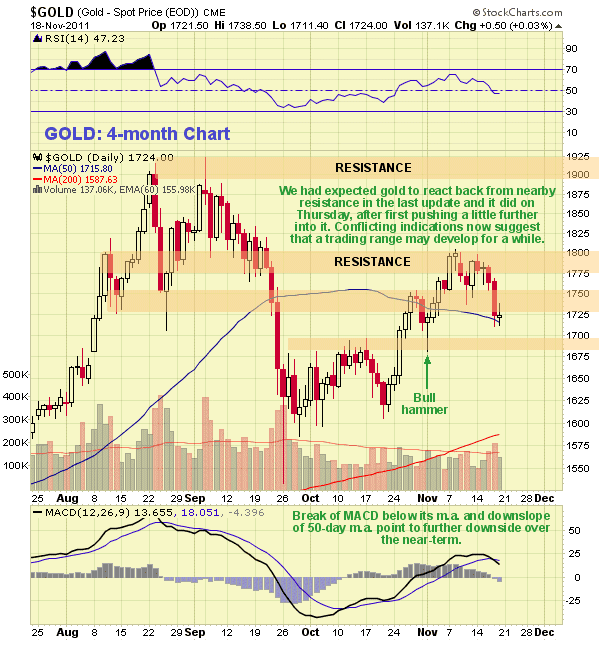

Bearing in mind the mounting deflationary forces let's now take an updated look at the charts for gold. You will recall that in the last update we had expected politicians and world leaders to beat back these forces, at least temporarily, with massive blasts of QE, but as mentioned above this fast moving situation appears to be slipping rapidly out of their control, an example being the rising bond interest rates in Italy, and now countries such as France and even Finland and Holland. On its 4-month chart we can see that gold has reacted back from the nearby resistance as expected, breaking sharply lower last Thursday, but it did not follow through on Friday, and it looks unlikely that we will see a severe drop from here similar to that which occurred in September. However, the unfavorably aligned 50-day moving average and the break of the MACD indicator below its moving average do suggest that it is likely to drop further over the short-term. Over the medium-term conflictiing indications suggest that a trading range is likely to develop. Now let's have a look at the big picture for gold on its long-term chart.

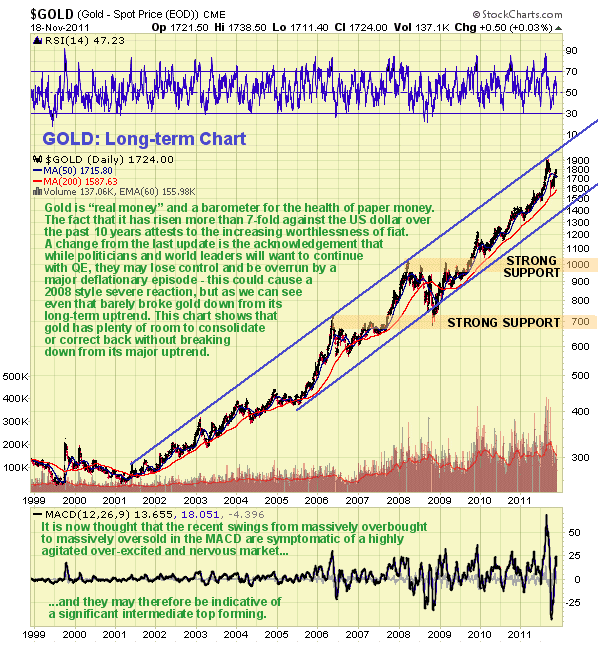

The long-term chart for gold going back to a point before its bullmarket started shows a generally steady uptrend in force over many years, the biggest interruption within which was the drop occasioned by the 2008 market crash which saw gold breach the lower trendline temporaily to drop back to an important support level where it reversed back to the upside. As we can see, gold touched the top of this major uptrend channel in August where the latest advance peaked and it is still towards the top of the channel. The wild swings in the MACD indicator from massively overbought at the August peak to massively oversold just a month later are now interpreted as being symptomatic of a highly agitated, over-excited and nervous market, the sort we would associate with a peak of some significance and so it is thought quite likely that gold will now enter a longer and deeper reactive phase. This fits with a deepening of the European crisis and a deflationary episode that would be expected to generate further inflows into the US dollar, and as we can on gold's chart it could fall as low as the mid $1400's without breaking down from its long-term uptrend.

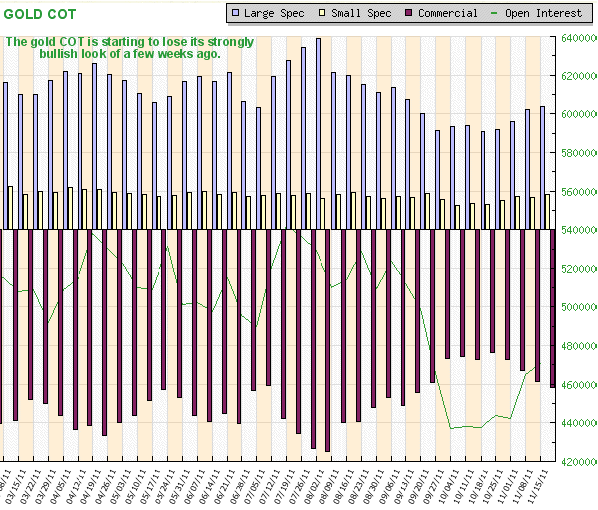

The latest gold COT chart shows that the COT structure is starting to lose its stongly bullish look of a few weeks ago, with Commercial short and Large Specs long positions continuing to rise steadily.This is opening up downside potential, although the picture is certainly not strongly bearish.

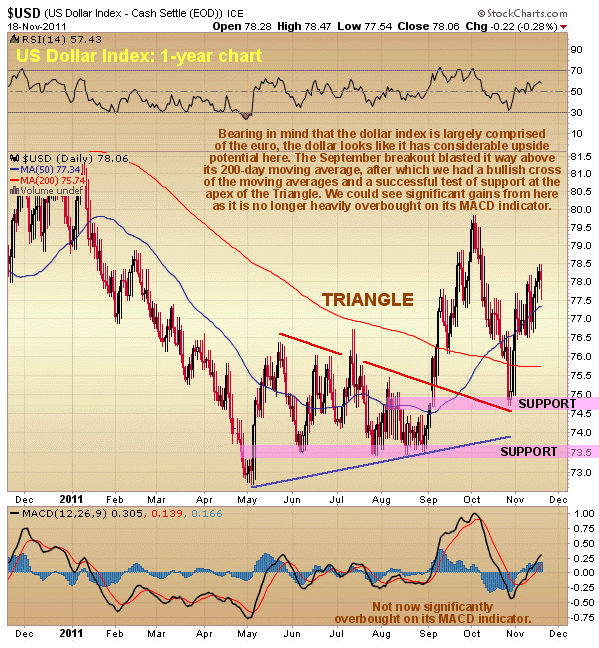

The dollar index now looks like it is swinging into bullmarket mode. The big September breakout from a base Triangle took it way above its 200-day moving average - the first time this has happened for a long time - and this indicator is now about to turn up. This breakout move was followed by a bullish moving average cross and by the index reacting back heavily to successfully test support at the apex of the Triangle. Now it is advancing again and is much less overbought than it was at the start of October, because of the reaction. Quite clearly, if the ECB fails to do QE big time and the euro now founders, the dollar stands to be a big beneficiary, and as this will involve mayhem in Europe - a major deflationary episode - that will lead to collapsing commodity and stockmarkets, it does not look like a favorable setup for gold.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2011 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.