Perfect Financial Storm; Eight Reasons to be Bullish on the US Dollar

Currencies / US Dollar Nov 08, 2011 - 04:58 AM GMTBy: Mike_Shedlock

One of my much appreciated contacts is Steen Jakobsen, chief economist for Saxo Bank in Copenhagen, Denmark. Today he passed on an "internal note" that he gave permission to share.

One of my much appreciated contacts is Steen Jakobsen, chief economist for Saxo Bank in Copenhagen, Denmark. Today he passed on an "internal note" that he gave permission to share.

For ease in reading, I will not follow with my usual indented blockquote format.

Steen Writes ...

One of my main themes over the last quarter has been a “relative outperformance” of the US economy relative to consensus. This has materialized and our call was almost entirely driven by Consumer Metric data which over the last three years has outperformed any other relevant predictor. This is now slowing down slightly, but still elevated. Meanwhile Europe start election cycle where Spain goes to the election in less than two weeks, while Sarkozy starts his re-election campaign when he is done playing Napoleon in European politics.

The outlook for 2012 is a “Perfect Storm” with increased austerity, higher unemployment, and weaker global growth (read: China).

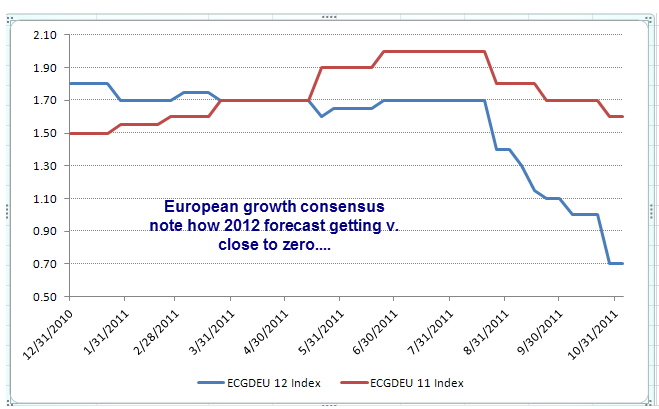

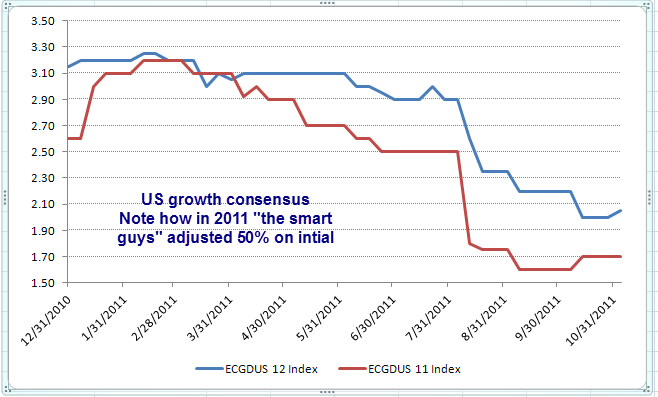

My colleague Peter Garnry was kind enough to quickly program a small excel thing which can track changes to growth by consensus using the ECST function on Bloomberg. This is the result.

European consensus growth by market consensus

European growth coming off hard and has been in almost free fall since end of July.

US consensus growth by market consensus

US growth has seen a low and looks higher, but there is a number of issues ahead:

- The Super Committee needs to finalize its work by this weekend in order to secure proper processing Congress. WSJ journal this morning says sources say some progress is being made and main points for now are: A. Limiting tax deductions replacing tax hikes. B. Getting permanent Bush tax as payment and most importantly for FX markets: C. Republicans seems fighting for repatriating capital back to the US at tax rate of 5.25% vs. presently 35% - this topic has even been on 60 Minutes, so to me it looks like “deal to be done shortly” as it plays nicely to create “Job creating program.

- The headwind from fiscal tightening will equal negative 1.00 percent of GDP – this is federal, state and local communities trying to cut back, but also investment will remain meek.

Long-Term Up-Cycle for US Dollar

A long life has taught me that everything “mean-reverts”.

When I moved back from the US in 2000, the EURUSD was trading below 0.8400 – since then the US has pursued a policy a “benign neglect” and succeeded in making the US extremely weak by all definitions.

Clearly the US has debt issues on their own, but currencies are relative trades. To me we are entering long-term up cycle for the US dollar. The final QE/Printing of money will come in Q1 of 2012 and could cement the low, but I am willing to start overweighting US dollar relative to Europe, not Japan, and further down the road to go full in.

I suggest the EUR/USD is out of touch with relative rates, funding needs, and relative dynamics of the economies.

Four Reasons to be Bullish on the US Dollar

- The EU debt crisis – when ECB becomes lender-of-last-resort we will see 10 figure move lower.

- Relative growth differences – The US is more dynamic and with only “one master” . – i.e. Congress vs. Europeans 27 members and lacking fiscal union.

- Competitiveness. US will able to compete on labor costs with close to 20 pc real unemployment and incoming tax incentives.

- HIA – Homeland investment Act – as stated above the Super Committee is trying to get a reduced tax of 5.25% in place.

My bullishness is relative, but the biggest contributors to long-term wealth tends to be your choice of currency. I have a target of 100 in DXY for next year, so a 25% rise in the US dollar during 2012 – and in EURUSD terms the expected move is changed range from 1.30/1.40 now to 1.20/1.30 on ECB rolling over, another 5-6 figures on interest rates, and then HIA II we end around 1.10-1.15 for 2012 end target.

That said, I will, as always, add, my own believe in me being able to predict anything remains 0.001 percent.

Safe travels,

Steen Jakobsen

Mish Comments:

I do not share Steen's bullishness on the Yen, but otherwise I am in general agreement with his prognosis.

I do not have specific targets, but I too expect the US dollar to strengthen. That is not what Bernanke wants.

However, 58% of the US dollar index is the Euro, and the Euro is a basket case. European banks are in worse shape than their US counterparts, and a breakup of the Eurozone that I expect will certainly exacerbate the problem.

For a discussion and timing of a Eurozone breakup, please see History Suggests Greece Will Freeze Bank Deposits, Exit Euro by Christmas; Spain and Portugal to Follow Next Year; What's the Rational Thing to Do?

Moreover, in conjunction with the upcoming regime change in China, I expect a significant slowdown in China coupled with a shift from huge infrastructure projects to a more consumer-driven model of growth.

When that happens China's demand for commodities will plunge, so will its exports, and a plunge in commodity prices will be good for the US dollar. A plunge in commodity prices will also be bad for the "hard asset" currencies, especially Australia and Canada.

Thus, to Steen's four reasons, we can add

- Breakup of the Eurozone

- China regime change and shift to consumption model slowing Chinese exports

- Falling commodity prices

- Weakening of "hard currencies"

Since little of the above scenario is widely believed (either Steen's or mine), and since a strengthening of the US dollar is not likely to be good for equities in general, not only will this scenario be good for the US dollar, it will help contribute to the "Perfect Storm" of deflation

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.