Gold and All Markets Volatile on Alarm Over Greek Economy

Commodities / Gold and Silver 2011 Oct 26, 2011 - 01:36 AM GMTBy: Ned_W_Schmidt

Sometimes the headlines say a lot more than the obvious. Below is the headline of the lead article for the Financial Times, 22 October 2011.

Sometimes the headlines say a lot more than the obvious. Below is the headline of the lead article for the Financial Times, 22 October 2011.

New Alarm Over Greek Economy Study says bail-out needs could reach €444bn 60% haircuts considered for bondholders

We would like to add a third line to the above. How about this?

2011: Keynesianism Dead

Greece was the poster child for Keynesianism. The idea was simple. No one would really have to work. Everyone could retire after a few years of work on a full government pension. Pay taxes? Not required. All of this was to be financed indefinitely by the issuance of government debt.

The government debt would be sold to banks. What if some of those debts, now in the case of Greece, might be uncollectible in the promised time period? No need to worry. The taxpayers in the rest of the EU will pay the credit card companies.

That 60% haircut for Greek bond holders in the above headline might be greater than actually experienced. Seems the rest of the EU might take care of the first 20%. Taxpayers would take that loss, and the banks would only lose 40%.

So now we understand the beauty of Keynesianism. The "greeks" get the free lunch. The bond holders and tax payers discover the meaning of the phrase "adverse financial consequences." But, investors do learn from their mistakes. They are not likely to be so fooled again. And, we suspect that German taxpayers, and others, will be far less tolerant of Keynesian spendthrifts in the future.

What is the real lesson from the Greek situation? Quite simply, Keynesianism is dead. Admittedly, the nonsensical concept that a free lunch society could be created through debt financed government spending was appealing. It was, unfortunately, financial alchemy, an attempt to convert idleness into prosperity.

Economic theories do come and go. Keynesianism has clearly over stayed its welcome. No economic ideology has been such a failure, as evidenced by the faltering Western economies over the past twenty years. Certainly the ongoing economic stagnation in the U.S., likely to continue for sometime, should be justification for giving the final rights to Keynesianism.

Situation with Greece is on the road to resolution. Their debts will be paid by the taxpayers of other nations, directly in some cases and indirectly through bank losses in others. Greece is yesterday's question. Tomorrow's question revolves around those other sovereign debts that continue to mount. Which taxpayers will pay those? Who will become responsible for the debt of the U.S. and others?

Given the magnitude of the losses, for investors and taxpayers, some learning is taking place. Greece has been a great educational experience for all. Investors will be far less willing to finance the empty promises of Keynesianism. Government debt is now understood to be "fiat debt", and not necessarily real. In considering the graph below, we wonder if investors are now reacting to the implications of Greece and the death of Keynesianism.

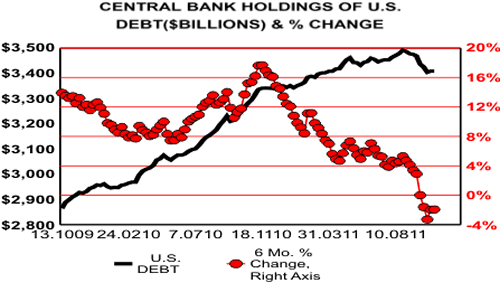

Each week in the financial data release from the Federal Reserve is included the size of foreign central bank ownership of U.S. government debt held at the Federal Reserve. It holds those investments as custodian for the owners. That ownership is the black line in the graph, using the left axis, which is in billions.

Line of red circles, using the right axis, is the rate of change in those holdings. That rate of change peaked late last year. In recent weeks, as can be observed in the graph, these holders of U.S. government debt have been reducing that investment. Most likely these foreign institutions are allowing U.S. government debt to mature without reinvesting the proceeds.

This development is worrisome. Has a structural change in the demand for funds bythese institutions occurred? We know many governments in the Middle East and North Africa are spending money to appease their populations. Those in the EU are also in need of money to pay the bills, and bailout Greece, et al. Could some be starting to worry about the massive debt of the U.S. government and the unwillingness of the Obama Regime do to something constructive about the U.S. deficit?

Problems of Greece and potential for similar problems with the U.S. and others are good reasons for investors to include Gold in their portfolios. When doing that, do it with the recognition that prices of all investments can be quite volatile when the financial world is dominated by high frequency traders and other speculative funds serving no economic purpose. On that subject, the $1,600 level for US$Gold has become a "fiat" support level. Vulnerability for $Gold to $1,500 should be assumed. Silver is now trading also at a "fiat" support level of $30-31. Vulnerability for that latter metal remains high and a bottom is not likely for it till the first of the new year.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.