Berkshire Hathaway : Great Value in a World-Class Company

Companies / Investing 2011 Oct 11, 2011 - 12:29 PM GMTBy: Rory_Gillen

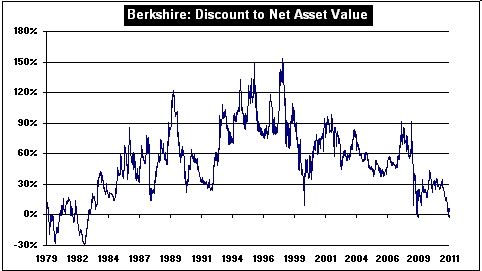

Berkshire Hathaway's shares (BRKA & BRK-B) trade on only a small premium to their underlying net asset value, a highly unusual occurrence. The board of Berkshire Hathaway is clearly of the same view and has recently obtained the authority from shareholders to buy-back shares at between 0-10% premium to net asset value. At $73 a share (B shares), the stock is currently trading on a 12% premium to the 2010 net asset value (NAV) or 5-6% to the estimated 2011 NAV.

Berkshire Hathaway's shares (BRKA & BRK-B) trade on only a small premium to their underlying net asset value, a highly unusual occurrence. The board of Berkshire Hathaway is clearly of the same view and has recently obtained the authority from shareholders to buy-back shares at between 0-10% premium to net asset value. At $73 a share (B shares), the stock is currently trading on a 12% premium to the 2010 net asset value (NAV) or 5-6% to the estimated 2011 NAV.

It has been a long time since Berkshire Hathaway shares have traded anywhere near their net asset value i.e. the balance sheet worth. And a quick perusal of Berkshire’s 2010 Annual Report provides some figures and facts to back up what appears to be a fairly compelling long-term value investment opportunity.

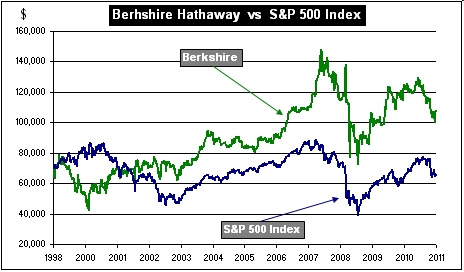

Although the US stock market peaked in late 1999, Berkshire's share price (first chart) has shown progress over that same timeline. The out-performance is a pale shadow of what the company achieved from 1965 to 2000 but it has continued to outperform, nonetheless.

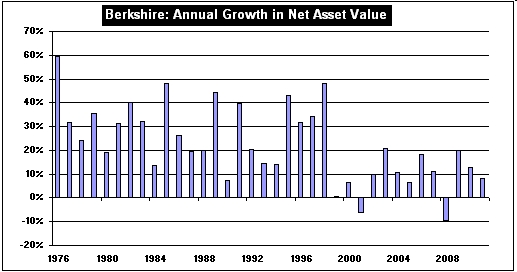

The second chart highlights the growth in Berkshire's net asset value (NAV) from 1976 to 2011 inclusive. Recent growth rates have slowed but have still been between 10-20% annually with the exceptions of down years in 2001 and 2008.

An examination of the group's 2010 Annual Report highlights a number of relevant points;

- shareholders funds were $157.3 billion or $95,453 per share ($64 per B share)

- Cash holdings were $38 billion

- After tax earnings were £13 billion

The third chart highlights the price-to-net asset value that Berkshire has traded at since 1979. At the current share price, the shares are trading at a 12% premium to 2010’s net asset value and 5-6% to an estimated net asset value for 2011 of $170 billion (or $103,300 per ‘A’ share: $69 per ‘B’ share). Since the early 1980s, when Buffett's record started to stand out, the shares generally traded at a premium to NAV of between 30-150%. The shares briefly traded at NAV in 2008 and again recently.

After Tax Earnings Understated

In Buffet's letter to shareholders, he highlights that the after tax earnings power of the business is circa $12 billion. To that we can make a couple of additions;

- the group’s construction and building materials earnings remain well below trend and are likely to add circa €1 billion to earnings when they recover.

- the group has cash balances of $38 billion earning practically zero interest. Interest rates will eventually go up or Berkshire will reinvest the cash in higher-earning assets. Either scenario will add to its long-term earnings power. Let's take the case where an acquisition is made and an immediate return of even 7% after tax is achieved - that would contribute a further $2.7 billion to earnings.

Combined, this could add a further €3.7 billion to Berkshire's earnings power and suggests that Berkshire's assets, as they stand, can deliver after tax earnings of $15.7 billion. That would represent a 10% after tax return on 2010 net assets of $157.3 billion. Given the quality and likely growth attached to that earnings stream, one could argue that you have a bond-like asset with an initial earnings yield of 10%, which should continue to grow. To an investor who pays a 12% premium over the 2010 net asset value, then the starting earnings yield is still an attractive 8.9%. The attractions of an earnings yield with both defensive and growth characteristics appear fairly obvious. In comparison to a 2% yield from US 10-year government bonds, which offer no growth, the opportunity or value on offer is even more striking.

Dealing with the Elephant in the Room

Of course, some of the de-rating of the shares reflects underlying concerns about what happens when Buffett moves on to the other world. He has threatened to direct the company from the grave which he says brings new meaning to the phrase 'thinking outside the box'. I believe two sensible observations can be made when Buffett is no longer around;

- Firstly, he will have left behind a collection of world beating companies that will continue to pour out earnings and cash flows for years to come;

- Secondly, while it is unlikely that anyone of Buffett's calibre will be there to reinvest those cash flows as well as he has done for forty-six years now, the board will have other options for re-deploying the cash flows. These options include;

- share buy-backs which would underpin the growth in net asset value as well as providing a floor under the shares near net asset value

- paying a dividend - if 50% of earnings were paid out by way of dividend today, the dividend yield would be circa 4.5% (based of $15.7 billion of earnings power).

The B Shares (BRK-B) Trade at a Lower Price

Investors can buy the B shares which trade at 1/1500th of the price of the A shares (or $73 a share). This should suit investors with more modest means than institutional investors. Owners of the 'B’ shares can also attend the annual general meeting in Omaha, Nebraska which takes place every May.

Rory Gillen Founder www.investRcentre.com

Rory Gillen is a qualified Chartered Accountant, a former equity analyst, stockbroker and fund manager who has spent over twenty years working in the financial services industry. He founded The InvestR Centre in 2005 as a stock market training company. www.investrcentre.com

© 2011 Copyright Rory Gillen - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.