The Most Dangerous Time Ever for Investors

Stock-Markets / Financial Markets 2011 Sep 28, 2011 - 01:13 PM GMTBy: Andrew_Snyder

The government has taken control. No longer is Washington about justice and liberty. It's all about money.

The government has taken control. No longer is Washington about justice and liberty. It's all about money.

This is perhaps the most dangerous time ever to be an investor. Sounds dire, I know, but it is the truth.

And it is not just us -- the outspoken pundits -- making the claim. It is everybody, everywhere.

Guys like Warren Buffett, Bill Gross and Jamie Dimon have all cried out. Each of them has their own agenda, yet they point a finger in the same direction... straight at Washington.

Let me show you something.

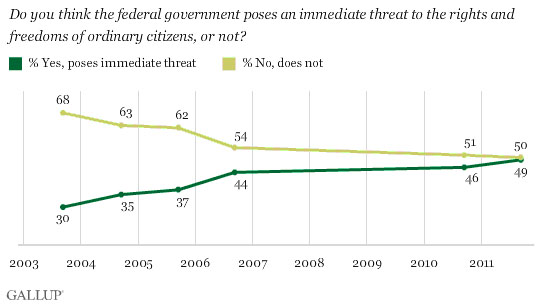

All week, the pollsters at Gallup are surveying the nation to get our take on the role and performance of government. Most of what they reveal is nothing new -- we don't trust our leaders.

But there is something more ominous happening, especially for investors:

This survey shows that half of Americans believe our government (the one so many sons and fathers have died for) poses an immediate threat to our rights and freedoms.

Scary stuff... at least if you believe in liberty for all.

The worst of this, at least for investors, is the pressure Washington has put on American businesses. From banks to steel mills, if you aren't doing the work of the White House, you face tough times.

We saw this in the comments from Muhtar Kent, Coca-Cola's CEO, this week.

Thanks to our politics, he hints, he would rather do business in China. At least there, he knows what he will get.

"In the west, we're forgetting what really worked 20 years ago," Kent told the Financial Times. "In China and other markets around the world, you see the kind of attention to detail about how business works and how business creates employment."

"I believe the U.S. owes itself to create a 21st century tax policy for individuals as well as businesses."

He blames the lack of action inside the Beltway on a "polarized political process."

We say it's all about greed. Dirty, disgusting greed.

As long as we let money become the central theme in Washington, we are destined for trouble. Think about it. Somehow over the past two decades we let our politicians become the ruler of everything financial.

It is a role they accepted all too keenly. After all, if they control the money, they control the votes.

Instead of fighting for our liberty and freedom, the politicos fight over the direction of your money. Should billions more go to FEMA or the solar industry? Should Detroit get some cash or should we send a shot to Wall Street?

This is exactly the reason our markets are so volatile and why it is the most dangerous time to be an investor. The uncertainty is off the charts.

It is also exactly why Warren Buffett is investing in himself.

(This isn't the first time I've spoken about Warren Buffett. Sign up for Taipan Daily to receive more investment commentary.)

On Monday, the Oracle of Omaha told us his Berkshire would spend around $10 billion to buy its own shares. It was a move that went against everything Buffett stood for during his 40-year tenure.

Instead of searching for an undervalued insurance firm or a cheap railroad or a growing energy company, Buffett kept his cash to himself.

It's too risky to jump into the unknown, he figured. Tomorrow's forecast is too vague.

When Mr. America says I can't make money in this mess... When he says there is nothing worth buying... When he tosses his hands in the air in disgust...

... it's proof things are not right.

We have let the government go too far.

Like Coke's Kent says, "There's too much comfort. We need more needles to stick in politicians."

But our solution does not involve voodoo dolls. It's far simpler.

We say it is time for a new strategy. It's time to take your money -- at least some of it -- somewhere else.

The idea came out loud and clear last Friday when I rang our newest editor, Steven Orlowski. It was time to plan his next issue of Safe Haven Investor. As a veteran of Wall Street, Steven does not need much prodding. He's always eager to share.

"It is time for something different," he starts. "If we are going to avoid this mess here at home, it's time we add another strategy to our game. I am aiming at a big gun in a country where they like investors. Where they greet us with open arms."

Really... it can be as simple as that.

While our leadership tears our nation apart, there are opportunities waiting for us. Coke knows it. Buffett knows it -- but his political ambitions got the better of him.

Most importantly -- as we saw last week -- Wall Street knows we are in trouble.

As the fear and distrust in our government grow, risk will increase at an even stronger pace. Fortunately, the world is a very big place.

P.S. We all know gold is one way to avoid the political circus. But what if the politicians already invaded the gold market? What if what you thought you knew about gold was 100% flat-out wrong?

Here is the gold story you have not heard... Fort Knox is empty.

Don't forget to follow us on Facebook and Twitter for the latest in financial market news, investment commentary and exclusive special promotions.

Source :http://www.taipanpublishinggroup.com/tpg/taipan-daily/taipan-daily-092811.html

By Andrew Snyder

http://www.taipanpublishinggroup.com/

Andrew Snyder is the Editorial Director of Taipan Publishing Group and Managing Editor of Taipan Insider. Andy's first year in the world of finance and investing involved learning the intricate details of the financial industry as an advisor. He specialized in handling the vast portfolios of very wealthy clients, where he excelled at making them even wealthier. Since then Andy has received his Master's Degree in Business Administration, has had an award-winning book published and has been featured in numerous publications.

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2011, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.