Did the Past 7Weeks Stocks Rally Lull You to Sleep? Bear Markets Are Cunning Beasts

Stock-Markets / Stock Markets 2011 Sep 28, 2011 - 11:47 AM GMTBy: EWI

Bear markets are cunning beasts.

Bear markets are cunning beasts.

Don't get me wrong -- we are not in the bear market territory yet. At least, not officially.

An "official" bear market begins when the stocks indexes decline 20%. The DJIA's decline from the May 2, 2011 high to the September 21 low is about 17%. Close, but no cigar.

Add to that the strong rallies we've seen over the past few weeks (Sept. 12-20: +685 points in the Dow, for example) -- and lots of people conclude that despite the volatility, things aren't so bad.

But let's get some perspective. The stock market has been around a while. Only when you look at its history do you realize just how cunning -- and fast, and strong -- bear markets can be.

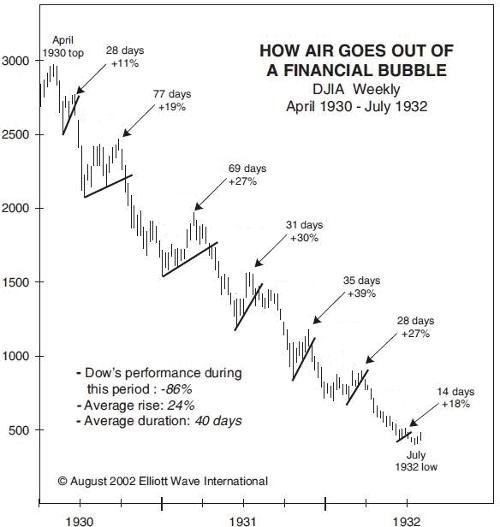

Here's a chart we've shown readers before. It's worth printing out and keeping on the wall above the desk where you open your brokerage statements.

This is the DJIA between 1930 and 1932, one of the worst bear markets in history. Robert Prechter, EWI's president, took the time to measure the percentage gain of each bear market rally during the 2-year period -- you can see them in this chart.

When you routinely see double-digit rallies (11 percent, 18 percent, even 39%) over the course of two or three years, it's easy to be lulled into thinking that maybe things aren't so bad.

The reality, of course, is that the bear market's chokehold grows tighter around your neck with every drop-rally sequence. (Think back to the 2007-2009 collapse, and you'll remember the same behavior.)

Which brings us to here and now. Rallies and declines of 300-400+ points have been so common since August that we're kinda getting used to them.

The question is: Are we in a bear market, or is it that "maybe things aren't so bad"?

You need some perspective to answer that question. The research we do here at EWI can help.

Find out what these market moves mean to your investments with current analysis from Elliott Wave International. Bob Prechter has just released a FREE report -- with urgent analysis from his August and September 2011 Elliott Wave Theorist market letters, including another video excerpt from the special video issue of the August Theorist. Stocks -- Buying Opportunity or Another "Free Fall" Ahead? will help you put these uncertain markets into perspective so that you'll be better positioned to both protect your investments when needed and prosper when opportunities arise. |

This article was syndicated by Elliott Wave International and was originally published under the headline Did the Past 7 Weeks of Rally Lull You to Sleep?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Free Report: Stocks -- Buying Opportunity or Another "Free Fall" Ahead?

Free Report: Stocks -- Buying Opportunity or Another "Free Fall" Ahead?