Freedom and Economic Growth in the Poorest Countries

Economics / Emerging Markets Sep 23, 2011 - 11:29 AM GMTBy: MISES

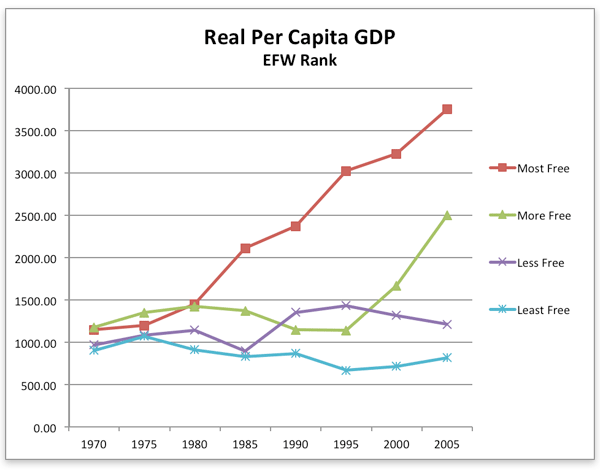

Ken Zahringer writes: I just finished the first draft of a paper exploring some of the factors influencing economic growth in poor countries. I put together a sample of 37 countries that were at the bottom of the income scale in 1970 and traced their economic performance over the ensuing 40 years, trying to discern some of the reasons for the differences in growth among countries. One of the measures I used was the Fraser Institute's Economic Freedom (EF) Index. The following simple table speaks volumes about why some countries prosper and others don't. (The chart divisions allow class mobility.)

The results are all the more dramatic when we realize just who these countries are.

All started in abject poverty; all had real per capita GDP of less than $2,000 per year in 1970. And none of these countries are paragons of freedom; of the 37, only two — the Philippines and Kenya — had EF scores above 7 (out of 10) in 2005.

Still, the freest 25 percent showed steady growth and the most unfree 25 percent were poorer in absolute terms in 2005 (average of 2005–2009) than they were in 1970.

Obviously there is more to the story — and the paper — than just this one graph. But if you still harbor any doubt as to the power of even a little bit of freedom to lift people up in even the poorest countries, this should help set you straight.

Ken Zahringer is currently pursuing a PhD in applied economics at the University of Missouri. He also works as a part-time piano technician. See Ken Zahringer's article archives.

© 2011 Copyright Ken Zahringer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.