UK Savers Benefit From the Liquidity Credit Crisis as Fixed Rates Rise Again

Personal_Finance / Savings Accounts Dec 10, 2007 - 12:17 PM GMTBy: MoneyFacts

Andrew Hagger, Head of News and Press at Moneyfacts.co.uk, comments on the recent increase in short-term savings rates.

“It seems that some institutions had pre-empted the recommendations issued by the FSA yesterday and may have already been assessing their funding and liquidity positions, as a result attempting to bring in more funds through the front door.

“We have seen the appearance of some very competitively priced products in the shorter term fixed rate market, further adding to speculation that the institutions are hoping to build up their stock of customer credit balances.

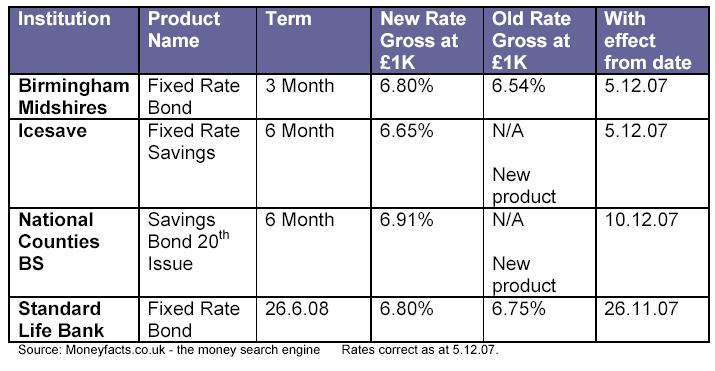

“In the following list of the most recent changes in short term fixed rate savings deals we can see some of the larger players in the mortgage market. Providers such as Standard Life Bank, which currently has 175 mortgage products on offer and Birmingham Midshires Solutions which offers 74 mortgage deals, both will no doubt find a good use for any new savings money they can attract in this way.

“As well as providing funds for the lenders, the current financial climate also represents an excellent opportunity for savers to bag themselves an outstanding deal. But hurry, there’s no guarantee how long these kind of deals will last.

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.