The USA and Saudi Arabia Combat the Axis of Oil - Iran, Russia and Venezuela

Commodities / Analysis & Strategy Feb 04, 2007 - 08:27 PM GMTBy: Gary_Dorsch

Crude oil is the key weapon in the battle between Saudi Arabia, Kuwait, and the UAE, aligned with the United States, against the “Oil Axis” of Iran, Russia, and Venezuela. The Persian Gulf Oil kingdoms fear the emergence of a Tehran-led axis linking Iran, Iraqi Shiites, Syria, Lebanon's Hezbollah, Palestinian Hamas in Gaza, and Islamic militants linked to al Qaeda trying to topple the Saudi royal family.

Crude oil is the key weapon in the battle between Saudi Arabia, Kuwait, and the UAE, aligned with the United States, against the “Oil Axis” of Iran, Russia, and Venezuela. The Persian Gulf Oil kingdoms fear the emergence of a Tehran-led axis linking Iran, Iraqi Shiites, Syria, Lebanon's Hezbollah, Palestinian Hamas in Gaza, and Islamic militants linked to al Qaeda trying to topple the Saudi royal family.

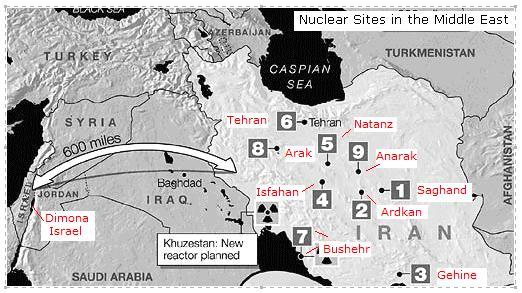

Earlier this month, Riyadh fired the first shot in the war against Iran, by knocking the price of crude oil to as low as $50 per barrel. The goal is to squeeze Iran's budget and wreck havoc on its economy, as much as possible, before the Ayatollahs can get their hands on the nuclear bomb. According to a Jan 24th report in the UK Telegraph, that indicated North Korea is helping Iran to prepare an underground nuclear test similar to the one Pyongyang carried out last year.

Under the terms of a new understanding between the two countries, the North Koreans have agreed to share all the data and information they received from their successful test last October with Teheran's nuclear scientists, to assist Teheran's preparations to conduct its own test, possibly by the end of this year.

On January 24th, the Saudi All Share Index (SASI) closed below the 7,000 level for the first time in two years, and has yet to confirm a bottom. The specter of a nuclear armed Iran is sinking SASI, but we are also reminded that SASI has been a good leading indicator for the price of crude oil for the past three years. Saudi Arabian Oil Minister Ali al-Naimi said on Jan 24th, he aiming for moderate oil prices but did not give an actual price level which he considers to be moderate. Saudi Arabia's spare crude production capacity is set to rise to 3 million barrels per day (bpd) in February and could put a ceiling over crude oil, if it chooses to do so. In the event of an embargo on Iran's daily oil exports of 2.4 mil bpd, Riyadh could fill the gap from its spare capacity.

To counter the Saudi inspired plunge in oil prices, Iranian President Mahmoud Ahmadinejad proposed on Jan 21st, to cut the oil price on which the next Iranian budget is based to $33.70 per barrel for the year starting in March, compared with what he said was a price of $44.10 for the existing budget. “It is a signal to Iran's enemies saying we are ready and we will manage the country even if you lower the oil prices more. We assume our enemies want to damage us by decreasing the price of oil. So we must reduce our dependency on oil revenue,” Ahmadinejad said.

Iranian crude usually sells for about $7 a barrel less than US crude oil, so the drop in crude oil to $52 per barrel for WTI in New York last week, would wipe out Iran's budget surplus. Any further drop in world oil prices would force Tehran to dip into its foreign exchange reserves or seek loans from Beijing and the Kremlin, its stalwart allies, in order to maintain vital subsidies for its population.

Tehran spends $20 billion to $30 billion on heating oil and gasoline subsidies per year, costing the government roughly 15% of Iran's GDP. Ahmadinejad was elected promising to bring oil revenues to every family, eradicate poverty and tackle unemployment. But he has failed to meet those promises. Anticipating a possible US blockade of gasoline imports, Tehran will start rationing gasoline as of March 21st.

Venezuela's oil revenue added $50 billion to government coffers last year, financing about half of the country's budget, allowing kingpin Hugo Chavez to fund domestic subsidies and overseas aid to propagate his 21st-century socialism. Russia's energy exports finance about 30% of the government's budget and have transformed a country that partially defaulted on its foreign debt in 1998 into a creditor nation. Russia's foreign-currency reserves have expanded sixfold in four years to $303 billion.

The US Treasury has barred Iranian institutions from the US banking system, effectively cutting Iranian banks off from foreign exchange transactions in US dollars, which require a US counterparty bank. Because of US sanctions, Iran is looking to China and Russia to help develop its resources, and in exchange has promised to coordinate with Russia in marketing its natural gas to ensure that it does not loosen Russia's stranglehold over European markets.

Tehran believes this strategy think will get them out of the box that the Saudis and the US are attempting to construct. China's national oil companies have secured $100 billion of agreements to develop Iran's huge oil and gas reserves.

The Specter of War hovers over the Middle East, Mohsen Rezai, secretary of Iran's Expediency Council, told the Dubai-based Al-Bayan newspaper on Jan 21st, “America will exploit sanctions against Iran to incite people to rise up against the Islamic revolution, provide aid to movements hostile to Iran, carry out operations inside Iran and promote a sectarian war. The next two months will show the world this strategy. An Iranian-US confrontation is inevitable,” he said.

Rezai would not rule out US missile strikes against Iran's nuclear installations. Ali Larijani, Iran's top nuclear negotiator, said in remarks on Jan 20th that Iranian armed forces were ready to face any threat to its nuclear installations, amid speculation Washington may be planning a military strike.

What about the outlook for Crude Oil? With renewed speculation of a US military strike against Iran or a gasoline embargo in the air, crude oil has hit rock bottom at $50 per barrel. Crude oil jumped $4 per barrel since the US Energy Department announced on Jan 23rd, a new push in the spring to fill the Strategic Petroleum Reserve with initial purchases of 11 million barrels. “In the spring, that is to say about two months from now, we will begin the fill. At current market prices we believe that we can purchase about 11 million barrels of oil over the course of a few months, so that would be approximately 100,000 barrels per day,” said Energy secretary Samuel Bodman said.

The 100,000 barrels per day to be added to the SPR in late March or early April only represents a 0.50% increase in daily US consumption, but was taken as a psychological signal, that Washington thinks crude oil is near a bottom. From a technical perspective, crude oil has stiff overhead resistance in the $56 /barrel area, from the Neckline of a “Head and Shoulders Top” pattern, and more resistance from a downward sloping trend-line which intersects around $58 per barrel.

Most H&S Top Patterns don't reach their downside objectives, and usually end up as bear traps. In other words, short-selling the crude oil market below $56 per barrel, might only be the fuel for a short squeeze to higher prices later on, especially if tension between the US and Iran heats up in the months ahead. Saudi attempts to put a lid on oil, might only allow a crude oil rally to start from a lower starting point.

Furthermore, gold traders appear to be convinced that crude oil has bottomed out at $50 per barrel and it's only matter of time, until shorts are squeezed. Given the enormous amount of global liquidity and super low interest rates in Japan and Switzerland, hedge funds might become buyers of crude oil in the weeks ahead.

Arab Oil kingdoms Shifting into Gold

Saber rattling by Iranians officials to the media, and test firing missiles in the Persian Gulf, are ultimately designed to raise the tension level in the world oil markets. Recognizing the high risk strategy of taking on Tehran thru economic means, jittery Saudi princes have been moving money from their local stock market into gold, British pounds, and US Treasury notes. The net result has been a 25% gold rally against the price of crude oil since Dec 15th, to a 3-year high of 12.2 barrels.

That's significant, because it means that gold is shaking off its worries about a weaker oil market. Still, lower oil prices should lower official G-7 inflation figures and confuse potential gold converts. The relative strength of gold will present a major dilemma for G-7 central bankers sometime in 2007, especially if bond markets begin to break-down from explosive money supply growth and rising gold and silver prices.

Global Money Supply out of Control, While crude oil has a major impact on inflation statistics churned out by governments, the gold market has shifted its primary focus to explosive money supply growth that is pumping up global stock markets. Central bankers have not raised their short term interest rates high enough to slow down the global money supply, which according to the Economist magazine, expanded an average 18% in 2006. In Japan, the central bank loan rate is absurdly low at 0.25%, while the Swiss National Bank's Libor target is only 2%.

“Markets show very strong risk appetite and risk premiums are very low,” said Swiss National Bank Chairman Jean-Pierre Roth on January 24th, warning market volatility would inevitably return, hurting investors. “My current thinking on the franc is that this is part of the exuberance in the financial markets,” he said

Baby step rate hikes by central banks have failed to rein in explosive money growth. In Australia, the M3 money supply is 13% higher from a year ago, British M4 is 13% higher, the Euro zone's M3 is 9.3% higher, a 16-year high, Korea's M3 is 10.3% higher, China's M2 is 16.9% higher, India's M3 is 20.5% higher, Russia's M2 is 45% higher, and the US M3 has been reconstructed to show 10.7% growth in 2006.

BullionVault.com is currently giving a FREE gram of Swiss vaulted gold bullion to everyone who registers (worth $24)- to try the service and learn how to trade. Sign-up is easy, fast and credits you immediately.

The great “paper chase” is on, but would an investor trying to stay ahead of monetary inflation be better off putting money into gold or a basket of Dow Jones Industrial shares? Both trading vehicles are good choices to stay ahead of expanding M3 growth, which is diluting the purchasing power of fiat currency For the past three and a half months, the DJI to Gold ratio has been locked in a tight sideways range between 18.8 oz's and 20.8 oz's.

In fact, during the DJI's last 1,000 point advance since September, Gold has also moved higher at an equal pace, thus the DJI to Gold ratio at 19.4 oz's, is unchanged from four months ago. If this stalemate pattern continues, a further advance for the DJI to the 13,000 level in the weeks ahead could also lift gold to as high as $675 per ounce, while keeping the DJI /Gold ratio steady.

The recent sharp drop in crude oil prices to $55 per barrel leaves US consumers with more money to spend, while they lower expenses for heavy fuel users, including big manufacturers and Dow Transport companies. That's positive news for US corporate profit growth, which helped stocks put in a strong performance last year. Cheaper fixed costs are welcome by corporate bond investors, too.

Lower oil prices can cushion the blow to an expected slowdown in S&P 500 profit growth of 8.2% for the fourth quarter, after about four and a half years of straight double-digit profit gains for S&P 500 companies, according to Standard & Poor's.

So while Saudi Arabia keeps oil prices low to squeeze Tehran, Wall Street power brokers can drive the DJI higher, even when S&P 500 profit growth is slowing. But what would happen if crude oil prices suddenly surged above $60 per barrel or much higher due to fears of a military explosion in the Middle East? In the event of a US military strike on Iran's nuclear facilities and its oil refineries, or an embargo on Iranian oil exports, would gold or the DJI be a better investment?

The answer is elementary, so while the timing is uncertain, it pays to own Gold rather than the DJI, because when the fateful day arrives, a military strike will be complete surprise to Wall Street power brokers but not to gold bugs. In any case, one can still argue, that in hard money term, the DJI is in a seven year bear market vs Gold, highlighting the supreme importance of global liquidity and explosive money supply growth in lifting the DJI and other stock markets higher around the world.

Gold Shines in Tokyo as BoJ Buckles Under pressure,

Gold got a big boost last week, when the Bank of Japan succumbed to heavy political pressure from the Shinzo Abe government and voted 6-3 to leave its overnight loan rate unchanged at 0.25 percent. The BoJ is finding the radical inflationist Abe regime to be a much tougher opponent to tighter money, than its predecessor regime under Junichiro Koizumi.

It's doubtful that BoJ chief Toshiro Fukui could have drained 26 trillion yen from the banking system with Abe in power. Moreover, political pressure from the Abe regime to hold rates steady is not expected to abate and could even intensify ahead of an election for parliament's upper house in July. “We expect the BOJ to conduct monetary policy appropriately while keeping in close contact with the government,” said Chief Cabinet Secretary Yasuhisa Shiozaki on Jan 21st.

The final BoJ board vote was the closest in over three years and showed a marked shift from the 9-0 vote at the last meeting when rates were also held steady. One of the three hawks on the Bank of Japan Policy Board member Miyako Suda said on Jan 25th, the central bank needs to take certain risks in deciding monetary policy to prevent excessive stimulative effects in the economy.

“Since we are guiding monetary policy in a forward-looking manner we need to take certain risks, even if uncertainties remain in the outlook for the economy. Otherwise the timing of a rate hike may be delayed," Suda said. Still, the hawks are out numbered 2 to 1 at the BoJ, and the stench of dirty LDP politics hangs in the air.

After climbing to a 5-year high of 0.57%, Japan's 3-month Libor rate plunged 14 basis points to 0.43% on January 25th, after the BoJ left its overnight rate unchanged at 0.25%. Tokyo gold climbed 8% towards 78,800 yen /oz, just 3% shy of an 18-year high. Tokyo gold traders have little faith in the BoJ to maintain the purchasing power of the Japanese yen, which fell to 9-year lows against the British pound, the Euro, and the Korean won, and down to a 4-year low against the US dollar.

Gold Bumping against 500 Euros /oz,

The European Central Bank is dragging its heels in containing the explosive growth of the Euro M3 money supply, which expanded at a 9.3% clip in December, it's fastest in 16-years. The 14% decline in crude oil prices in January is bound to exert downward pressure of European inflation statistics, buying the ECB more time, before contemplating another rate hike.

The ECB kept its key rate at 3.50% this month, without giving any clear guidance on the timing of its next likely move. “Lower oil prices could help ease Euro zone inflation pressures in 2007 but upward risks still prevail,” said Bundesbank chief Axel Weber on Jan 22nd. “There is potential for a slight relaxation in inflation for 2007, as long as the oil price remains permanently at the current lower level,” he said.

“But I don't think that is the most likely outcome when I look at the futures markets, quite the opposite,” Weber noted. While the price of US light crude oil for February delivery is trading at $51.20 per barrel, the farther dated June contract is quoted above $55 /barrel. Still, the timing of Weber's hawkish jawboning was designed to turn back gold's rally from the psychological 500 Euros /oz level.

For now, the ECB can offer nothing but verbal threats to restrain gold bulls in Europe, who are squarely focused on the explosive M3 money supply growth. A surge in gold above 500 Euros /oz would force the ECB's hand, and make a quarter-point rate hike to 3.75% all but inevitable. While not specifically mentioning the gold price, which is foremost on his mind, Weber offers a diversion to explain his hawkish line.

“I fear that in the current economic environment, and given the political acceptance that wage increases have found at the moment that wage settlements could turn out stronger than we have assumed,” Weber said. German unions are seeking 5.5% more pay for construction workers this year and up to 6.5% more in the engineering industry, although official inflation in the Euro zone's biggest economy was just 1.4% in December. The gold market doesn't place much faith in such statistics.

“Monetary policy cannot wait until second-round effects materialize. We have to run a forward-looking monetary policy and orient ourselves based on what our expectations are,” he said. According to the Frankfurt futures market, the ECB is expected to hike its repo rate 0.25% to 3.75% in the first week of March.

The ECB is walking a tight rope, between growing political pressure to halt its rate hike campaign, and fears about an upsurge in gold prices above 500 Euros /oz, which can undermine the European bond markets. In the end, the ECB is expected to continue lifting its repo rate, but at a slower pace than in H'2 of 2006. But a slower pace would make it more difficult to rein in the explosive growth of the M3 money supply.

Six baby-step ECB rate hikes to 3.50% have kept gold locked within a range of 450 to 500 euros /oz for the past six months, or 14% below its 2006 high of 565 euros /oz. European Gold bulls are waiting for the earliest signal that the ECB has run out of ammunition on the monetary front, and is getting ready to join the Federal Reserve, the Bank of Japan, and the Bank of Canada to sit on the sidelines.

The earliest date for the next ECB rate hike to 3.75%, which has a 140% probability according to the Frankfurt Euribor futures market, is the first week of March, still six weeks away. But such a long delayed manuever, is comparable to fighting pnuemonia with aspirin, and not likley to contain the explosive growth of the Euro money supply.

Gold Ready to Rumble higher from Down Under,

Gold is starting to break-out in Sydney, climbing above key horizontal resistance at 630 Aussie dollars /oz on Jan 25th. More importantly, Gold is busting out of an extended triangle pattern, which is typically a continuation pattern of the previous major trend, which is obviously Upward! Most interestingly, Gold is up 10% since the Bank of Australia's last rate hike to 6.25% in November.

The new RBA chief Glenn Stevens wanted to prove his mettle as an anti-inflation fighter, with a quick rate hike at the start his tenure. But in reality, Stevens has been busy feeding strong loan demand at home, with explosive growth of the Aussie M3 money supply. It's important to realize, that three RBA rate hikes to 6.25% last year, did not slow down the growth rate of the M3 money supply.

Instead, Aussie M3 soared to a three and a half year high of 13% growth in November, up from an annualized growth rate of 7.6% a year earlier. The RBA would have to lift its cash rate another 75 basis points to 7.00% to get control over M3. For now, the central bank is content to feed strong loan demand at home with injections of cash, which has been pumping the ASX-200 Index to dizzying heights.

The ASX-200 Index has doubled from four years ago, while gold has gained 45% against the Australian dollar. There is more at work behind the ASX's strength besides rapid money supply growth. Booming commodity prices, especially for base metals, uranium and gold, boosted Australia's mineral and energy exports to A$111 billion in 2006, up 20% from the A$92 billion in 2005, lifting profits for ASX-200 miners. Coal and iron ore lead Australia's resource exports.

By Gary Dorsch, Editor, Global Money Trends newsletter

## “This article is just the Tip of the Iceberg” of what’s available in the Global Money Trends newsletter published around the 1st and 15th of each month in pdf format, and 20-25 pages in length. GMT collects a wide array of news and information from reputable sources, filters out the noise and distractions, and puts all the pieces of the global economic puzzle together into coherent snapshot analyses, with lots of cool charts depicting the inter-relationships of markets and economies from around the world.

Here's what you will receive with a subscription,

Insightful analysis and predictions of, (1) top stock market indexes around the world, and US-listed Exchange Traded Funds (ETF’s) and closed-end country funds. (2) Commodities such as crude oil, copper, gold, silver, the CRB index, and gold mining and oil company indexes. (3) Foreign currencies such as, the Australian dollar, British pound, Euro, Japanese yen, and Canadian dollar. ($) Libor interest rates, global bond markets and their central bank monetary policies.

Subscribers will also receive Email Alerts, sent out in-between regular newsletter postings, when important information unfolds in the global markets. A subscription to Global Money Trends is only $125 US dollars per year for 24 issues, including access to all back issues. Click on the following hyperlink, to order now, http://www.sirchartsalot.com/newsletters.php

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.