Stupid Politician Monkeys Another Reason to Buy Gold

Politics / US Politics Sep 12, 2011 - 02:19 PM GMTBy: David_Galland

David Galland, Managing Director, Casey Research writes: The human ape has any number of qualities not often found in other species of mammalia, including opposable thumbs and the ability to fashion and use tools.

David Galland, Managing Director, Casey Research writes: The human ape has any number of qualities not often found in other species of mammalia, including opposable thumbs and the ability to fashion and use tools.

Continuing the list, I would add a tendency to form all manner of mental constructs and to then act in accordance with those constructs, even when those constructs have little or no connection to reality.

Thus, for instance, I stride confidently onto the golf course with the firmly held conviction that I am a solid striker when, in fact, on most days I am a wild-hitting duffer of the lowest order.

But an over-elevated opinion of one’s golf game is harmless compared to some of the delusions humans are capable of. For instance, the teenager who becomes convinced that by blowing himself up in a crowd of innocents, he is serving some sort of higher purpose… or that his reward will be an eternity highlighted by bedding virgins.

A more widespread delusion is a tendency to believe in the status quo. Simply, that tomorrow will be roughly on par with today, a construct that extends out as far as the mind’s eye can see.

This particular construct is entirely understandable – it’s this expectation that things will be more or less constant that allows us to make plans and take the steps necessary to execute those plans. In other words, it is a lynchpin to human progress.

Conversely, when the controlling force of the economy that sustains us in our businesses and lifestyles is ever changeable – and these days that controlling force is the government – sensible humans become wary and start squirreling away nuts in preparation for an uncertain future. This is, of course, not conducive to a vibrant economy.

What will Team Obama dream up next in their flailing attempts at reinvigorating an economy that more than anything needs certainty? It is literally anyone’s guess. Are we going all in on the whole carbon credit thing, or is that now a passing fad? Will the Dodd-Frank Act, with its 400+ new rules for financial institutions and everyday businesses, such as automobile dealers who offer financing, help or hurt? Will the government, having bailed out the big banks, now turn around and sue them out of existence… or just until they squeal?

Is it any wonder that the banks now have upwards of $1.6 trillion in reserves sitting on the Fed’s balance sheet? Sure, they are earning a whopping 0.25% interest rate while taking no risk, as they would do if they put the money out as loans to the public. But the real implication – at least to me – is that they are keeping their capital on hand against the uncertainty of future government action and to deal with the hundreds of billions in toxic loans still on their balance sheets.

Another large subset of the human herd has become brainwashed to the point of delusion by a combination of state education, misinformed college professors, mainstream media, religious leaders and high-talking politicos into believing that they as individuals are little more than pawns, knee-benders, set on this planet to follow a path proscribed by the power elite.

As a consequence, when social trials arise on that path, they look first to the government for solutions. And they cling stubbornly to false beliefs, such as the myth of anthropogenic global warming, even though the truth of the situation would be readily apparent if they trusted in their instincts and did some actual research.

And so it is that while the world is dominated by the human ape, the species is greatly hindered in its progress by stupid monkeys. Let anywhere near the levers of power, it is a certainty these stupid monkeys will start pulling madly, and keep pulling even as the machine begins to shudder and smoke.

Making the point, I would like to share with you – a more sensible species of simian, I am sure – a few examples of stupid monkeys at their dumb deeds; deeds that can only make one shake one’s head in dismay.

For example….

The stupid monkeys at the Justice Department decided to block a merger between AT&T and T-Mobile because it would “harm competition.”

“Gawd’s blood!” I cry out loud to no one. The whole idea of such a business combination is, of course, to “harm the competition” by enhancing profitability with a combination of larger market share and reduced redundancies. Maybe the Justice Department should require AT&T to shut down, because the very act of staying in business is clearly damaging to the competition. And while they are at it, the feds should also clamp down on the burgeoning Internet telephony companies that are now slashing into the market share of all the big telecoms.

A sub-species of particularly stupid and destructive capuchins in the California legislature appear poised to pass a bill that will effectively put an end to hiring an adult babysitter or anyone seeking casual employment doing odd jobs.

Here’s the state’s own legislative summary of the bill’s intent:

Existing law requires employers to secure the payment of workers compensation for injuries incurred by their employees that arise out of and in the course of employment. The failure to secure workers compensation as required by the workers’ compensation law is a misdemeanor. Under existing law, employers of persons who engage in specified types of household domestic service and who work less than a specified number of hours are excluded from that definition of employer and are therefore excluded from the requirement to secure the payment of workers’ compensation, as specified.

This bill would remove that exclusion and require all domestic work employers, as defined, to secure the payment of workers compensation and would make conforming changes. By expanding the definition of a crime, this bill would impose a state-mandated local program.

In lay terms, the bill – which already overwhelmingly passed in the Democrat-controlled assembly and just passed unanimously through the California State Assembly Committee on Appropriations, precedent to passage by the Senate and therefore into law – will require you as a parent (or otherwise casual employer) to follow formal employee reporting protocols and, among other disincentives to employ, provide your babysitter with worker’s compensation benefits, regularly scheduled rest and meal breaks and even paid vacation time.

Failing to do so will open you up to lawsuits from disgruntled help and being dragged into court by the nanny’s nanny (state).

Now, a monkey with even average intelligence might conclude that passing this law in the grips of an unemployment crisis – and California’s unemployment rate is over 12%, versus the nationwide average of 9.1% – would curb enthusiasm for hiring and so should be avoided. But not the stupid California capuchins.

Vermonters want to block the shipment of oil from the tar sands through the state.

This next example is particularly ripe, providing evidence of just how badly the US educational system has failed its pupils.

Quoting a supportive article in Vermont’s Burlington Free Press…

A tar sands oil developer might be planning to pipe its product to Montreal – and then across Vermont’s Northeast Kingdom in an existing pipeline to Portland, Maine, according to Canadian and American environmental groups.

That threatens the region’s air, water and wildlife habitat, the environmentalists say.

Egad, a reader might decide, the region’s environment is at risk. Break out the placards, fuel up the lawyers!

We are all aware, of course, of the principle of NIMBY – as in Not in My Back Yard. But even the most simple of simians might want to rethink the notion that Ft. McMurray, Alberta – the hub of the Canadian tar sands and source of the hateful oil – is in Vermont’s backyard. Unless one also considers, say, Phoenix, Arizona to be similarly a part of the neighborhood: Ft. McMurray is about 2,750 miles from Vermont, and Phoenix just 2,600.

And how is it that feeding processed oil into an existing pipeline constitutes such a dire threat?

Oh, what folly these enviro-monkeys are capable of. It it’s positively laughable, but only if you like laughing in the dark.

Then there’s this, from the Stupid-Monkey-In-Chief (SMIC)

This week, our own President Obama, the SMIC, has confirmed his intention to tune up his vocal chords in order to create the jobs that have so far gone missing in this crisis, and which, according to today’s again dismal unemployment data, remain nowhere in sight.

Said the SMIC:

“It is my intention to lay out a series of bipartisan proposals that the Congress can take immediately to continue to rebuild the American economy by strengthening small businesses, helping Americans get back to work, and putting more money in the paychecks of the middle class and working Americans, while still reducing our deficit and getting our fiscal house in order,” Obama said.

“We’re saved!” shout the staunch few that still believe the SMIC is cut from superior cloth. But even the stupidest of the stupid monkeys might be tempted, after so many disappointments, to raise their hands and ask, “What’s the plan, chief?”

In answer to which I provide the following preview of “the plan,” courtesy of Bloomberg…

Obama’s plans include more infrastructure spending, tax incentives to spur hiring, a reduction in the employer portion of the payroll tax credit and changes to unemployment insurance to subsidize worker retraining.

Did you just get an overwhelming sense of déjà vu? If so, it’s probably because the SMIC’s latest plan is pretty much the same as the previous plan, and the one before that. Sure, there are a few tax breaks here and there – but companies don’t hire people based on tax breaks. They do so because there is work to be done and people are needed to do it. And in the real world, a $5,000 tax credit for hiring someone – the amount being bandied about in the new plan – will be burned through in a couple of months of (now mandatory) health insurance payments.

Still in the real world, if the country is to pull itself out of the muck, the government needs to stop spending itself into a deeper and deeper fiscal hole. And it needs to undergo radical reforms in regulatory and tax regimes (to attract businesses and capital here, versus over there). And it needs to remake the monetary system on a foundation of something more tangible than political promises.

But first of all, the government has got to acknowledge the simple reality that it cannot meet its obligations and begin, in earnest, the restructuring of those obligations.

Of course, only a stupid monkey would look at the state of our degraded democracy – where half of the monkeys pay no taxes while complaining about the half who do – and believe that the government will willingly make any significant reforms, versus just handing out more bananas.

Therefore, smarter-than-average monkeys are actively taking steps to protect themselves from the coming currency debasement – the only way the government knows to reduce its debt in a politically acceptable way.

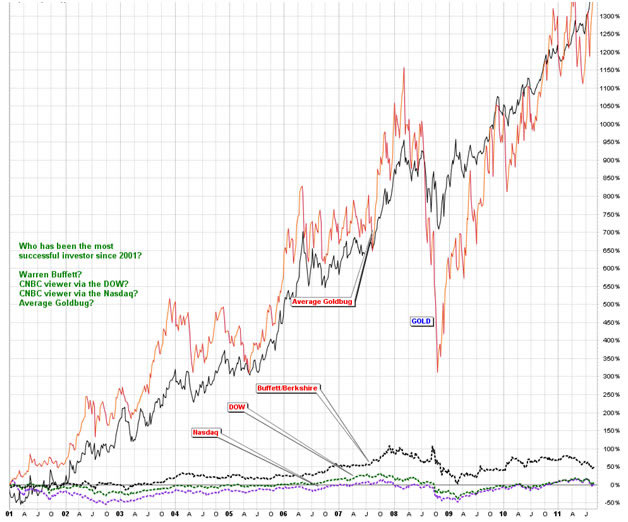

Back in 2001, Doug Casey and very few others were waving their arms and hooting about the need to buy gold – had you acted then, you would have outperformed even the legendary Warren Buffett. And as the chart here shows, you would have outperformed them, decisively so.

[Don’t let your future be at the mercy of the D.C. stupid monkeys. Register today for the upcoming Casey online, free video event – The American Debt Crisis: How Big? How Bad? How to Protect Yourself. Listen to Doug Casey, David Galland, others from the Casey Research team, and some special guests explain how bad things are likely to get for the US economy and dollar… and learn how you can start to prepare and even thrive during it. The event will be held Wednesday September 14 at 2 p.m. EDT. Don’t miss it!]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.