Monday Stock Market Pivot Point

Stock-Markets / Stock Markets 2011 Sep 11, 2011 - 03:06 PM GMTBy: George_Maniere

In 1940 Jesse Livermore wrote one of the classic books on the workings of the Stock Market “How to Trade in Stocks. By this time Jesse Livermore had developed a mathematical formula that incorporated what he termed “Pivot Points” in determining when to initiate a buy or a sell. When he calculated pivot points, the pivot point themselves, were the primary support or resistance of the asset. This meant that the largest price movement (either up or down) was expected to occur at this point. The other support and resistance levels were less influential, but still had the ability to generate significant price movements.

In 1940 Jesse Livermore wrote one of the classic books on the workings of the Stock Market “How to Trade in Stocks. By this time Jesse Livermore had developed a mathematical formula that incorporated what he termed “Pivot Points” in determining when to initiate a buy or a sell. When he calculated pivot points, the pivot point themselves, were the primary support or resistance of the asset. This meant that the largest price movement (either up or down) was expected to occur at this point. The other support and resistance levels were less influential, but still had the ability to generate significant price movements.

I have found that the use of pivot points is another useful tool that can be should be added to any trader's toolbox. It enables anyone to quickly calculate levels that are likely to cause price movement. The success of a pivot-point system, however, lies squarely on the shoulders of the trader, and on his or her ability to effectively use the pivot-point system in conjunction with other forms of technical analysis. These other technical indicators can be anything from MACD crossovers to candlestick patterns - the greater the number of positive indications, the greater the chances for success.

While Jesse Livermore used pivot points to determine when to initiate buys or sells of stocks, I have found that pivot points can be used to determine the overall market trend. If the pivot point price is broken in an upward movement, then the market is bullish, and if the pivot point price is broken in a downward movement, then the market is bearish. It is important to note, however, that pivot points are short-term trend indicators, useful for only one day until they need to be recalculated.

What makes this essay so important today is that Monday will be one of the pivot point moments. There are several reasons why.

- The European Central Bank (ECB) is on the cusp of dealing with a default of Greece. If Greece defaults on their debts it will have a negative ripple effect through the global economy. All global banks have some skin in this game and a Greek default would be catastrophic for the global financial system. Add to this that if the Greeks default what will stop Portugal, Spain and Italy from pursuing the same course of action. Needless to say the consequences would be disastrous.

- President Obama laid out his jobs creation plan for the nation last Thursday and while the market sold off hard on Friday I believe the selloff was more a factor of the ECB contagion than how Congress felt about President Obama’s bill. I think that Monday we will get a good look at how Congress viewed his proposed jobs creation bill.

- There is an alarming lack of confidence in our government and its ability to create growth, our economy to create new jobs and our ability to maintain our standard of living. I believe that most people feel that our children will have a more difficult life than we did.

- The tensions in the Middle East are escalating as Israel is on the brink of war; Egypt looted the Israeli embassy and effectively cut off relations with its neighbor to the north and Syria has a vicious dictator that is engaging in slaughtering his own people.

These are just a few of the reasons that I feel we are at a pivot point on Monday. Please see the chart below.

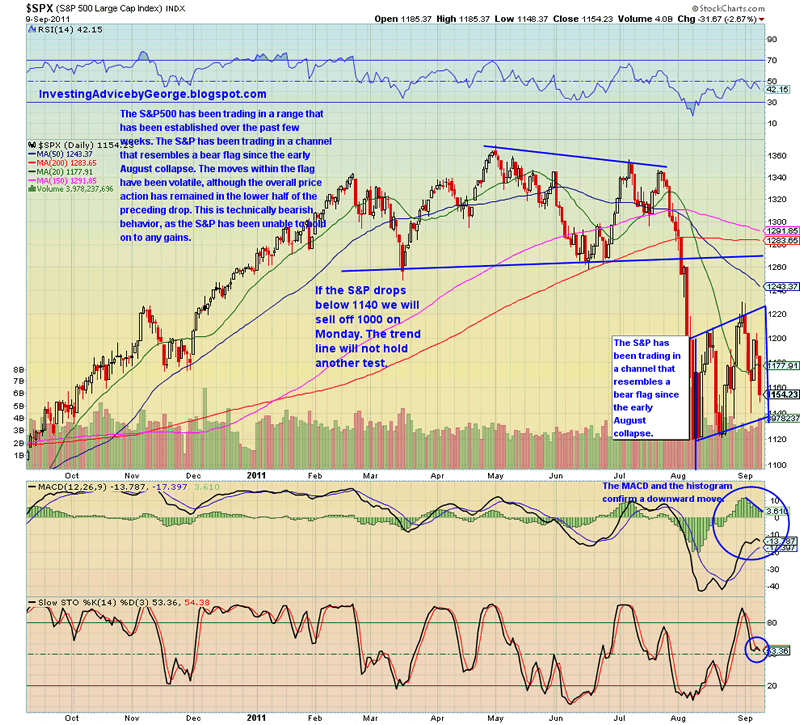

A look at this chart will show that stock market once again finished the week on a sour note after a promising start. The holiday shortened week began with a significant gap to the downside that threatened a breakdown. However, after the initial weakness on Tuesday, the markets steadily rose higher closing near the highs for the day. While the end result was still a down day, it was a big improvement compared to the open. By Wednesday, the markets gapped higher and had a strong day. This had bulls in a great mood, but this would be short lived as a mid-week reversal left a bad taste in their mouth. The markets remain range bound and Monday will be a very important day for the market.

In looking at the chart for the S&P500 it is clear to see the trading range that has been established over the past few weeks. The S&P 500 has been trading in a channel that resembles a bear flag since the early August collapse. While the overall price action has remained in the lower half of the preceding drop, the moves within the flag have been volatile. This is technically a very bearish indicator, as the S&P has been unable to hold on to any gains. The close on the S&P on Friday at 1154 is a pivot point. When the market opens, one of two things will happen. The market will snap back to the 1180.00 range which would indicate that we may have a bit more upside potential to go possibly the 1250 range. The second thing that might happen is that we will sell off at the bell. If we selloff and break 1140 we could go down 100 points by Tuesday.

I advise all of my readers to keep a close eye on this range, as a move in either direction could escalate quickly.

If we break 1140 on the trend line I will go long SPXU.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.