Bernanke Keeps Door Open for Additional Stimulus on Weaker Economic Growth

Economics / US Economy Aug 27, 2011 - 02:49 AM GMTBy: Asha_Bangalore

Chairman Bernanke stressed that the Fed “has a range of tools that can be used to provide additional stimulus” but he was silent on specifics. He mentioned that the costs and benefits of these options were discussed at the August 9 meeting. These details will be available when minutes of this meeting are published on August 30. He reiterated parts of the August 9 policy statement noting that “the Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger recovery in a context of price stability.”

Chairman Bernanke stressed that the Fed “has a range of tools that can be used to provide additional stimulus” but he was silent on specifics. He mentioned that the costs and benefits of these options were discussed at the August 9 meeting. These details will be available when minutes of this meeting are published on August 30. He reiterated parts of the August 9 policy statement noting that “the Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger recovery in a context of price stability.”

In Bernanke’s opinion, the “growth fundamentals” do not appear to have been modified by the shocks of the last four years. Despite positive developments he sees the recovery from the crisis to be “less robust” compared with expectations. He projects an improved outlook for the second-half as temporary factors which setback economic growth in the first-half of the year have receded. He went on to add that “economic healing will take a while, and there may be setbacks along the way.” In this context he added that the Fed “will remain alert to risks to the recovery, including financial risks.”

In the near term, the Fed expects a moderate recovery to continue and strengthen over time. He noted that the Committee had marked down its outlook for the likely pace of growth over coming quarters. The FOMC views inflation to come in at or below 2.0%, such that it is consistent with the Fed’s dual mandate. Bernanke also indicated that the September 20 FOMC meeting has been changed to a 2-day meeting concluding on September 21, implying that the nature of recent economic data has raised the level of concern at the Fed.

About the long-run outlook of the economy, Bernanke does not expect the long-run potential of the U.S. economy to be materially affected by the crisis and the recession if our country takes the necessary steps to secure that outcome.”

On the fiscal policy front, Chairman Bernanke made two important remarks: First, “U.S. fiscal policy must be placed on a sustainable path that ensures debt relative to national income is at least stable or, preferably, declining over time.” Second, a gentle scolding after the recent federal budget impasse was part of the speech indicating that the “country could be well served by a better process for making fiscal decisions.”

Second Quarter Growth is a Tad Weaker than Prior Estimate

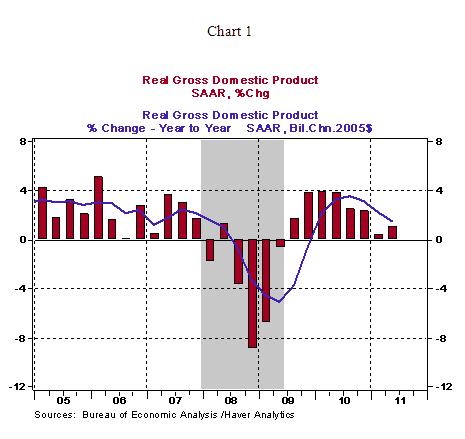

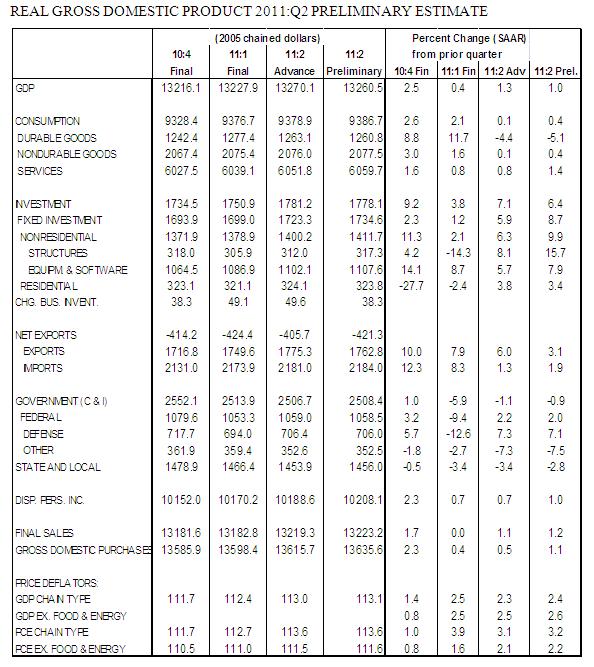

Real gross domestic product (GDP) of the second quarter was revised to a 1.0% gain from the prior estimate of a 1.3% increase. Effectively, the U.S. economy nearly stalled in the first-half of the year. A reduction of prior estimates of inventories and exports made up a large part of the downward revision. Consumer spending and equipment and software spending recorded small upward revisions but were only a partial offset to downward revisions.

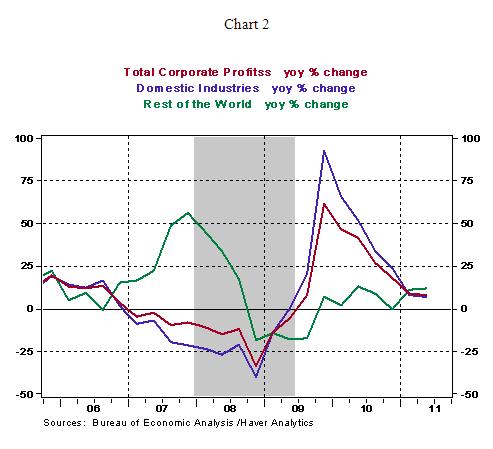

Corporate profits rose 3.1% in the second quarter after a 1.0% gain in the prior quarter. However, from a year ago, corporate profits show a decelerating trend. Earnings from the rest of the world moved up 6.6% in the second quarter, while profits of domestic industries rose only 2.1%.

The outlook for the second-half of the year is sluggish growth. Auto production is likely to give a lift to third quarter real GDP growth but it is unclear if this trend will prevail in the fourth quarter. The soft performance of the economy is most likely lead to a higher unemployment rate.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.