Germany May Want PIIGS Gold as Security for ‘Bailouts’, Merkel’s Officials in Damage Limitation Mode

Commodities / Gold and Silver 2011 Aug 24, 2011 - 03:38 PM GMTBy: GoldCore

All major currencies are lower against gold today with the Japanese downgrade and concerns about global growth taking their toll on Asian stock markets. While European indices have eked out gains, some selling of peripheral European debt has been seen again and yields on German bunds have risen.

All major currencies are lower against gold today with the Japanese downgrade and concerns about global growth taking their toll on Asian stock markets. While European indices have eked out gains, some selling of peripheral European debt has been seen again and yields on German bunds have risen.

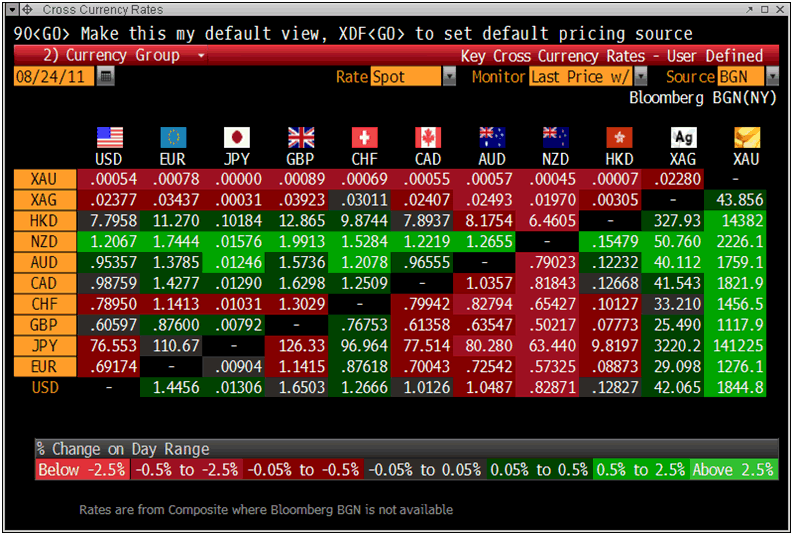

Cross Currency Table

Gold is trading at USD 1,844.80, EUR 1,276.10, GBP 1,117.90, CHF 1,456.50 and JPY 141,225 per ounce.

Gold’s London AM fix this morning was USD 1,850.00, EUR 1,279.30, and GBP 1,119.58 per ounce (from yesterday’s USD 1,886.50, EUR 1,301.75, GBP 1,138.64 per ounce).

The long expected correction in gold began yesterday and gold fell 1.6% in dollar terms. Traders taking profits after the recent price surge led to the falls yesterday.

In trading terms, gold’s recent price appreciation of nearly 17% in one month had been excessive - although completely understandable given the scale of the crisis facing the global financial and economic system.

Another very significant development for the gold market took place yesterday when an influential member of Germany’s ruling coalition, Ursula von der Leyen, said that Germany should follow Finland’s lead on Greece and seek collateral for loans from bailout countries and the collateral should preferably be gold.

Ursula von der Leyen is a senior German minister; deputy chairwoman of the Christian Democrats (CDU) and is a potential rival to Angela Merkel. It is unlikely that she would have made a solo run on this if she had not had a prior discussion with Merkel or at the very least with her government colleagues and lawmakers.

Government officials and anonymous government sources were quick to distance the chancellor and her government from Ms von der Leyen’s demands but Merkel herself did not comment and did not reject the call.

CDU finance spokesman Michael Meister said the call for periphery nations to give their gold reserves as loan collateral was a distraction. “The most important thing is that central banks retain independent control of their own gold reserves,” he said.

However, German officials were in full damage limitation mode. The maxim ‘never believe anything until it is officially denied’ may be appropriate.

Germany is likely to push for European gold reserves to be used as collateral. The Deputy Chairwoman of the Christian Democrats is an astute woman and politician and knew exactly what she was saying.

Indeed, she echoed other senior lawmakers who in May called for Portugal to consider selling their gold.

Two leading governing party members - Norbert Barthle, Germany’s governing coalition budget speaker and his counterpart Carsten Schneider from the Social Democrats, the biggest opposition party, urged Portugal to consider selling some of its gold reserves to ease its debt problems. They called for a review of Portugal’s request for financial aid to include gold and other potential asset sales.

The German people and lawmakers realize that the euro is being debased and lawmakers realize that gold may offer protection from the debasement of the euro but also from sovereign default and systemic contagion.

Some of the PIIGS (to use the unfortunate and unfair acronym) have very sizeable gold reserves – especially Italy which alone has some 2,452 tonnes of gold. Portugal has 421.6 tonnes, Spain 281.6 tonnes, Greece 111.7 tonnes and Ireland has just 6 tonnes.

The ‘German PIIGS gold collateral’ story is a very important one that is unlikely to go away. Indeed, it may be the story that helps educate those not familiar with economic and monetary history and with monetary economics and who do not understand gold and why gold remains valuable and remains a safe haven asset and currency today. (World Gold Reserve Chart - Wikipedia)

Misguided ‘Gold Bubble’ Callers Out in Force Once Again

Gold remains overbought in trading terms and due a correction but the continuing simplistic talk that gold is a bubble is again misguided. It is a simplistic call based on assumptions and not based on the fundamentals of the gold market.

Some of the people calling gold a bubble today have been saying gold was a bubble when it reached $850/oz in early in 2008.

There remains a massive lack of understanding of what is happening in the gold market and very significant developments in the gold market are ignored due to a lack of knowledge and in some cases due to bias and ignorance.

The fact is that those who claimed gold was a “barbaric relic” and a “useless commodity” have gotten gold spectacularly wrong.

This is because gold is not just a commodity. It is much more than that – it is money. Money that cannot be created at a whim and debased by politicians, bankers and central bankers.

It is also a safe haven asset and safe haven currency that has no counter party risk as it cannot default.

This is why gold is in demand today by astute people, governments and central banks.

This is why central banks internationally were net buyers of gold in 2010, and will be in 2011and 2012, and almost certainly throughout this decade.

This is why the People’s Bank of China is building their gold reserves without declaring it to the world and is encouraging their citizens to buy gold.

This is why overnight Kazakhstan has given its central bank a ‘priority right’ to purchase all domestically mined gold "in full".

This is why Chavez has nationalized the Venezuelan gold industry and is repatriating Venezuela’s gold reserves.

This is why Bild, the best selling daily newspaper in Germany urged their readers to buy gold two weeks ago.

This is why senior German government officials are calling for the gold reserves of European countries such as Greece, Portugal, Spain, Italy and Ireland to be used as collateral for future loans.

Importantly, gold is a store of value unlike other assets, and unlike fiat currencies such as the US dollar, pound and the euro.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

SILVER

Silver is trading at $41.89/oz, €29.02/oz and £25.46/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,863.50/oz, palladium at $761/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.