Gold $2000 and Silver $100 by Years End

Commodities / Gold and Silver 2011 Aug 22, 2011 - 02:20 AM GMTBy: George_Maniere

Politicians should stick to what they’re good at, groveling for money to fund their next re-election campaign and making pompous speeches to stir up even more partisan bickering. What they should not do is stop making believe that they know anything about economics. If I bought Harvard University it would not qualify me to teach organic chemistry. Well the same is true of politicians. Just because you have a pleasant smile and a personality that does not completely turn every voter off does not make you qualified to speak about economics. Politicians should simply stick to what they’re good at and if anyone can figure out what they’re good at would you be kind enough to drop me a post and let me know.

Politicians should stick to what they’re good at, groveling for money to fund their next re-election campaign and making pompous speeches to stir up even more partisan bickering. What they should not do is stop making believe that they know anything about economics. If I bought Harvard University it would not qualify me to teach organic chemistry. Well the same is true of politicians. Just because you have a pleasant smile and a personality that does not completely turn every voter off does not make you qualified to speak about economics. Politicians should simply stick to what they’re good at and if anyone can figure out what they’re good at would you be kind enough to drop me a post and let me know.

As I predicted last week the meeting between French President Nicholas Sarkozy and German Chancellor Andrea Merkel was more a photo op and a reason to have tea than a real opportunity. The reason for this has been long been known and written about. In an essay by one of my favorite writers Martin Armstrong he talked about the folly of creating a euro currency without creating a Euro debt. He argued that all of the European debt should be combined in to one debt. Indeed, by not consolidating all of the European debt onto one Euro – Bond and eliminating the use of the trading bonds as an alternative to the ability or inability to trade currencies, then Europe has all but guaranteed the collapse of the Euro.

As I read this essay I imagined all of the states in the U.S., which have their own budget, also having their own printing presses to solve their debt problems. In case that wasn’t clear, while every state has its own budget and debt concerns, the U.S. has one currency and one debt. The federal government collects taxes from all fifty states and doles out funding to each state on an “as needed basis.” Sometimes one state will receive more funding than another state but we see ourselves as on nation working together. So to finish with Sarkozy and Merkel, the fact is that they have not got the idea that if they want one currency then they have to have one combined debt. Maybe they might want to read some of the fine posts on this site and learn a little bit about trading because until they fix this problem the bond bullies will short the Greek, Italian, Portuguese and Spanish bonds. Sadly what effects Europe affects our economy. Our banks have Billions of dollars that have been leant to European countries.

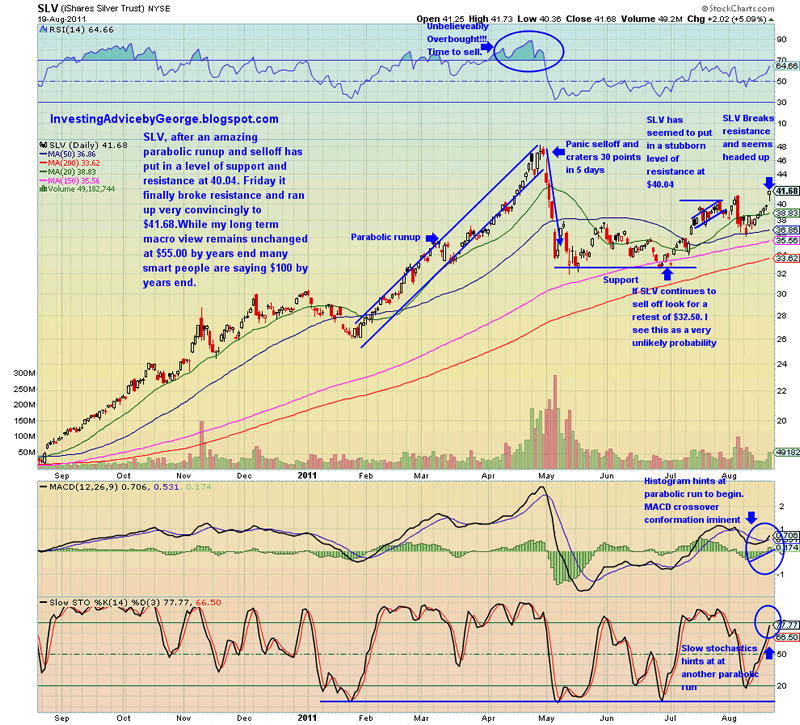

The degree of uncertainty that exists today is tearing the world apart. The only safe haven that people are flocking to is Gold and Silver. While the gold trade is unbelievably crowded there seems to be no stopping it. While JP Morgan put a target on it of $2000.00 by the end of the year I’d be surprised to see it not hit $2000.00 by the end of next week. Silver broke a key level of resistance on Friday and did it in a convincing fashion. Until Friday the Silver ETF (SLV) had stubbornly held onto a resistance level of $40.04. In Friday I blew through it and closed over $2.00 at $41.68. Please see the enclosed chart below.

A study of this chart will show that since it corrected back in May it has been floundering around in the 35 range and it did stage a fake break out and ran up to $40.04 but pulled back. What makes this breakout all the more convincing is that The MACD has yet to confirm the breakout by crossing over the nine day exponential moving average, and the tell me it still has room to run. When it does it will go to $50.00 in a hurry. In fact I’m changing my target for end ot the year to $100.00 It’s going to run up in a hurry. I sent my readers an alert Friday night and told them to start buying in slowly and keep a watchful eye on gold because that could be a game changer. Denis Gartman was finished a speech and got in a cab to catch a flight back to Virginia Beach, where he lives. The cabbie said he looked familiar and Denis told him he was on CNBC from time to time and they guy connected the dots and gave Denis a course on owning gold all the way to LaGuardia. As soon as Denis got home he sold half of his Gold ETF (GLD).

I saw a video on YouTube by a very smart man who calls himself Brother John F and I would encourage you all to watch this video by clicking here. I have been watching his analysis

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.