Evidence Banks Bought Off Washington

Politics / US Politics Aug 19, 2011 - 08:57 AM GMTBy: Mike_Stathis

One of the themes I have been emphasizing over the past few years focuses on the destruction of the U.S. economy and control over the political system by lobbyist groups. As long as lobbyists exist, America will continue to be run by corporations.

One of the themes I have been emphasizing over the past few years focuses on the destruction of the U.S. economy and control over the political system by lobbyist groups. As long as lobbyists exist, America will continue to be run by corporations.

What does this really mean?

It’s quite simple. Control over government by corporate interests is defined as fascism. This is precisely the type of government that has presided over United States for well over three decades. As long as corporate interests control Washington, the United States will never have a government that resembles a democracy, much less a republic.

When so-called experts in the media discuss America’s problems and offer solutions, you are not likely to hear mention of the power held by lobbyist groups. On rare occasion when the influence of lobbyists is mentioned, it is only in passing. Never will you hear anyone in the media recommend an end to all lobbyist activities as one component of restoring America’s past greatness.

Today, the power wielded over Washington through lobbyist organizations is thought of as a birth right of sorts. Thus, because corporations exert complete control over Washington by the use of lobbyists, a prerequisite for those who propose economic solutions must include a recommendation to ban all lobbyist activities. Otherwise, such individuals either have no interest in the American public and the future of this nation, or else they are unqualified to offer real solutions.

Lobbying firms receive huge sums of money from corporations and other entities. Under the direction of corporate liaisons, lobbyists use their bank accounts to get the bills passed that favor their corporate clients. Many lobbyists themselves are former politicians and corporate insiders. They use their connections and network to bribe politicians in exchange for favors. Most often, these favors include blanket impunity. As a result, corporate CEOs are untouchable, regardless of their crimes. Other times, lobbyists use blackmail, extortion and threats in order to get monopolistic mergers and acquisitions and industry deregulation approved.

Often, lobbyists actually write the bills they want passed and shuttle them to congressional puppets. They also devise deceptive strategies to mask their real intent, such as when they lobby for lax or excessive regulation so that corporations will have valid excuses for sending jobs overseas. All one need do is to examine the business activities of any mega-corporation over the years, and you’ll see what’s going on; Wal-Mart, Intel, AT&T, Microsoft, Google, Pfizer, etc. Just from this short list of corporations you will see a long history of bribes, violations of anti-trust laws, industry collusion, and taxpayer fraud.

In defense of their actions, Washington officials and corporate lobbyists work closely with America’s tightly-controlled media monopoly to disseminate inaccurate information after receiving huge corporate bounties. For instance, despite substantial evidence pointing to the contrary, deregulation most often leads to higher prices for consumers because it facilitates the elimination of competition and promotes collusion. This is especially the case for industries supplying basic necessities.

As we have seen throughout history, the laissez-faire business environment endorsed by Milton Friedman and Alan Greenspan actually widens the avenues for corporate fraud, industry collusion, and many other manipulative market behaviors due to the influence of lobbyists. Moreover, the prevalence of the revolving door connecting Washington with corporate America has also served to transform America’s former free market economy into crony capitalism.

We have seen far too many examples illustrating the behavior of corporate giants when not held accountable for their actions. The same can be said of elected officials. Even when regulatory agencies have been assigned the responsibility of ensuring a fair and competitive market place, regulatory capture is most often the end result. In this case, regulatory agencies are bought off by industry lobbyists to serve as an ally to the industry and an enemy of consumers.

The corporate media aids lobbyists in spreading propaganda to the public, using its own version of experts who insist that regulation stifles the free market system. In reality, the United States has not enjoyed a real free market system for decades. The unified mechanism of fraud and deception has been highly effective in the preservation and further strengthening of America’s fascist regime.

Today, most Americans are convinced of the lies they have been fed from the media. The list is endless, ranging from 9-11 and the war on terror, the economy and healthcare, to politics and education. In fact, the lies have become so pervasive and routine that well-informed Americans assume the media and Washington are lying until proven otherwise. Unfortunately, this group of Americans accounts for only a very small percentage.

The end result of lobbyist activities is the theft of wealth and income from consumers by corporate giants through price hikes facilitated by collusive activities, corporate bribes and extortion, taxpayer fraud, securities fraud, and government subsidies.

As you can imagine, financial lobbyists played a major role in the financial crisis just as much as the Wall Street and Washington criminals. The accompanying charts demonstrate clear evidence of this.

When George Bush ran for his second term, Wall Street ponied up the largest bribes for his presidential campaign. Shortly after his (controversial) reelection, Bush rewarded the banks for their “generosity” by signing the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, making it much more difficult for consumers to file bankruptcy. The timing of this law was perfect. Within two years after the new law was passed, the credit bubble had begun to implode.

Morgan Stanley |

$603,480 |

Merrill Lynch |

$586,254 |

PricewaterhouseCoopers |

$514,250 |

UBS AG |

$474,325 |

Goldman Sachs |

$394,600 |

Lehman Brothers |

$361,525 |

MBNA Corp |

$350,350 |

Credit Suisse Group |

$326,040 |

Citigroup Inc |

$320,820 |

Bear Stearns |

$313,150 |

Ernst & Young |

$305,140 |

Deloitte LLP |

$292,250 |

Wachovia Corp |

$279,310 |

Ameriquest Capital |

$253,130 |

Blank Rome LLP |

$225,150 |

Bank of America |

$218,261 |

Of course it was the banks that served as the “credit junkie” to consumers who became hooked on a quick fix of credit, offering guaranteed credit approvals irrespective of one’s credit score. Washington passed numerous laws to aid in these activities since it was the only means by which to boost an economy that had been wrecked by years of unfair trade.

As the credit wave continued, more toxic loans were bundled up into securities that would serve as the core ammunition for the global economic collapse. Wall Street banks and hedge funds leveraged their debt by 50 to 100 times the amount of cash on hand in order to keep the money machine running. In the process they created trillions of dollars in derivative securities. Once the sub-prime loans began to blow up, a domino effect ensued, multiplying the losses and freezing up liquidity throughout the global financial system.

Early on during the meltdown, when Senator Obama sought campaign contributions, Goldman Sachs stepped up to the plate to become his leading (private sector) contributor. In return for this bribe, President Obama allowed Goldman to escape billions of dollars in fines and hundreds of criminal indictments as a result of taxpayer and securities fraud stemming from the AIG bailout, which landed Goldman a $20 billion parachute from the hands of taxpayers.

Goldman Sachs |

$994,795 |

Citigroup Inc |

$701,290 |

JPMorgan Chase & Co |

$695,132 |

Sidley Austin LLP |

$588,598 |

UBS AG |

$543,219 |

Wilmerhale Llp |

$542,618 |

Skadden, Arps et al |

$530,839 |

Morgan Stanley |

$514,881 |

General Electric |

$499,130 |

Latham & Watkins |

$493,835 |

The organizations themselves did not donate, rather the money came from the organization's PAC, its individual members or employees or owners, and those individuals' immediate families. Organization totals include subsidiaries and affiliates.

Similar to the case with President Bush, Goldman Sachs wasn’t Wall Street’s only donor to Obama’s presidential campaign. Several additional financial and related firms shuttled millions to the man who promised “hope” and “change.” At this point, the only “change” we can “hope” for is an end to America’s fascist government, although this is not likely to happen anytime soon.

In return, Obama ensured that the crime bosses most responsible for the destruction of the global economy would never see one day in prison; not Alan Greenspan, not Robert Rubin, not Larry Summers, not Dick Fuld, not Hank Greenberg, not Jamie Dimon, not Angelo Mozilo, not Ken Lewis, not Lloyd Blankfein; not Franklin Raines; not Richard Syron; not even the tens of thousands of small criminals under their watch; no one. It has easily been the most colossal theft of wealth in world history. Yet, no one is in prison.

Once the house of cards toppled, it was former Goldman Sachs CEO, Henry Paulson, who serving as U.S. Treasury Secretary, devised a scheme along with Federal Reserve officials (including then New York Federal Reserve President Timothy Geithner, who would later become Obama’s Treasury Secretary) to provide congressmen a scapegoat so they would has an excuse to pass TARP (the banking system bailout). “We had to bail out the banks or we would have a depression,” they insisted.

Well, the fact is that the U.S. would have suffered a depression either way. In combination with additional bailouts (which have been hidden from the public) and the irresponsible monetary policies of the Fed, TARP has ensured a more severe period of depression. Remarkably, at no time either during Bush or Obama’s tenure were Wall Street firms ever required to suspend cash dividends to shareholders even after receiving a taxpayer bailout. Thus, the tax dollars from working-class actually went towards cash dividend payouts to the wealthy bank shareholders.

Furthermore, with the passage of the ridiculously inadequate Wall Street reform bill which was sliced down to consumer finance reform, Obama has ensured the continuation of Wall Street fraud. As you will recall, this was the same mechanism utilized by Obama to address healthcare, when he transformed healthcare reform into health insurance reform, inspired by industry bribes. See here.

Adding insult to injury, by removing the government insurance option, he failed even to reform the health insurance industry. Similar to Bush’s Medicare Part D gravy train for big pharma, Obamacare ensures more taxpayer subsidies for the industry.

Although the power held over Washington by healthcare, financial, and oil industry lobbyists is frightening, the single most powerful lobbyist group in Washington is AIPAC. That’s saying a lot. Using the money from wealthy Zionists, AIPAC is able to almost effortlessly tap into the Zionist Jewish network from within the Washington to control U.S. foreign and even certain aspects of domestic policy.

Despite common public perception, numerous surveys have shown that the official position of AIPAC as it relates to Palestine is not shared by the majority of Jewish Americans. But you aren’t going to hear America’s tightly-controlled Zionist media speak of this. In fact, you won’t even hear an open debate regarding the pros and cons of Washington’s unilateral support for Israel’s terroristic activities towards Palestinians. What you will see is every politician in Washington pledging their unconditional support for Israel because they understand the key to reelection.

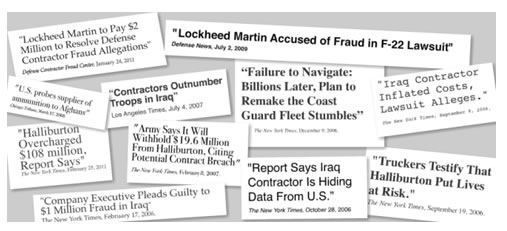

There is no doubt that without the influence and power of AIPAC, the U.S. would never have gone to war in Iraq. Along with the equally unnecessary war in Afghanistan, America’s prolonged occupation in the Middle East has cost taxpayers trillions of dollars, resulted in the loss of thousands of American lives, while wounding hundreds of thousands of U.S. military personnel, both physically and psychologically. Once their active duty has ended veterans return home, only have their benefits denied or delayed for several years by the VA.

And we certainly cannot forget that several hundred thousand innocent Iraqi civilians have been murdered, some by U.S. mercenaries like Blackwater (which changed its name to Xe to avoid more criticism). Finally, we cannot forget about the innocent women and children who have been murdered by these useless wars that have been based on deception and lies. The war in Iraq has been a complete embarrassment to the U.S. Likewise, the war in Afghanistan has been nothing more than a farce. Although Washington promised to bring democracy to Iraq, it has brought nothing other than pain, suffering and misery to Iraqis.

If it were not for the decision by Washington to fabricate these wars, there would be more federal funds available to use towards the current depression. Ironically, as the U.S. economy continues to suffer the effects of banking fraud carried out by Wall Street crime bosses, Israel’s economy is humming along quite nicely.

By now, it should be obvious who will ultimately pay the price for the criminal arrangements engineered between lobbyists and politicians. In coming years, the working class will be hit with dozens of tax hikes and/or new taxes in order to pay for the money stolen by the banks.

As first discussed in America’s Financial Apocalypse, basic government services will be auctioned off to the private sector. Many will cheer this move, as they have been brainwashed to think that private industry is less exploitative than government. Remember, we are talking about a fascist government. Regardless whether the highway system or school system is run by the public or private sector, you are guaranteed to get screwed to the same degree.

In coming years, toll booths will sprout on every major road along with surveillance cameras, all HOV lanes will charge a fee for access, and every parking place will be metered. Candy and sodas will have a special sugar tax, coffee and other food and beverage items deemed “unhealthy” will be taxed as an excuse to “encourage less consumption for the health and safety of society.”

Americans will pay higher prices for energy, while oil companies continue to receive generous tax breaks. I’d say it’s a decent bet the gasoline tax will be raised by the next administration. To gain support for higher taxes, Washington will remind Americans that they pay amongst the lowest gasoline taxes in the world. Tell that to tens of millions of working-class Americans earning a minimum wage that remains 60% below inflation growth over the past four decades.

America will continue to fight wars for Israel, based on more lies and scare tactics, all while the military-industrial complex defrauds taxpayers of trillions of dollars. See here.

Pension plan deficits will continue to widen due to record-low interest rates set forth by the criminal Federal Reserve in order for banks to steal even more wealth and savings from Main Street.

As millions of additional Americans face losing their home due to chronic unemployment, tens of millions remain underemployed, barely scraping by. Meanwhile, already 50 million Americans live in poverty according to slanted criteria from Washington. When adjusted for regional cost of living variations and other factors, the real number is easily over 70 million.

The continued economic demise spearheaded by Wall Street and the Federal Reserve has created yet another opportunity for banking vultures to exploit their prey. Banks have jacked up credit card rates, knowing that many consumers have only their credit cards as their remaining safety net.

The bought-off media establishment insists that corporate America has no jobs to offer. The truth is that they just aren’t hiring in the U.S. Likewise, the media tells us that U.S. banks are lending money, when in fact they are; they just aren’t lending it to Americans.

Where is the money that the Federal Reserve has handed to the banking cartel at essentially 0% interest rates? Check with Brazil and China.

After having squeezed all they can from their victims, the traditional financial industry has cast millions of destitute consumers aside for yet other vultures to move in for the final kill. Today, the fastest growing industry in the U.S. is the payday loan and auto title business.

In exchange for an advance on your pay check or the title to your vehicle, these sweat shops charge annual interest rates ranging from 300% to 650%, stamped with the seal of approval from the state and federal government, compliments of finance industry lobbyists. These are America’s depression-era banks, serving the most unfortunate victims of America’s financial apocalypse.

If you want to move ahead of the curve, subscribe to one of our newsletters while the promotional rates are still around. www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2011. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

READ THIS LEGAL NOTIFICATION IF YOU INTEND TO REPUBLISH ANY PORTION OF THIS MATERIAL

Market Oracle has received permission rights to publish this article. Any republications of this article or any others by AVA Investment Analytics must be approved by authorized staff at AVA Investment Analytics. Failure to do so could result in legal actions due to copyright infringement.

Our attorneys have determined that the so-called “Fair Use” exemption as it applies to the Digital Millennium Copyright Act does not permit use by websites that have ads or any other commercial application.

In addition, fair use does not imply articles can be republished or reproduced. The distinction between fair use and infringement may be unclear and not easily defined. There is no specific number of words, lines, or notes that may safely be taken without permission. Acknowledging the source of the copyrighted material does not substitute for obtaining permission. Please see this statement from the U.S. Copyright office for more information. http://www.copyright.gov/fls/fl102.html

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.